Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 21, 2023

“Eaten Alive”: Solar cannibalization in Europe

Increased record additions in solar PV capacity over the past year (60 GW), following strength in the prior couple of years, are certainly a positive outcome for the European energy transition. This increase in renewables, coupled with stalling and even declining demand, is also contributing to undermine wholesale prices. The erosion is particularly visible during solar hours, an effect that we call "cannibalization."

Current wholesale prices already showing signs of deteriorating solar PV captured prices

The key question is how power market prices in Europe will decrease in the medium term, driven by the additional capacity of renewables.

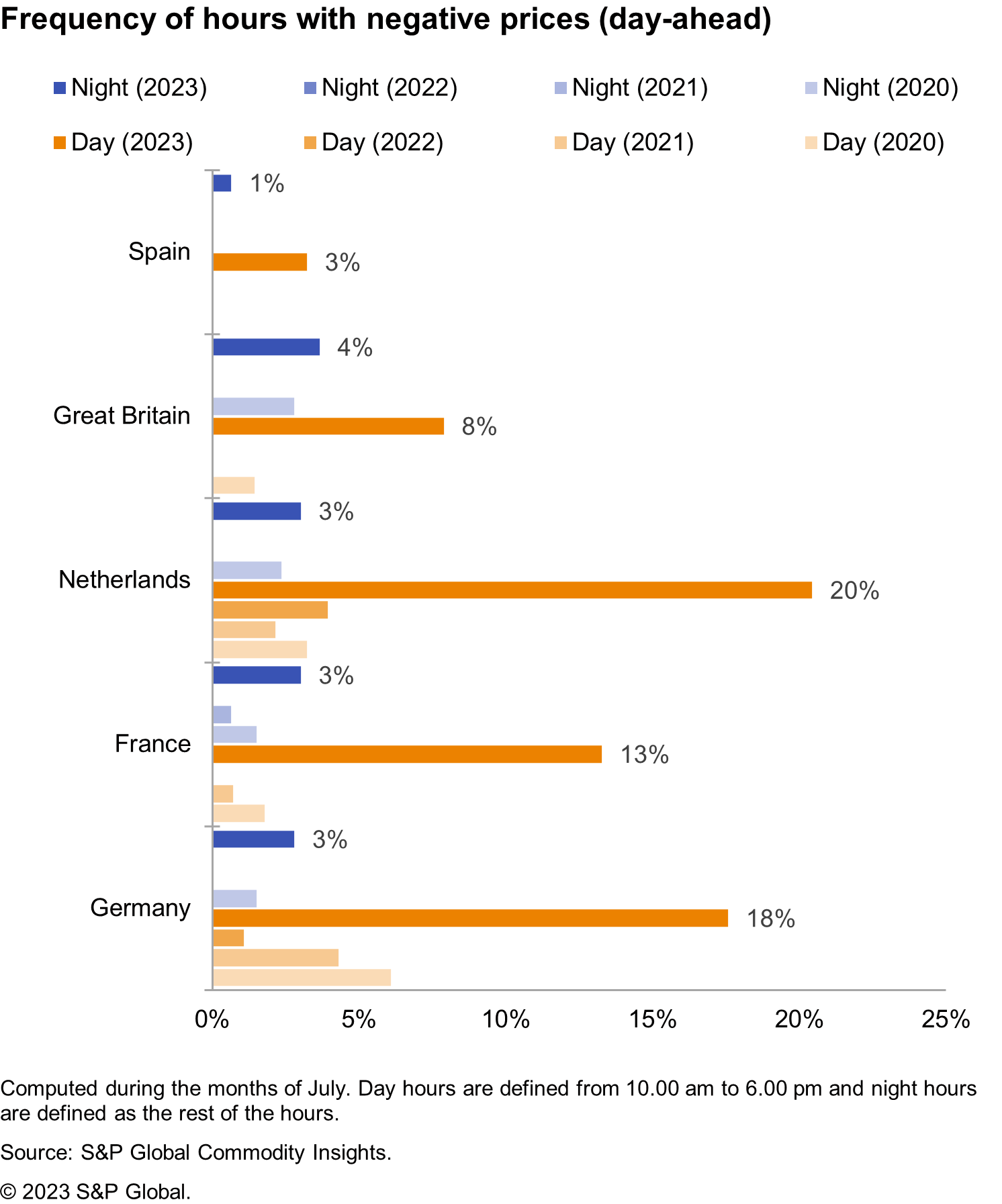

Summer 2023 is already showing signs of high saturation, foreseeing what we could expect in summers on a day-to-day basis in the mid-term as more solar PV capacity are connected to the network. Frequency of negative prices reached groundbreaking values in most countries in Europe with the Netherlands leading the pack with 20% of negative prices during daylight hours in the day-ahead market.

