Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 10, 2017

Week Ahead Economic Overview

Updated inflation data for the US, UK, China and the euro area will offer analysts hints on the direction of future monetary policy decisions, while fourth quarter growth figures for the eurozone and Japan provide insights into the health of two of the world's key economic regions.

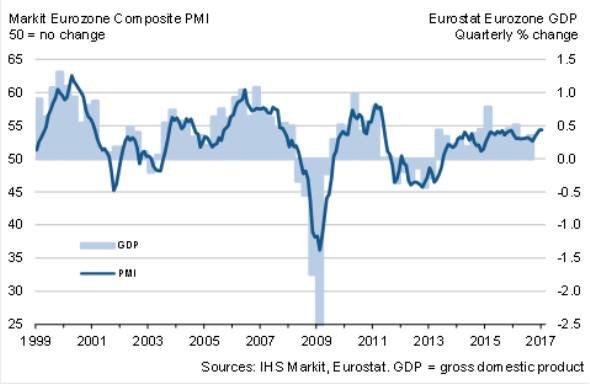

The first estimate of euro area GDP figures for the fourth quarter were positive for policymakers in the single-currency bloc, when a better-than-expected 0.5% expansion in the three months to December was announced. In fact, the annual increase for the whole of 2016 stood at 1.7%, the first year since the 2008 financial crisis in which the eurozone grew at a stronger pace than the US economy. PMI data signalled a faster upturn in the region towards the end of 2016, with the surveys pointing to the sharpest expansion for five-and-a-half years. Subsequently, when Eurostat issues its second estimate on Q4 2016 GDP growth, forecasters predict that data will remain unchanged from the initial estimate.

Eurozone Composite PMI vs GDP

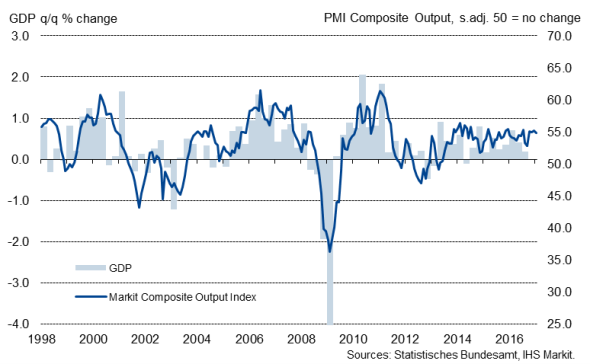

Meanwhile, flash GDP data are updated for Germany, Italy and Greece, providing data watchers a clearer picture on the drivers behind euro area economic growth. Germany's economy was particularly disappointing during the third quarter of last year, expanding only 0.2%, down from 0.4% in the second quarter. Analysts are pencilling-in a 0.5% bounce back during Q4, however recent retail sales and industrial production figures for December declined solidly, suggesting the consensus may be overly optimistic. If German GDP numbers underachieve, then this will likely weigh on the total performance of the eurozone economy.

Markit Germany PMI vs GDP

Industrial production data for the Eurozone is also available next week, along with inflation figures for a number of key economies within the region, all of which offer insights into latest economic trends. The Governing Council of the ECB also holds a non-monetary policy meeting in Frankfurt ahead of its first interest rate decision at the start of March.

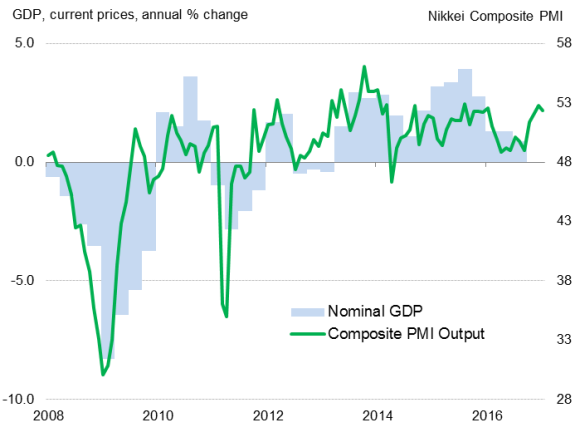

Over in Japan, economic growth appeared to shift into a higher gear at the end of 2016, with December's PMI data hitting a 16-month high. The recent upturn has been led by stronger export orders, stemming from the depreciation of the yen. Balance of trade data for December highlighted a 5.4% rise in exports, the first increase in 15 months. Consequently, data watchers are expecting Q4 GDP growth to pick-up from the 0.3% reported in the third quarter. December's second estimate of industrial production numbers is also published, though forecasters are anticipating the data will remain unmoved from the 3% rise previously reported.

