IHS Markit European loan volume survey

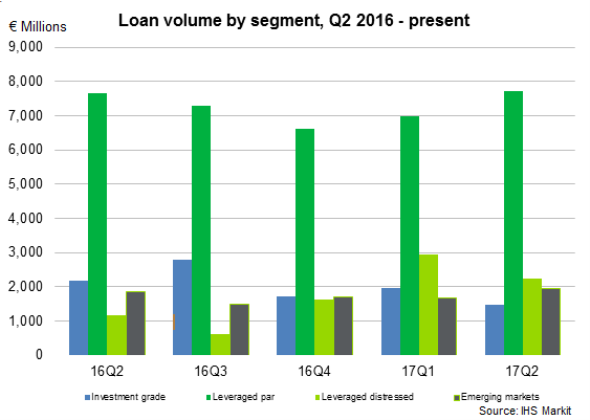

The European loan market has stayed pretty flat for the second quarter of 2017 with the figures being down by around 1.5% from "13,586 last quarter to "13,377 for Q2 2017. The year on year figures on the other hand are up by 4% compared to the "12,868 in Q2 2016.

- Leveraged loan volumes (Western Europe) constituted 74.3% of the volumes, which was slightly up on the 73.2% observed in the previous quarter and 68.6% in Q2 2016. Of the 74.3% this quarter, 57.6% was conducted on LMA Par documentation compared against 16.7% on LMA Distressed documentation.

- European Investment Grade loan volumes represented 11.1% of the total, down on the 14.5% in the last quarter, and even more so on the 16.9% we recorded in Q2 2016.

- Emerging Market figures (Eastern Europe, Middle East and Africa) represented 14.6% this quarter, which was down slightly from the 12.3% we saw last quarter, but around the same as the 14.6% we saw at this time in 2016.

Survey results

2016 saw some of the lowest volumes recorded, but 2017 has certainly got off to a better start. Total volumes for Q1 and Q2 were close to each other, but there have been some shifts in the segments. The losers this time around were the Investment Grade and Distressed segments, which both fell by just under 25%. The former dropped from "1,965m to "1,486m, and the latter fell from "2,954m to "2,228m. Par levels moved up 10.2% from "6,993m to "7,708m, while Emerging Markets rose 16.8% from "1,674m to "1,955m.

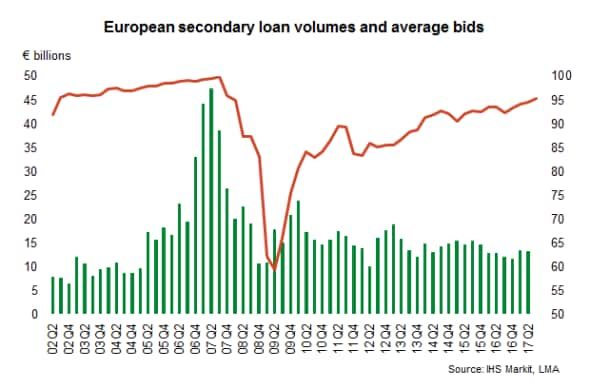

The average bid for the last day of Q2 2017 was 95.30, another rise on the 94.50 recorded on 31st January, which represents 11 consecutive quarter end price rises. The average bid over Q1 was a bit lower at 94.89, but still higher than the average for Q1 which stood at 94.72.

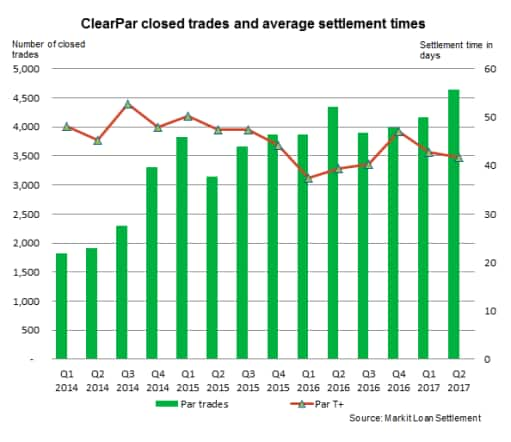

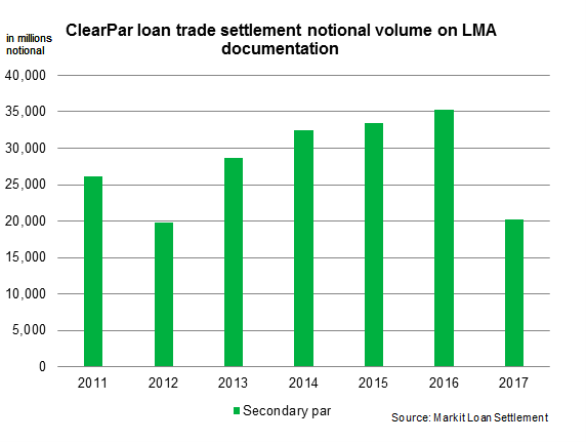

Markit Loan Settlement volumes

Each quarter the Markit Loan Settlement team provide us with their quarterly trade figures, which allow us to take another perspective on trade volumes in the secondary market.

Rory McSwiggan, AVP, Markit Loan Pricing

Tel: +44 20 7064 6404

rory.mcswiggan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.