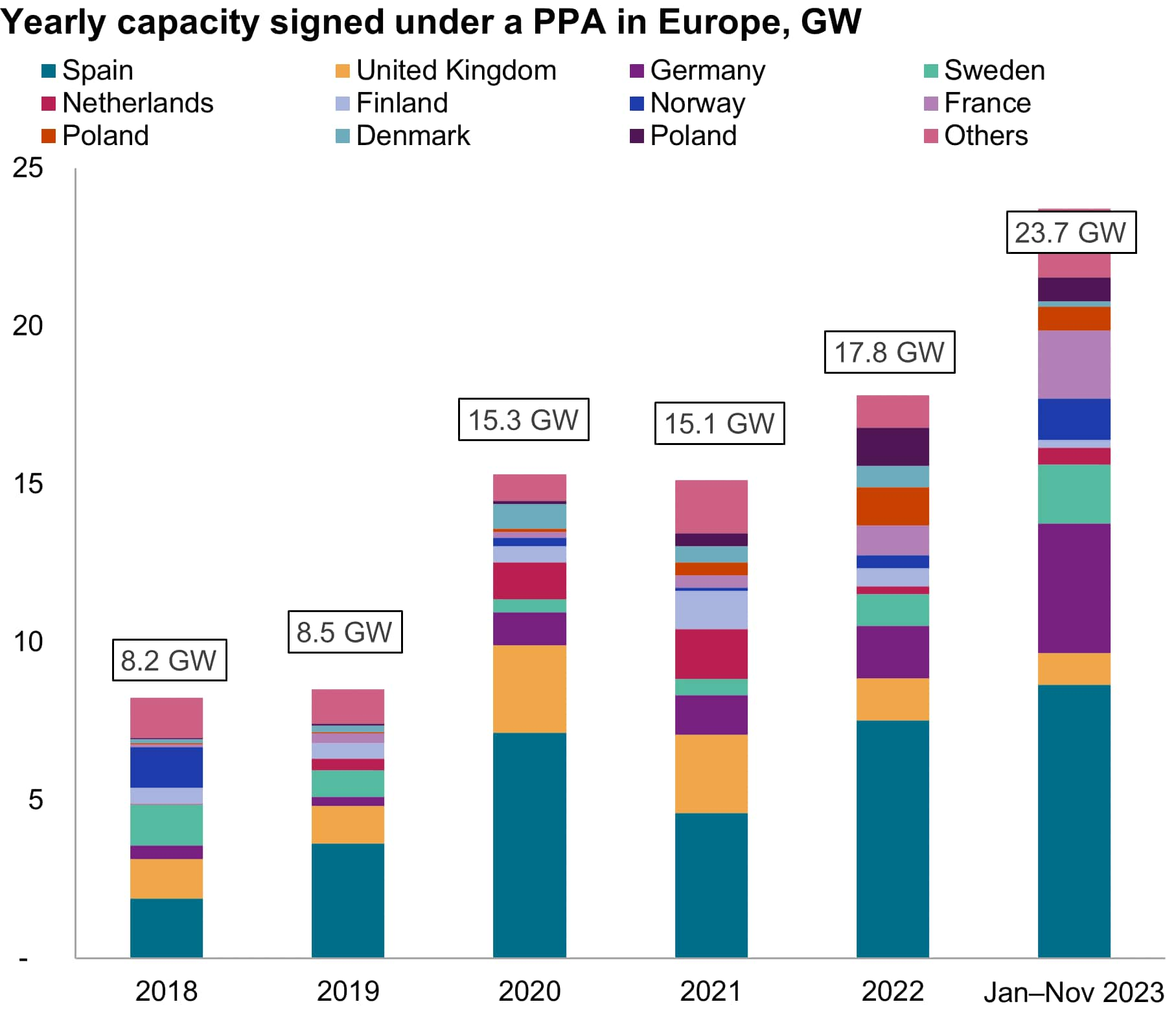

Power plants operators will use revenue stacking and PPAs to manage risks

Although all technologies will be affected by the lower prices during daylight hours, it is the solar PV technology that will most suffer from those as we analyzed above. For solar PV, our outlook shows that installed capacity will triple by 2030. In this context, developers and investors will not be able to rely on power market spot prices alone to build new projects. After a profitable 2022, we expect the "missing money" problem to be a major concern for solar PV assets. Indeed, the spot market is losing relevance to provide signals, fortunately the development of PPAs across Europe is helping to some degree hedge against the exposure to volatile wholesale markets.

Ideally a generator will prefer to cover its generation over the lifetime of its asset - around 30 years, however, consumers are more prone to shorter-term contracts - 10 years or even less. Today, most PPAs are signed for a period of 5 to 15 years so the main challenge is to correctly price PPAs because of the difference between the term of the PPA and the financing horizon of the asset. Merchant exposure in the last 15 to 20 years of the asset could reduce the benefits of the PPAs, weighting stronger on the risk management of the seller thus increasing PPA prices.

As of today, PPA prices tend to be negotiated on the back of wholesale forward power prices which provide a middle point were supply and demand agree to sign deals. However, agreeing on forward capture rates will become increasingly difficult given the increasing negatively priced hours or low-priced settlements. In the future, as merchant prices are depressed, we believe generators will look more closely at defining a floor that is related to their capex and risk management of the assets.

In other words, stand-alone Pay as Produced solar power plants PPAs are becoming increasingly riskier and hard to price because of the solar cannibalization and price volatility in the wholesale market. Currently, solar PV Pay as Produced PPAs are already being quoted in certain countries, such as Spain, below investable levels, which makes it unsustainable in the long term. To secure financially viable PPAs, solar PV developers will need to include flexibility to their offer such as batteries (on-site or off-site) or hybridization with wind power plants.

