Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 21, 2023

The COP28 pledge to triple renewable capacity by 2030: Which countries will find it hardest to achieve?

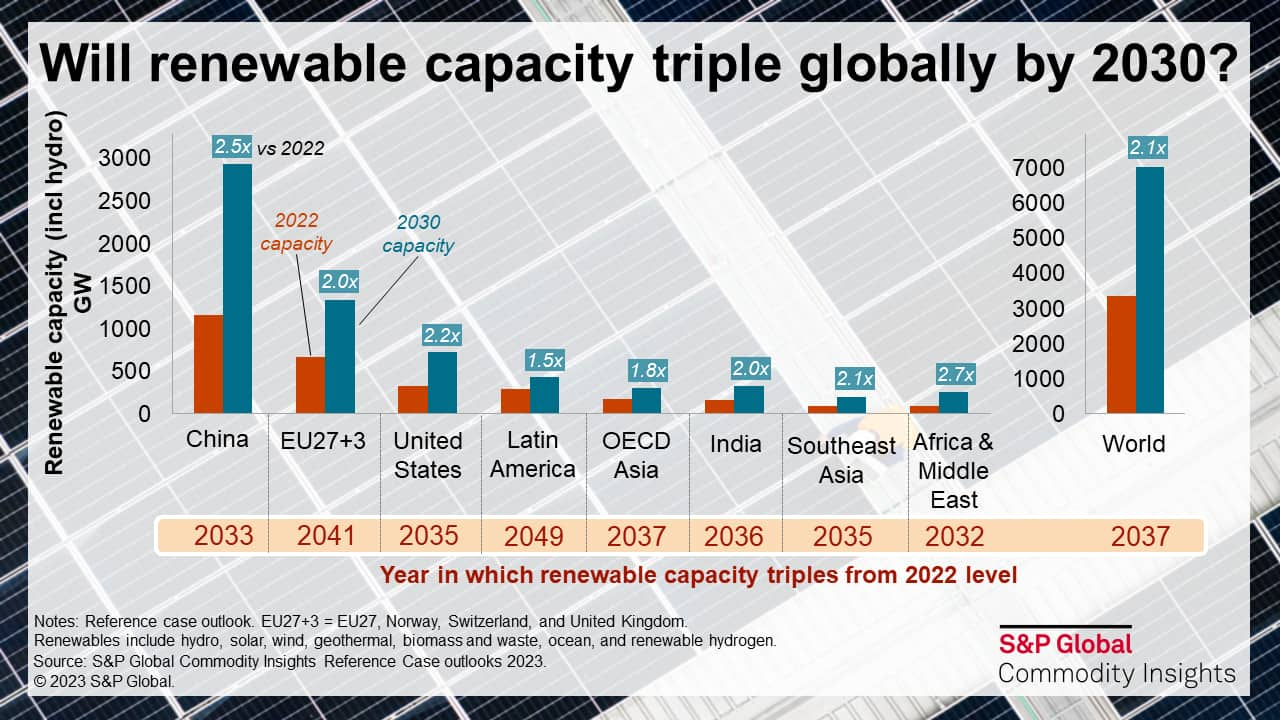

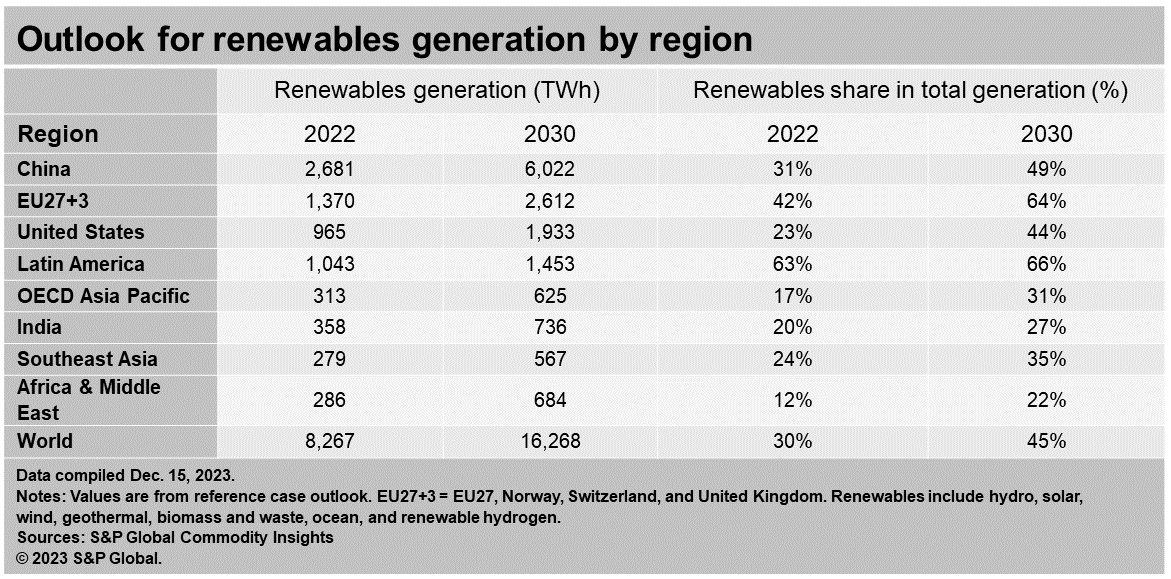

COP28 ended on December 13th with parties pledging to triple renewable energy capacity by 2030. How difficult is this goal for different governments? And which markets will likely find it easier or harder to achieve it than others? S&P Global Commodity Insights reviewed renewable project pipelines around the world, analyzed existing policies and market dynamics, and compared our latest 2030 outlooks by market. We conclude that although the tripling objective is not established by country—it is global, or "collective"—reaching it will require accelerating renewable deployment in markets that have substantially different advantages and challenges.

Several factors impact how much more renewables capacity different markets are likely to see.

- The more renewables one has, the harder it is to build more. Land acquisition and siting can be challenging where renewables growth has been rapid, as rich resource areas have already been developed. Furthermore, the higher the share of variable renewables in a market, the harder it is to add more because of grid constraints. In Europe, for example, wind and solar already represent over 25% of total generation. Insufficient investment in transmission networks—a common theme in many regions—compounds the reliability challenge. Such markets will need to look beyond simply adding cheap variable solar and wind resources, and invest in transmission reinforcements, demand side management, and dispatchable, reliable clean power sources.

- Project development timelines vary greatly. Related to the point above, permitting and interconnection queues are lengthening in several core markets worldwide, due to the growing demand for renewable energy, local and environmental opposition, and regulatory complexities. Our research shows that, on average, permitting a utility-scale solar project takes 3 years in Europe and the US, or 60% of the project development cycle. In Europe, onshore wind permitting can take an average of 3.5 years, almost as long as for offshore wind. In contrast, completing projects in China can take half to a fifth as long. Such variations will affect the renewables build rate in different markets.

- Power demand growth affects the scope for renewables expansion. Renewable additions in emerging economies will primarily satisfy growing electricity demand, while in developed economies they will often replace existing thermal capacity. This shapes the pledge's impact on renewable penetration rates and how it fits with other system requirements. China and India, non-signatories of the Global Renewables and Energy Efficiency Pledge, have promising fundamentals to build more renewables. In rapidly growing markets, the question of base year (not mentioned in the COP28 document) is also important. China, for instance, had 210 GW more renewables in 2022 than in 2023.

