Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 07, 2017

Japan PMI points to solid fourth quarter growth, but cost pressures hit near-decade high

Japanese growth remained robust in November, setting the scene for another solid quarter at the end of the year, according to the latest Nikkei PMI survey. The survey's sub-indices showed that the upturn in output was accompanied by steady employment growth, linked to stronger gains in new business, but also revealed signs of increasingly tight profit margins.

Robust demand drives upturn

The economy grew 0.3% during the third quarter, according to official estimates, down from 0.6% in the three months to June. However, the PMI surveys, which accurately foretold the slowdown in quarter three, have since gained ground, suggesting that GDP growth could pick up in the fourth quarter.

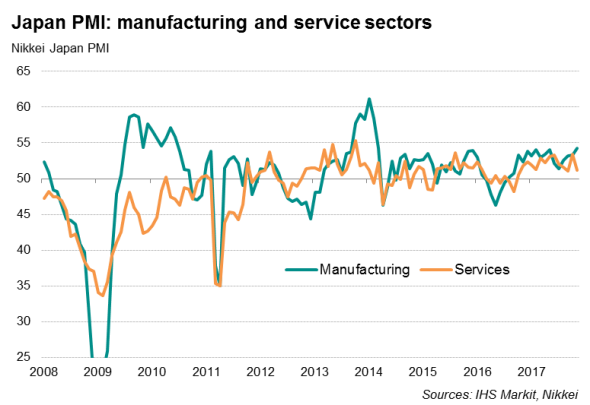

Although down from 53.4 in October, the Nikkei Composite PMI Output Index continued to signal a robust improvement in Japan's private sector economy in November at 52.2. The latest reading means the PMI average for the fourth quarter so far is 52.8, marking one of the strongest performances seen in recent years.

The upturn continued to be led by manufacturing, where PMI data showed the best expansion in over three-and-a-half years during November, supported by rising orders.

The solid manufacturing upturn looks set to continue into December. Backlogs of uncompleted orders rose to the greatest extent since March 2014, suggesting a developing pipeline of work to undertake amid robust demand from both domestic and export customers.

While the surveys showed a renewed slowdown of services activity growth, with the latest PMI reading below the average for the year so far, other survey indicators hinted at the possibility of growth picking up again. Most encouragingly, inflows of new business placed at service providers rose at one of the strongest rates recorded over the survey history, reflecting increased demand in the domestic market.

Outlook

Business optimism in both sectors also remained upbeat, notably improving in services to the highest in six months to add to suggestions that the sector could see growth revive again in coming months.

The worry is that a tighter labour market and the ongoing squeeze on profit margins could dampen future growth.

Staff shortages have become particularly acute in the service sector, with the survey showing employment to have barely risen in November. Many companies blamed a lack of workers for the stagnant jobs growth rather than low demand for labour. As such, capacity constraints may affect future business activity.

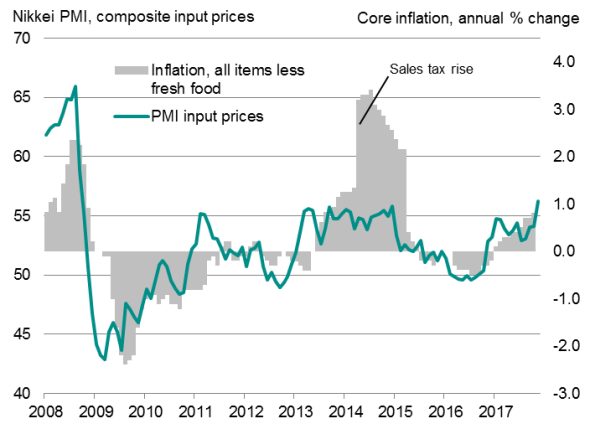

At the same time, companies are struggling with rising costs. Composite survey data showed input price inflation reaching the fastest rate since the heights of the global financial crisis. However, firms were unable to raising selling prices to match the rise in costs, suggesting increasingly tight profit margins. Firms' reluctance to hike charges is also partially responsible for the low inflation environment.

Input costs and inflation

The good news is that candidate shortages could lead to upward wage pressures. That will be welcomed by the Bank of Japan, which is relying on a tight labour market to drive up salaries, and in turn, inflation.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122017-Economics-Japan-PMI-points-to-solid-fourth-quarter-growth-but-cost-pressures-hit-near-decade-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122017-Economics-Japan-PMI-points-to-solid-fourth-quarter-growth-but-cost-pressures-hit-near-decade-high.html&text=Japan+PMI+points+to+solid+fourth+quarter+growth%2c+but+cost+pressures+hit+near-decade+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122017-Economics-Japan-PMI-points-to-solid-fourth-quarter-growth-but-cost-pressures-hit-near-decade-high.html","enabled":true},{"name":"email","url":"?subject=Japan PMI points to solid fourth quarter growth, but cost pressures hit near-decade high&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122017-Economics-Japan-PMI-points-to-solid-fourth-quarter-growth-but-cost-pressures-hit-near-decade-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+PMI+points+to+solid+fourth+quarter+growth%2c+but+cost+pressures+hit+near-decade+high http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122017-Economics-Japan-PMI-points-to-solid-fourth-quarter-growth-but-cost-pressures-hit-near-decade-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}