Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2014

ECB to reassess policy stance in early-2015

The European Central Bank made no changes to interest rates or other non-conventional policy tools at its December meeting, dashing any hopes that recent signs of a deepening economic malaise might spur the central bank into further action.

The ECB will instead wait until early next year to gauge the effectiveness of current stimulus measures. While ECB head Mario Draghi has stressed that the governing council is unanimous in being prepared to use new measures if necessary, it is widely believed that substantial roadblocks still need to be cleared to pave the way for the ECB to include the buying of government debt in the list of any further measures.

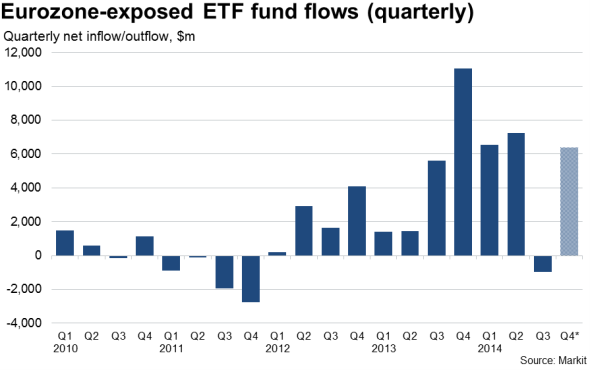

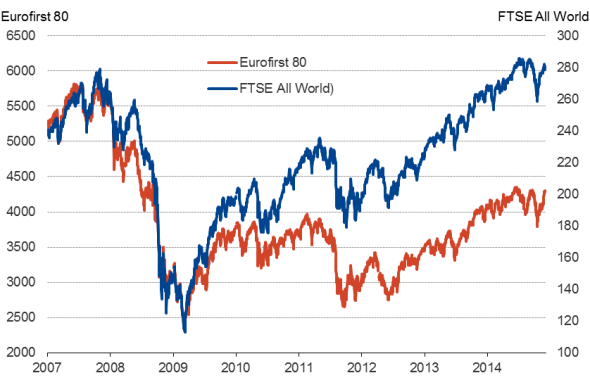

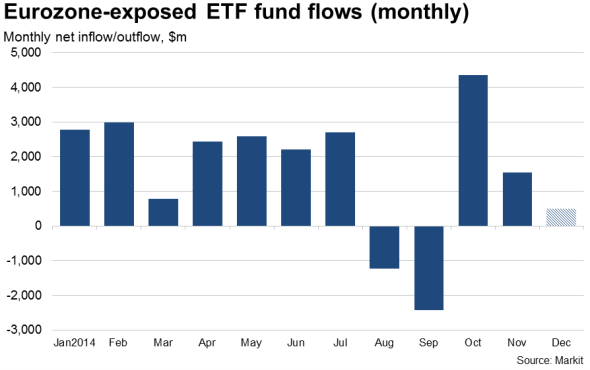

Markets were disappointed, with the euro rising 1% and share prices dropping over 1% after the ECB press conference. Exchange trade funds and equity markets had signalled renewed investor interest in gaining an exposure to the eurozone following previously-announced ECB initiatives. However, the latest drop in share prices suggest that, in the absence of improved economic performance, more aggressive ECB action is likely to be needed to retain such interest.

Downgraded growth forecasts

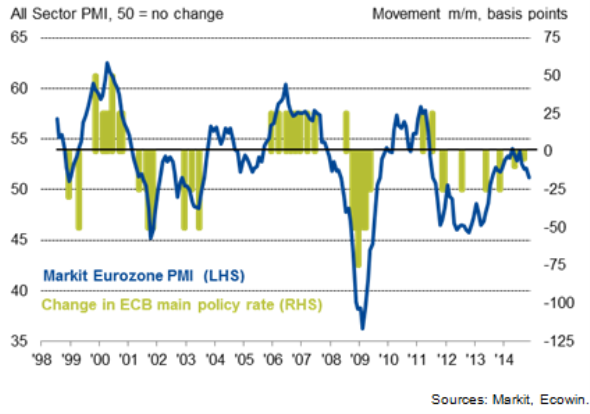

Sighs of relief were heard when the eurozone avoided sliding back into recession in 2014, albeit by the narrowest of margins, but there's still a chance that a renewed downturn will be seen in 2015. The Eurozone PMI was more buoyant than the official data in mid-2014, but has gradually edged closer toward stagnation, hitting a 16-month low in November. Eurozone GDP growth of just 0.1% is signalled for the fourth quarter.

