Brexit lifts gate on commercial property shorts

Short sellers have continued to gravitate towards UK real estate in the wake of Brexit, with commercial property firms attracting the bulk of the negative investor sentiment.

- Average short interest for UK real estate firms has spiked 28% since the UKreferendum

- Short interest in Intu Properties has hit the highest levels seen since 2009

- Record high levels in short interest at Capital & Counties

Flagship real estate shorts

The UK real estate sector experienced its first "bear raid" in the lead up to last month's European Union referendum. Bearish sentiment has accelerated in the wake of the "leave" outcome, although short sellers have so far preferred to target commercial property firms.

Rapid investor withdrawals from real estate funds have forced commercial funds into putting prime flagship properties up for sale in order to improve liquidity positions. Short sellers hope that these 'forced' sales will put downward pressure on asset prices and subsequently further pressure on share prices.

Since Brexit, average short interest across UK real estate firms (63 names in total) has surged by a dramatic 28%, rising to 1.3%.

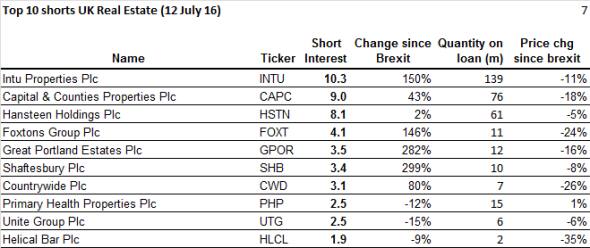

Leading this surge with a significant 141% jump in short interest is retail shopping centre operator Intu Properties. Currently Intu is the most shorted stock among UK real estate with 10.3% of shares outstanding on loan.

Capital & Counties follows closely behind Intu with short interest of 9%. Short interest has also been rising since the start of the year but Brexit has seen levels jump 43% higher.

Although off a somewhat smaller base than its two heavily shorted peers, London freeholder Shaftesbury has also seen its short interest surge to new highs in the wake of the referendum.

Demand to borrow Shaftesbury shares to go short, which was already elevated heading in to the vote, has jumped by a fifth since Brexit to 3.4% of shares outstanding. These recent developments mean that the firm's short interest has jumped fourfold since the beginning of June.

Great Portland Estates which is active in retail and commercial office property in London has seen a steep 92% increase in short interest to 3.5%. While shares in the firm have trended downward since the end of 2015, subsequent to the vote they slumped a further 16%.

On the side, short sellers have been increasing their bets in high street estate agent Foxtons. The firm issued a profit warning in the wake of the referendum citing the post Brexit uncertainty, which has emboldened short sellers to add to their positions by a quarter to 4% of shares outstanding. Its shares are down by 24% since the referendum.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.