Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 01, 2016

Worldwide manufacturing prices rise at fastest rate for over five years

Global manufacturing is showing signs of resurgent growth in the fourth quarter, but the expansion is being accompanied by rising prices.

With oil prices rising in late November as OPEC agreed to cut supply, global manufacturers face further increases in their costs. However, demand and supply for many commodities appear to be in balance, meaning limited scope for suppliers to hike prices further for many other commodities, for now at least.

Cost rise at fastest rate since 2011

While the JPMorgan Global Manufacturing PMI, compiled by Markit from surveys in over 30 countries, rose to its highest since August 2014, the survey's gauge of input prices also signalled an increase (for an eighth straight month). The rate of input cost inflation is now running at the highest since September 2011.

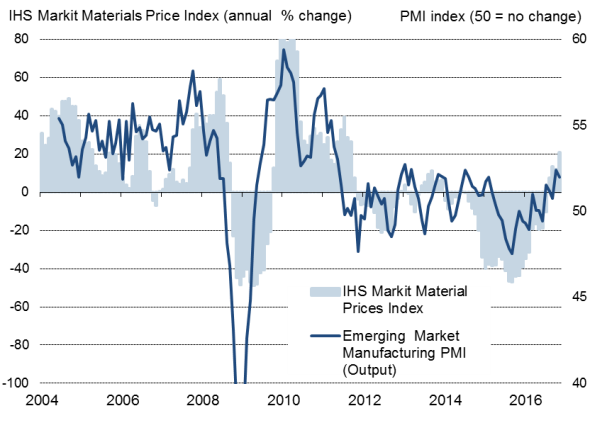

The upturn in prices has in part been driven by commodity prices reviving in line with stronger demand, especially from emerging markets. Emerging market manufacturing is enjoying one of its best spells of growth seen for five years so far in the fourth quarter.

Emerging market growth and raw material prices

Source: IHS Markit.

Developed world manufacturing is also seeing growth pick up to the highest for over two years. Faster growth gobbles up more raw materials, meaning suppliers can often demand higher prices, albeit to a limit.

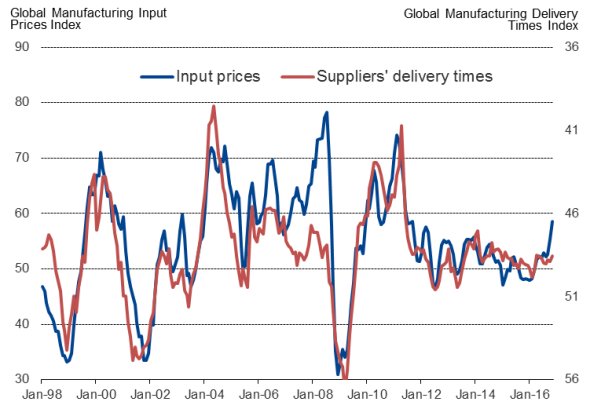

Few signs of supply bottlenecks

Importantly, at present, global supply chains have not been sufficiently stretched to mean shortages are a problem. The survey data in fact provide scant evidence to suggest that prices are being driven up by demand rising faster than supply. Global suppliers' delivery times, for example, lengthened only slightly in November. The implication is that, with demand and supply largely in balance for many goods, there's a limit to how much suppliers can raise prices.

Price & supply pressures

Sources: IHS Markit, JPMorgan

Exchange rate impact

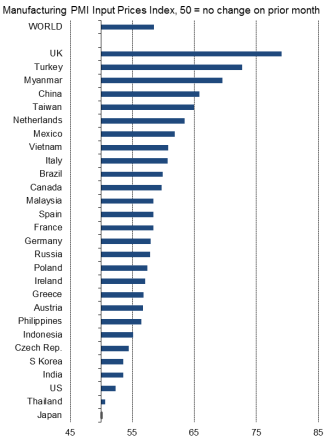

Exchange rates have meanwhile clearly played a major role in driving national price divergences. UK manufacturers saw the steepest increase in costs of all countries by a wide margin for the second month running in November, as the weaker sterling exchange rate (which hit a record low in October on a trade weighted basis) drove up the price of imported raw materials.

The weaker euro is likewise starting to push up input costs in the single currency area. Manufacturing input price inflation in the Eurozone is currently running at its highest since March 2012.

Conversely, Japan's strong yen meant it again saw the smallest increase in costs of all countries surveyed by the PMIs. Similarly, the strengthening dollar has meant US producers saw only a modest increase in input costs in November.

Input cost inflation rankings

Sources: IHS Markit, JPMorgan, Nikkei, Caixin.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Worldwide-manufacturing-prices-rise-at-fastest-rate-for-over-five-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Worldwide-manufacturing-prices-rise-at-fastest-rate-for-over-five-years.html&text=Worldwide+manufacturing+prices+rise+at+fastest+rate+for+over+five+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Worldwide-manufacturing-prices-rise-at-fastest-rate-for-over-five-years.html","enabled":true},{"name":"email","url":"?subject=Worldwide manufacturing prices rise at fastest rate for over five years&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Worldwide-manufacturing-prices-rise-at-fastest-rate-for-over-five-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+manufacturing+prices+rise+at+fastest+rate+for+over+five+years http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Worldwide-manufacturing-prices-rise-at-fastest-rate-for-over-five-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}