While large consumers will continue to look for price stability and advancing their clean energy procurement targets, the increased interest from sellers to hedge ahead their revenues will continue to underpin the PPA market and we forecast the current growth to continue in the short term both in terms of volume and number of contracts signed. However, pricing approaches and even structures are likely to evolve as markets reach higher renewables penetration.

Learn more about our European gas, power, and renewables coverage.

Julien Chan Yao Chong, Consulting Manager for Power & Renewables Europe at S&P Global Commodity Insights, focuses on power markets and clean energy finance. He has extensive experience modelling power markets for long-term forecasts, strategic planning and project finance using power system modelling.

Bruno Brunetti is Head of Low-Carbon Electricity Analytics at S&P Global Commodity Insights, which includes forecasting services for renewable power capture prices for wind and solar plants across the globe, power purchase agreements (PPAs) and environmental commodities.

Posted on 21 December 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2featen-alive-solar-cannibalization-in-europe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2featen-alive-solar-cannibalization-in-europe.html&text=%e2%80%9cEaten+Alive%e2%80%9d%3a+Solar+cannibalization+in+Europe+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2featen-alive-solar-cannibalization-in-europe.html","enabled":true},{"name":"email","url":"?subject=“Eaten Alive”: Solar cannibalization in Europe | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2featen-alive-solar-cannibalization-in-europe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=%e2%80%9cEaten+Alive%e2%80%9d%3a+Solar+cannibalization+in+Europe+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2featen-alive-solar-cannibalization-in-europe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}