Nikkei Japan PMI v GDP

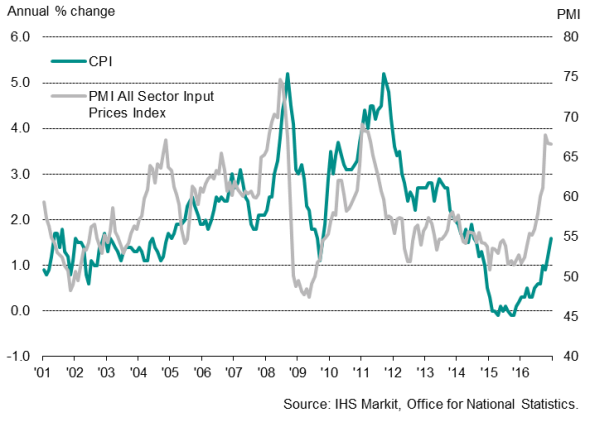

An update on UK inflationary trends will be issued by the Office for National Statistics on Tuesday, with Bank of England policymakers scrutinising the extent of the expected increase. The UK inflation rate jumped to 1.6% in December, edging closer towards the bank's 2% target. The Governor of the BoE, Mark Carney, has already warned that there are limits to the amount of inflation the central bank will tolerate, bringing forward the likelihood of a rate rise. Moreover, with survey data pointing to a record-high increase in purchasing prices in the UK manufacturing sector, the speculation will intensify that the Monetary Policy Committee may act on curbing rising prices sooner than first expected.

UK Inflation rate and consumer prices

The ONS will also issue UK retail sales data for January, with analysts anticipating a pick-up from December's 1.9% drop, the biggest monthly decline in four-and-a-half years. Meanwhile, latest unemployment rates and average earnings data provide indications on the strength of the UK labour market.

Finally, US inflation numbers released on Wednesday will also be a main data point to watch. The core inflation rate reached 2.2% in December and is expected to remain broadly similar when updated next week. Moreover, latest retail sales data and industrial production numbers will provide an early guide to US economic performance at the start of 2017.

Monday 13 February

The week begins with an update on Japanese GDP data for the fourth quarter.

Latest consumer price index date for India are released.

Chinese foreign direct investment figures are updated.

Tuesday 14 February

The NAB Australian Business Conditions and Business Confidence indicators are issued.

In Japan, industrial output figures are published.

Chinese consumer and producer prices indexes are released.

South Africa's latest unemployment rate is published.

Flash Q4 GDP data for the eurozone is out, with breakdowns for Germany, Italy and Greece.

German inflation figures are released.

Industrial production data for the eurozone is available.

The Office for National Statistics provides a string of inflation data for the UK including latest consumer and producer price indexes.

Brazilian retail sales data are out.

The US producer price index is updated.

Wednesday 15 February

The release of latest Russian Industrial Output numbers is available.

In South Africa, an updated consumer price index is provided, along with latest retail sales figures.

The Governing Council of the ECB gathers for a non-monetary policy meeting in Frankfurt.

France releases its latest unemployment rate.

The consumer price indexes for Spain and Greece are issued.

Unemployment rates and average earnings data are updated in the UK.

An update is provided on latest Canadian manufacturing sales data.

The US Bureau of Labor Statistics updates its consumer price index, while latest retail sales and industrial production numbers for the US are also provided.

Thursday 16 February

Australian employment figures are released.

Germany's wholesale price index is published.

Trade balance numbers for Italy are updated.

Friday 17 February

In Russia, an update on the latest producer prices index is provided.

Eurozone and Brazilian current account figures are released.

UK retail sales figures are published by the ONS.

Samuel Agass | Economist, Markit

Tel: +441491461006

samuel.agass@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}