Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 06, 2017

Japan PMI signals slower growth compared with the first half of 2017

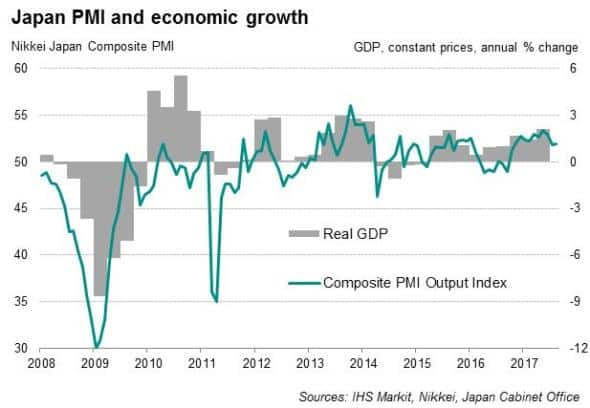

The Japanese economy expanded further midway through the third quarter, but the pace of growth remained below the average seen in the first six months of the year, according to the latest PMI data. And forward-looking indices suggest that the weakening growth trend may persist in coming months.

The Nikkei Japan Composite PMI Output Index came in at 51.9 in August, up slightly from 51.8 in July but below the average (52.7) recorded in the first half of the year.

Slower growth in new work and diminishing business confidence (especially among service providers) weighed on output, and are likely to impact future level of business activity. The rate of growth in new business eased for a third straight month in August, reaching the joint-weakest since November last year. The Future Output Index ? a gauge of business confidence ? sank to the lowest so far this year.

However, despite the signs of slower growth, the average composite PMI reading for the past two months suggests that the economy has continued to expand at a solid pace in the third quarter, following the 1.0% growth in GDP seen in the second quarter.

Similarly, although slowing demand also affected hiring, overall employment growth has eased only modestly from the near decade-high seen in June.

Diverging growth

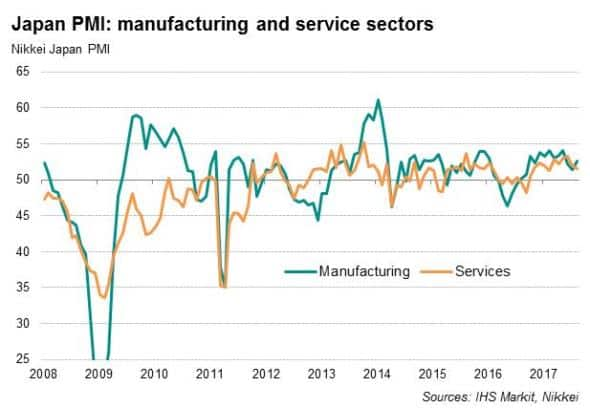

Looking at the details, August's survey also showed a renewed divergence between the manufacturing and service sectors: manufacturing output growth picked up from a ten-month low in July while the rate of expansion of services activity eased further to a six-month low.

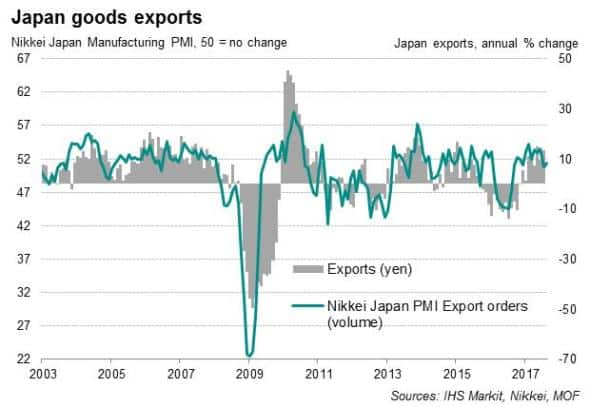

The recent slowdown in the manufacturing sector had raised worries that the economic upturn could lose momentum, but the pick-up in manufacturing output during August goes some way to ease those concerns. However, other indicators suggest that the survey's output index may trend lower over the next couple of months, thereby dampening overall GDP expansion. Modest growth in new business (in particular in export sales) and increased inventories of finished goods may reduce the need for higher future factory output.

If it materialises, lower production would impinge on jobs growth. Signs of spare capacity ? manufacturing backlogs fell for a second successive month in August ? and diminishing confidence may also discourage firms from hiring. Japanese factories were the least optimistic about the year-ahead outlook for five months.

By contrast, while business activity growth in the service sector slowed further in August, rising backlogs suggest a potential pick-up in coming months, which in turn could boost hiring. However, the extent to which activity increases could be limited, as optimism among service-providing firms came in at the lowest in just over a year during August.

Rising price pressures

Persistent signs of higher costs again pushed firms to raise output prices in order to protect margins, as has been the case throughout this year so far. While the rate at which selling prices rose remained below that of input cost inflation, the pace of increase was the joint-highest in two years and will be welcomed by the Bank of Japan, who recently postponed the timeline of meeting the 2% inflation target to March 2020.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Japan-PMI-signals-slower-growth-compared-with-the-first-half-of-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Japan-PMI-signals-slower-growth-compared-with-the-first-half-of-2017.html&text=Japan+PMI+signals+slower+growth+compared+with+the+first+half+of+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Japan-PMI-signals-slower-growth-compared-with-the-first-half-of-2017.html","enabled":true},{"name":"email","url":"?subject=Japan PMI signals slower growth compared with the first half of 2017&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Japan-PMI-signals-slower-growth-compared-with-the-first-half-of-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+PMI+signals+slower+growth+compared+with+the+first+half+of+2017 http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Japan-PMI-signals-slower-growth-compared-with-the-first-half-of-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}