Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 14, 2015

US retail sales downturn adds to economic outlook uncertainty

Unexpectedly weak retail sales data add to signs that the US economy is slowing again after pulling out of the soft patch earlier in the year. Any signs of slower growth could easily dissuade the Fed from hiking interest rates later this year, pushing the first rate rise into 2016.

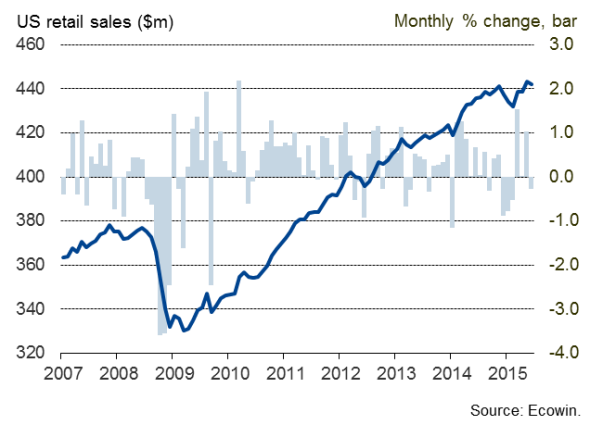

US retail sales

Data from the Commerce Department showed retail sales dropping 0.3% in June, rather than rising 0.2% as economists had expected. Core sales also fell, down 0.1%.

Despite the downturn in June, sales rose 1.5% in the second quarter as a whole after a 1.0% decline in the first quarter, with core sales up 1.0% after a meagre 0.3% gain in the first three months of the year.

The data therefore support the view that the economy will have grown quite impressively in the second quarter, with GDP up by around 2.5% on an annualised basis, but the worry is that this to a large extent merely reflects a rebound from the weather-related slump in the first quarter. The weakness of the sales data in June, alongside disappointing PMI survey data and a smaller-than-hoped-for rise in non-farm payrolls, all points to the economy having moved down a gear after this rebound, settling into a far weaker underlying pace of growth than was seen throughout much of last year.

Markit's Business Outlook survey (released this week) also found optimism among US companies to have failed to recover from the post-recession low seen at the start of the year, fuelling further concern about the strength of economic growth in coming months. Companies are anxious about the impact of the strong dollar and higher interest rates, as well as the potential for the eurozone crisis and slumping demand in emerging markets to hurt US economic growth.

Fed Chair Janet Yellen has recently stressed that she expects rates to start rising later this year, but these retail sales numbers add to a growing body of evidence which suggests that the economy is slowing again as we head into the second half of the year. Such a slowing will most likely persuade policymakers to hold off on raising rates until next year unless there is a swift revival of demand in coming months.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-US-retail-sales-downturn-adds-to-economic-outlook-uncertainty.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-US-retail-sales-downturn-adds-to-economic-outlook-uncertainty.html&text=US+retail+sales+downturn+adds+to+economic+outlook+uncertainty","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-US-retail-sales-downturn-adds-to-economic-outlook-uncertainty.html","enabled":true},{"name":"email","url":"?subject=US retail sales downturn adds to economic outlook uncertainty&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-US-retail-sales-downturn-adds-to-economic-outlook-uncertainty.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+retail+sales+downturn+adds+to+economic+outlook+uncertainty http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-US-retail-sales-downturn-adds-to-economic-outlook-uncertainty.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}