Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 14, 2017

Indonesia Manufacturing PMI surveys point to steady fourth quarter growth

Manufacturing conditions in Indonesia improved in November after a disappointing start to the fourth quarter, indicating further steady economic growth as we head towards the end of the year. However, the PMI survey also showed a further fall in employment, which could dampen hopes of a revival in household consumption.

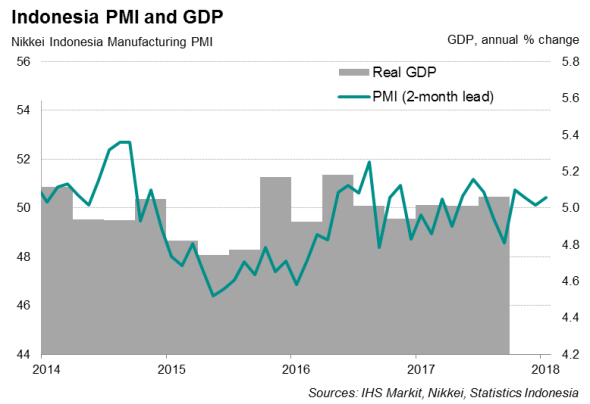

The headline Nikkei Indonesia Manufacturing PMI™ rose from 50.1 in October to 50.4 in November, to indicate a slight improvement in the health of the sector.

The latest reading is consistent with the Indonesian economy growing at an annual rate of around 5% in November, close to the pace of expansion seen over the previous few quarters. At an average of 50.3 so far in the fourth quarter, the reading is a slight improvement on the three months ending September.

Nevertheless, the mild survey data suggest that economic growth is failing to pick up speed, and may remain subdued in coming months. While business optimism remained high, survey data showed that over 40% of firms expect unchanged output volumes over the next 12 months.

The outlook for Indonesia's manufacturing job market likewise remains bleak as lower employment was recorded for the fourteenth successive month during November. With persistent signs of spare capacity, firms preferred to tap on existing workforce for production work.

Poor job prospects could continue to dampen household spending in the near future, which in turn would weigh on overall economic activity.

However, strong external demand remained a bright spot, with survey data pointing to a sustained increase in Indonesia's goods exports. The PMI's gauge of new export orders has signalled a near-continual trend of rising foreign demand since April. Export growth was reportedly buoyed by higher commodity prices, as raw material exports typically account for around one-fifth of all Indonesia's exports.

Monetary Policy

A slightly improving manufacturing sector helps to reduce the urgency for Bank Indonesia to cut rates further to stimulate economic activity. It is therefore not surprising that the central bank paused its rate-cut cycle at its recent meeting.

If subsequent manufacturing PMI numbers turned lower, there's a strong chance that the central bank will seek to restart lowering rates, given subdued inflationary pressures. However, the bank cited the need to monitor potential tighter monetary policy in advanced countries, in relation to its looser stance.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122017-Economics-Indonesia-Manufacturing-PMI-surveys-point-to-steady-fourth-quarter-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122017-Economics-Indonesia-Manufacturing-PMI-surveys-point-to-steady-fourth-quarter-growth.html&text=Indonesia+Manufacturing+PMI+surveys+point+to+steady+fourth+quarter+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122017-Economics-Indonesia-Manufacturing-PMI-surveys-point-to-steady-fourth-quarter-growth.html","enabled":true},{"name":"email","url":"?subject=Indonesia Manufacturing PMI surveys point to steady fourth quarter growth&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122017-Economics-Indonesia-Manufacturing-PMI-surveys-point-to-steady-fourth-quarter-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indonesia+Manufacturing+PMI+surveys+point+to+steady+fourth+quarter+growth http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122017-Economics-Indonesia-Manufacturing-PMI-surveys-point-to-steady-fourth-quarter-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}