Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 03, 2014

Steady global manufacturing growth masks wide variations in performance

Steady growth was reported by the world's goods-producing companies in October, but conditions varied markedly across the globe. Although the US has seen growth move down a gear in recent months, it remains an important bright spot in an otherwise generally lacklustre picture.

The JPMorgan Global Manufacturing PMI", compiled by Markit from its surveys*, recorded 52.2 in October, unchanged on September's four-month low but slightly below the third quarter average of 52.4.

The latest reading signalled an ongoing steady but unspectacular pace of manufacturing expansion at the start of the fourth quarter, with the survey broadly consistent with worldwide factory output growing at an annual rate of 4%.

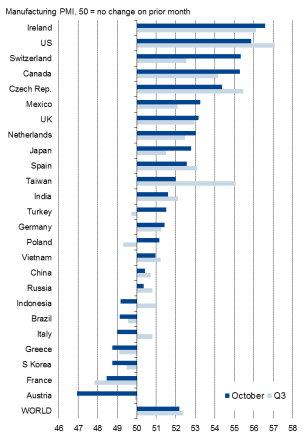

Key areas of weakness are the emerging markets and the eurozone, although the frailty of the latter is by no means ubiquitous, as highlighted by Austria slumping to the bottom of the PMI rankings in October while Ireland leapt to the top spot.

Eurozone and emerging market woes

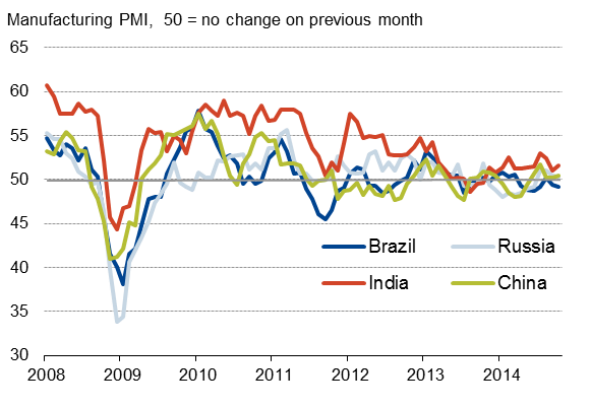

The overall steady pace of expansion masks worrying weakness in many regions, however, notably the Eurozone and many emerging markets. The Eurozone Manufacturing PMI signalled near-stagnation for a third month running in October, with the emerging markets faring little better. The Markit-produced HSBC PMI surveys for China and Russia both likewise barely registered any improvement in business conditions. Meanwhile, only modest growth was seen in India and Brazil saw the business situation deteriorate for the sixth time in the past seven months.

Of the seven countries which registered PMI readings below 50, signalling a deterioration of manufacturing conditions, four were eurozone members, highlighting the ongoing plight of the single-currency area. Austria saw the steepest downturn of all countries surveyed, with its PMI down to a two-year low, followed by France. Greece and Italy also saw deteriorating business conditions. The other countries with sub-50 PMI readings were all emerging markets: Brazil, South Korea and Indonesia.

Countries ranked by manufacturing PMI"*

Source: Markit JPMorgan, HSBC.

* flash PMI data used for Japan.

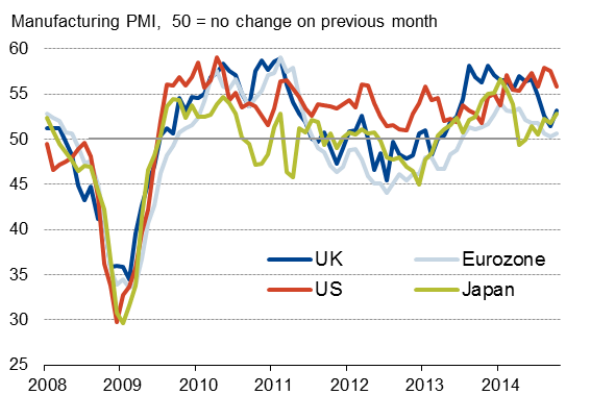

UK hit by eurozone weakness

The October data showed the overall weakness of demand in the Eurozone having an increasingly detrimental impact on other countries. Most clear was the effect on the UK, for which the euro area typically accounts for around 40% of its export trade. Although the Markit/CIPS PMI rose to a three-month high, the index remains well below levels seen earlier in the year. The downwards gear shift can be linked to export orders falling for a second successive month, dropping at the fastest rate since January 2013.

Irelands tops PMI ranking

The woe was by no means evenly spread across the eurozone, however, as clearly illustrated by Ireland rising to the top of the manufacturing PMI league table.

The Netherlands and Spain were also notable in breaking the malaise typifying the euro area, while Germany's PMI also pulled back above 50, having signalled a deterioration for the first time in 15 months in September.

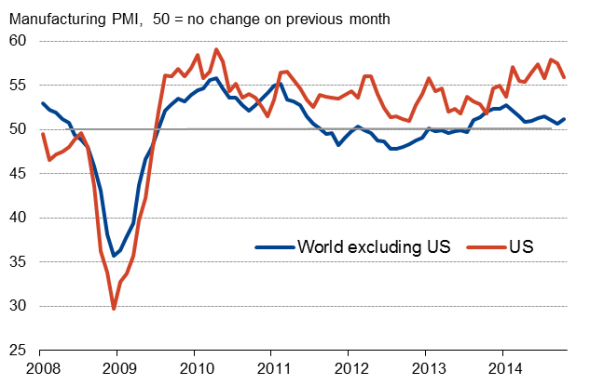

US shows ongoing resilience

The ascent of Ireland to the top of the PMI rankings knocked the US off the head of the table. However, although Markit's US Manufacturing PMI fell to a three-month low, the US recorded the second-strongest pace of expansion of the countries monitored. This ongoing robust performance provides the first indication that the US is set for another quarter of solid economic growth in Q4, and the combination of a buoyant domestic economy and cheap energy continued to help shelter US producers from the weakness of demand in the euro area and emerging markets as a whole.

Ray of hope in Japan

Finally, this release of the global PMI includes the flash PMI data for Japan (final data to be released on 4 November). The flash results showed manufacturing conditions improving at the fastest rate for seven months, suggesting the goods-producing sector is enjoying a modest bounce-back after being hit by April's sales tax rise.

Developed world PMI surveys

Emerging market PMI surveys

US resilience

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-Economics-Steady-global-manufacturing-growth-masks-wide-variations-in-performance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-Economics-Steady-global-manufacturing-growth-masks-wide-variations-in-performance.html&text=Steady+global+manufacturing+growth+masks+wide+variations+in+performance","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-Economics-Steady-global-manufacturing-growth-masks-wide-variations-in-performance.html","enabled":true},{"name":"email","url":"?subject=Steady global manufacturing growth masks wide variations in performance&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-Economics-Steady-global-manufacturing-growth-masks-wide-variations-in-performance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Steady+global+manufacturing+growth+masks+wide+variations+in+performance http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-Economics-Steady-global-manufacturing-growth-masks-wide-variations-in-performance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}