- Access to public funds and private capital varies. While growth potential is large, many emerging economies will face difficulties competing for green investment while improving basic access to energy. High interest rates and political and economic uncertainty lead investors to retrench to mature markets. According to S&P Global Commodity Insights, the substantial government incentives offered in the US, Europe, and China will lead the three markets to consolidate over 70% of global renewables additions during 2024-30. Changes in the renewables supply chain, stimulated by new policies on local content requirements, will also affect the geographic distribution of builds. A key ask from the "Global South" is for developed countries to allocate public and private capital and development assistance to developing countries.

Lastly, of note, the Global Renewables and Energy Efficiency Pledge includes hydropower in the 2030 target—but the COP28 Global Stocktake agreement does not mention it. This has major impact on the room for growth for power markets with significant hydro capacity. Markets in Latin America and Scandinavia have large-scale hydropower fleets that have very limited scope for growth. Even in less hydro-dependent regions, including the resource in the pledge complicates its achievement. For example, under the reference outlook of S&P Global Commodity Insights, India will triple its solar and wind capacity by 2033 but triple its renewables capacity (including hydro) by 2036.

Policymakers and other stakeholders will need to consider these geographic realities when elaborating new strategies that support the landmark pledge. These realities also demonstrate the benefits for governments and companies worldwide to collaborate to reach the objective in an economically and technically practical way.

Learn more about our Global Power and Renewables research.

Etienne Gabel, senior director at S&P Global with the Global Power and Renewables team, specializes in the analysis of market and regulatory developments in power sectors worldwide.

Posted on 21 December 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-cop28-pledge-to-triple-renewable-capacity-by-2030.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-cop28-pledge-to-triple-renewable-capacity-by-2030.html&text=The+COP28+pledge+to+triple+renewable+capacity+by+2030%3a+Which+countries+will+find+it+hardest+to+achieve%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-cop28-pledge-to-triple-renewable-capacity-by-2030.html","enabled":true},{"name":"email","url":"?subject=The COP28 pledge to triple renewable capacity by 2030: Which countries will find it hardest to achieve? | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-cop28-pledge-to-triple-renewable-capacity-by-2030.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+COP28+pledge+to+triple+renewable+capacity+by+2030%3a+Which+countries+will+find+it+hardest+to+achieve%3f++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-cop28-pledge-to-triple-renewable-capacity-by-2030.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}