ECB decisions and economic growth (PMI)

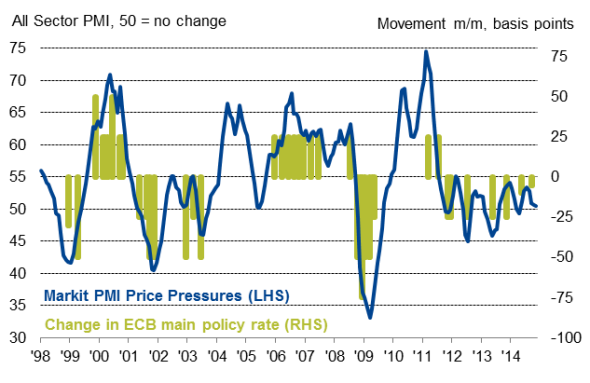

ECB decisions and price pressures (PMI)

The deteriorating economic data flow prompted the ECB to lower its growth forecasts. GDP is expected to rise by just 1.0% next year, downgraded from 1.6% three months ago. A slightly better performance is expected for 2016, with GDP set to rise by 1.5%, but that's also down from a previous forecast of 1.9%. However, even the 1.0% expectation for next year is better than the 0.8% which is pencilled-in for 2014, suggesting the ECB at least expects the economy to be moving in the right direction.

The outlook for inflation was also revised lower. Prices are expected to rise by 0.7% next year after a 0.5% rise in 2014, with the rate of inflation picking up to 1.3% in 2016, but still well below the bank's target of "below but close to 2.0%". What's more, the ECB stressed that even these forecasts did not take into account the recent further slide in the price of oil.

More time needed

Despite the downwardly revised growth profile and greater than previously expected undershooting of inflation, policymakers stood by their view that the impact of previously announced stimulus measures needs to be evaluated before any new initiatives are introduced. In particular, as well as introducing a negative deposit rate, the ECB announced a new scheme back in September of private sector asset purchases, buying asset backed securities and covered bonds. It more recently clarified that the intention of these purchases is to boost the bank's balance sheet by €1 trillion, back to the level reached in 2012.

Indeed, the only change to the ECB's statement in December was that it is "intending" to increase its asset purchases to this extent rather than "expecting" to. To highlight the mountains still needed to be climbed before government bond purchases might be possible, Draghi noted that even this change to the statement wording had not been agreed unanimously.

Improved investor sentiment

The previously announced measures had a marked impact on financial markets, especially equities. Investor sentiment has clearly improved in the fourth quarter, buoyed by the more aggressive ECB policy stance. Exchange trade funds with an exposure to the eurozone saw net inflows both October and November as investors sought to boost their exposure to the euro area, and December has so far likewise seen a net inflow. In contrast, such funds had seen net outflows in August and September, which resulted in the first quarterly net outflow seen for almost three years in the third quarter.

Alongside a 13% jump in the Eurofirst 80 share price index from its mid-October low, the renewed inflows into ETFs could be viewed as a thumbs-up from investors to the ECB's greater commitment to reviving the economy. But it remains to be seen how much of this improvement reflected a bet on the behalf of investors that the ECB will launch full-scale quantitative easing. There is therefore clearly scope for investors to be disappointed if economic growth fails to pick up and roadblocks persist to the ECB"s purchases of government debt.

Share prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-ECB-to-reassess-policy-stance-in-early-2015.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-ECB-to-reassess-policy-stance-in-early-2015.html&text=ECB+to+reassess+policy+stance+in+early-2015","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-ECB-to-reassess-policy-stance-in-early-2015.html","enabled":true},{"name":"email","url":"?subject=ECB to reassess policy stance in early-2015&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-ECB-to-reassess-policy-stance-in-early-2015.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+to+reassess+policy+stance+in+early-2015 http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-ECB-to-reassess-policy-stance-in-early-2015.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}