Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 13, 2017

UK business optimism remains among the weakest reported since 2011

The latest IHS Markit Business Outlook survey reveals that UK business confidence has picked up slightly since June, but private sector firms still remain more cautious about their growth prospects than at any other time in the past six years.

Please scroll down for more details and to download the report in full

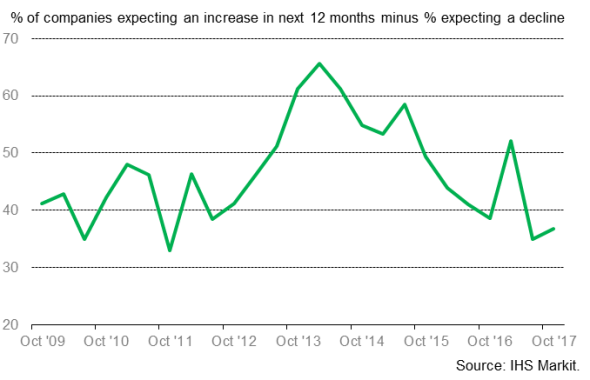

UK business activity expectations

The net balance of survey respondents expecting business activity growth over the next 12 months is at +37% in October, little-changed from +35% in June and well below the peak seen in February 2014 (+66%).

Fragile business confidence was widely linked to worries about the path to Brexit, in particular the speed of negotiating progress and the negative impact of political uncertainty on longer term planning.

Service providers commonly cited regulatory uncertainty and a perceived lack of clarity around negotiating aims. Concerns about the ease of staff recruitment were also mentioned, especially by companies in the Hotels & Restaurants sector.

Manufacturers generally reported worries about border issues and logistics, with some firms concerned that clients in mainland Europe would reappraise relationships with UK supply chains. Some goods producers also note that a Brexit-related slowdown in construction work is likely to act as a brake on customer demand.

Employment & Investment Plans

Despite subdued expectations for business activity, survey respondents commented on a range of growth opportunities over the coming 12 months. A number of UK private sector firms note that the resilient domestic economic backdrop and improving export demand were likely to support sales and business investment during the year ahead.

As a result, manufacturers and service providers retain a solid degree of confidence about the outlook for staff hiring. At +23% in October, the net balance of companies expecting to add to their payrolls is little-changed from +22% in June and higher than seen in 2016 (+20% on average).

The net balance for capital expenditure plans has edged up to +11% in October, from +9% in June. A rebound from the post-referendum low (net balance at +7% in October 2016) has largely been driven by the manufacturing sector. The net balance of manufacturers expecting to boost capex in the coming year is +20% in the latest survey period.

Inflation Expectations

Input cost expectations remain elevated in comparison to the low point seen in early 2016, driven by rising commodity prices, higher fuel and energy costs, as well as pressure from exchange rate depreciation.

At +45% in October, the net balance measuring input price expectations at private sector firms is little-changed from +44% in June and still close to February's six-year peak.

Meanwhile, the net balance of companies expecting to increase their average prices charged has reached +36% in October, from +34% in the previous survey period. Manufacturers remain much more likely to anticipate a rise in their prices charged (net balance at +57%) than companies operating in the service sector (+32%).

Corporate Earnings

A soft patch for profits expectations continues, despite the net balance picking up to +23% in October. The figure remains below post-crisis average, reflecting pressure on margins from strong cost inflation and heightened concerns about the outlook for customer demand.

Manufacturers remain more upbeat about the outlook for profits than service sector companies. Resilient export demand and new product innovations are cited as factors helping to support margins among manufacturing companies.

Meanwhile, consumer-oriented service providers noted difficulties passing on higher operating expenses to domestic customers against a backdrop of intense competition and stretched household finances.

Download the full Business Outlook Report for more details.

Tim Moore | Economics Associate Director, IHS Markit

Tel: +44 149-146-1067

tim.moore@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-economics-uk-business-optimism-remains-among-the-weakest-reported-since-2011.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-economics-uk-business-optimism-remains-among-the-weakest-reported-since-2011.html&text=UK+business+optimism+remains+among+the+weakest+reported+since+2011","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-economics-uk-business-optimism-remains-among-the-weakest-reported-since-2011.html","enabled":true},{"name":"email","url":"?subject=UK business optimism remains among the weakest reported since 2011&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-economics-uk-business-optimism-remains-among-the-weakest-reported-since-2011.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+business+optimism+remains+among+the+weakest+reported+since+2011 http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-economics-uk-business-optimism-remains-among-the-weakest-reported-since-2011.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}