Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 20, 2019

Weekly Pricing Pulse: Weak macro-data takes the wind out of commodity prices

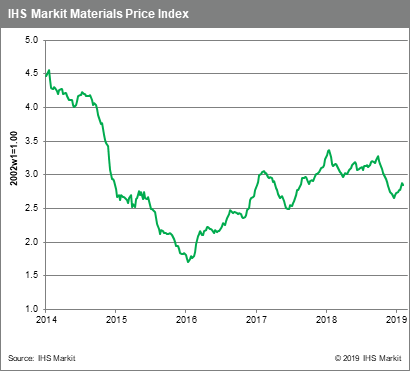

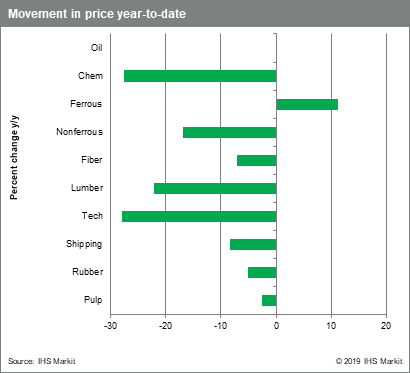

After rising for six straight weeks since late-December, the IHS Markit Materials Price Index (MPI) dipped 1.0% w/w, with eight of the index's ten components falling. Commodity trading was quiet, with Asian markets only slowly returning to normal after the extended Lunar New Year holiday.

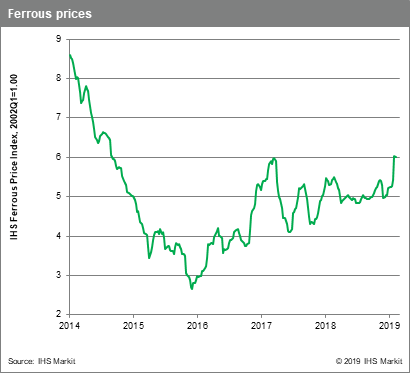

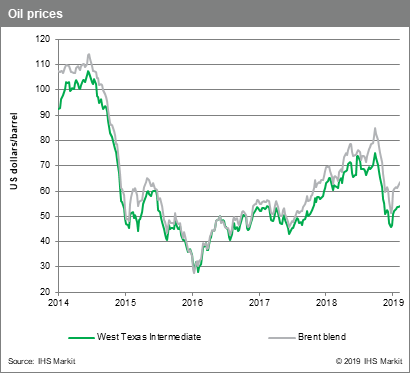

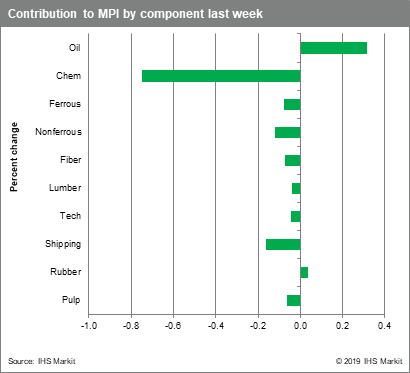

Oil and Rubber were the week's only winners rising, 1.9% and 1.5%, respectively. Oil was buoyed by Saudi and Russian supply cuts, although gains were tempered by persistently strong US oil production. Chemicals diverged from oil prices last week, falling 4.0%, as high inventory levels and seasonally weak demand continue to play on prices. Non-ferrous metals prices fell -1.7% on trade and economic concerns. All metals in the complex retreated save tin, which now seems to be the focus of electric vehicle hype among investors, supplanting cobalt. After gaining 17% in recent weeks, iron ore prices fell last week as markets weighed on market fundamentals, i.e. that Chinese steel demand, given production restrictions, is not booming, Chinese margins are wafer-thin and the value chain is well stocked with ore. Therefore, despite ferrous scrap prices ticking up last week, the MPI's Ferrous subcomponent fell 0.3% w/w.

Collectively, data from last week underlined the fragile state of the global economy. US retail sales fell 1.2% in December, a bigger fall than most analysts had been expecting, while US industrial production sank 0.6% in January. Poor US data bookended disappointing German GDP data for the fourth quarter that showed the economy barely avoided a recession. In China, the producer price index edged up by just 0.1% in January, continuing the deceleration in goods price inflation and highlighting a general softness in the country's manufacturing sector.

The good news for the week centered on trade and the on-going US-China trade negotiations, where progress was made toward a memorandum of understanding that could serve as a basis for a formal agreement. Markets will remain focused on trade with the pending delivery of the US Commerce Department's report on its Section 232 investigation into US imports of motor vehicles and automotive parts. The investigation was launched in May of last year and by law must be delivered within 270 days, placing the deadline in mid-February. Depending on the report's conclusion, markets will either be calmed or worried about a new front opening in the trade war.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-weak-macrodata-takes-wind-out-commodity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-weak-macrodata-takes-wind-out-commodity.html&text=Weekly+Pricing+Pulse%3a+Weak+macro-data+takes+the+wind+out+of+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-weak-macrodata-takes-wind-out-commodity.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Weak macro-data takes the wind out of commodity prices | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-weak-macrodata-takes-wind-out-commodity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Weak+macro-data+takes+the+wind+out+of+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-weak-macrodata-takes-wind-out-commodity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}