Oil bonds surge ahead of Doha meeting

Hopes are riding high that this weekend's oil producer meeting in Doha could see major producers address the current supply glut which has lifted bonds by oil producers to new annual highs.

- Markit iBoxx USD Liquid High Yield Oil & Gas Index benchmark spread falls below 1,000bps

- High yield oil and gas bonds have returned over 9.9% ytd, twice that of high yield bonds

- Investment grade bonds also rebounding strongly with spreads at five month lows

Oil bonds, which had been decimated in the opening weeks of the year, have been rebounding strongly in the run-up to this weekend's meeting for oil producers in Doha. This rebound is directly linked to oil's strong performance in anticipation of a possible production freeze which could put an end to the current market share grabbing supply glut.

High yield bonds surge ahead

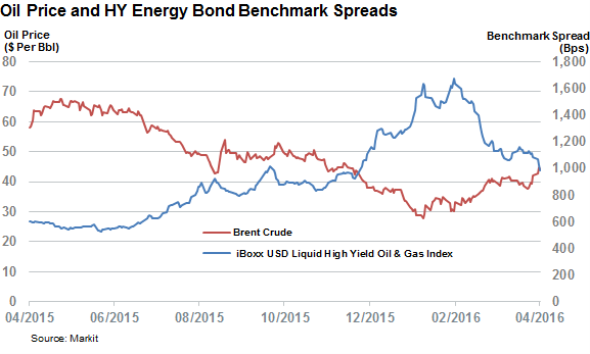

Speculative high yield bonds, which bore the brunt of the market volatility earlier in the year, have been the largest benefiters of the rebounding price of an oil barrel. The extra yield over risk free rates required by investors to hold high yield bonds in the oil and gas space tracked by the benchmark spread of the Markit iBoxx USD Liquid High Yield Oil & Gas Index is now less than 1,000 bps, the first time in over five months. The current level marks a spectacular rebound given that investors were requiring as much as 1,675bps of extra yield in order to hold the same asset class when oil was trading with a low $30 handle earlier in the year.

The current spread level is in line with when oil last traded at the mid-$40 range so there appears to be little indication of a dislocation between the price of oil and the extra yield required by investors to hold speculative oil & gas bonds. In fact the correlation between the two data points has been a staggering -95% over the last 12 months.

This improved mood towards high yield oil and gas bonds is translating into large paper profits for investors as the index has returned over 40% on a total return basis from its lows in the second week of February. The year to date performance of 9.9% is less spectacular given oil's volatility in the early part of the year but still nearly twice that seen in the high yield bond universe as gauged by the Markit iBoxx $ Liquid High Yield Index.

Investment grade bonds also benefit

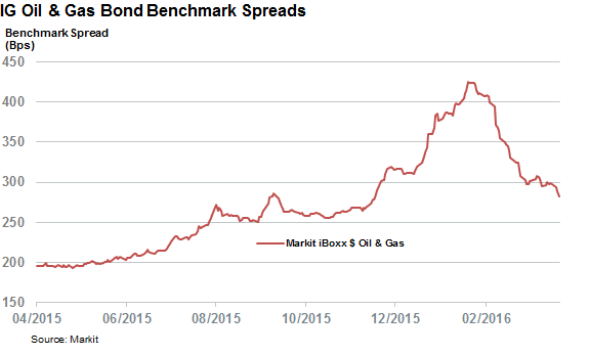

The same trend is also evidenced among bonds issued by investment grade oil and gas companies as the Markit iBoxx $ Oil & Gas index has seen its benchmark spread fall to a five month low 282bps, a third lower than the highs seen on February 11th.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.