Special Report: Prison revenue bonds break out

The outcome of the US presidential election on November 8 had an immediate impact on the global bond markets in the form of a sell-off in rates on increased growth and inflationary outlooks. The higher yield environment negatively affected the US municipal bond market, as it did most bond markets, but the new administration's platform of tax reform and increased infrastructure spending added to the pain felt by muni investors. Perhaps the biggest indicator of the stress in that market was the eight consecutive weeks of outflows from municipal bond mutual funds starting the week before the election after an astonishing 54 straight weeks of inflows that ended in mid-October. Also, while US high yield spreads generally tightened to some degree while rates increased post-election, municipal bond spreads actually widened through early-December on the uncertainty regarding whether or not the tax benefits of municipal bonds will be softened in the wake of the proposed lower taxes.

The new administration's impact on municipal bonds became very apparent once again this year, but in a positive way this time on the relatively niche prison revenue bond sector. The sector began to come under pressure last year as a result of declines in inmate population due to the US Department of Justice's (DOJ) Smart on Crime Initiative that included prison sentencing reforms and was launched in 2013. The success of the program led to financial distress across several prison systems due to the decline in federal subsidies on the lower incarceration rates. The decline was significant enough to give the DOJ the flexibility to issue a mandate on August 18, 2016 requiring prison systems to gradually wind down their use of private prison companies due to their assessment that private facilities were less safe and effective than government run prisons.

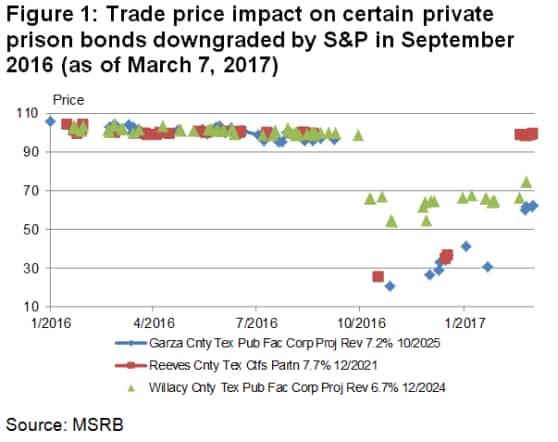

Since the DOJ's announcement in August, several private prison bonds have been downgraded, with some going into junk status. In September 2016, S&P announced a multi-notch downgrade of various private prison issues in Texas that it had already been in the process of reviewing before the DOJ edict. The downgrades included Willacy County Center from CCC+ to CC, Reeves County from CCC to CC, and Garza County Public Facility was downgraded from BBB to B-+. Figure 1 shows the price deterioration (average daily trade price of all size trades) of the downgraded bonds started in October and the turnaround began in late-February. The chart shows that the Garza Cnty Tex Pub Fac Corp Proj Rev 7.2% 10/2025 recently rallied back to a 62.20 average trade price on March 1 after being as low as 20.94 on October 31.

The declines in prison bond prices were not isolated to Texas issues, as the San Luis Arizona Facility Development Corporation 7.250% 5/2030, which traded as low as 38.975 on December 22, but has since recovered to an almost 60 price based on some recent smaller size trades.

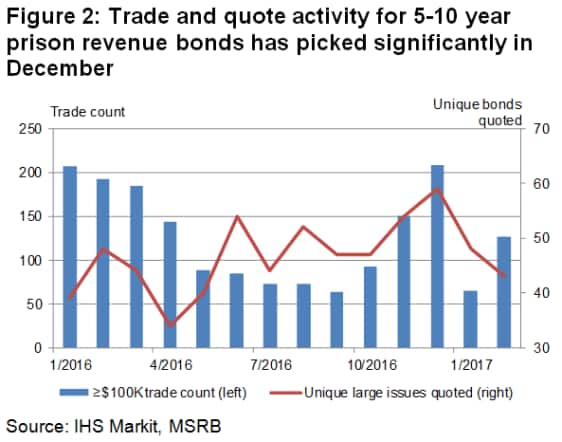

Since August, the worst performing 10% of bonds of the largest prison bond issues ($10MM or more original issue size and approximately 130 bonds) declined 28% in price and the 10% best declined only 2% as of February 28, keeping in mind that bond prices are now inherently lower given that treasury rates are much higher today. Further highlighting the increased activity in the sector, the count of trades $100K+ in size and the number of uniquely quoted large issues also increased steadily since the initial set of S&P downgrades for those same large issues (Figure 2).

A large driver for recent optimism in the sector has been driven by the new administrations stricter enforcement of immigration laws. The resulting surge in detention of undocumented aliens is requiring significantly more detention centres to house detainees until deportation proceeding can take place. This increased demand for prisons, could potentially benefit muni investors who hold certain distressed prison issues by driving the re-opening of publically financed prisons that were either closed or mothballed before construction was completed. In addition, the DOJ announced on February 23 a reversal of last year's mandate on decreasing the use of private prisons, which is likely another big positive for distressed private prison bond issues as evident in the average trade prices for the previously discussed Texas prisons.

Currently, the environment does appear to be taking a turn for the better for prison revenue bonds. That being said, it could be some time before any mothballed prison project can be opened and start receiving revenue streams and there is always the possibility of another shift in the current administration's policies regarding immigration and the use of private prisons that could result in further price volatility for the sector.

Chris Fenske | Director, Head of Fixed Income Pricing Research

Tel: +1 212 205 7142

chris.fenske@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.