Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 03, 2020

Weekly Pricing Pulse: Tighter lockdowns stoke uncertainty and commodities trend sideways

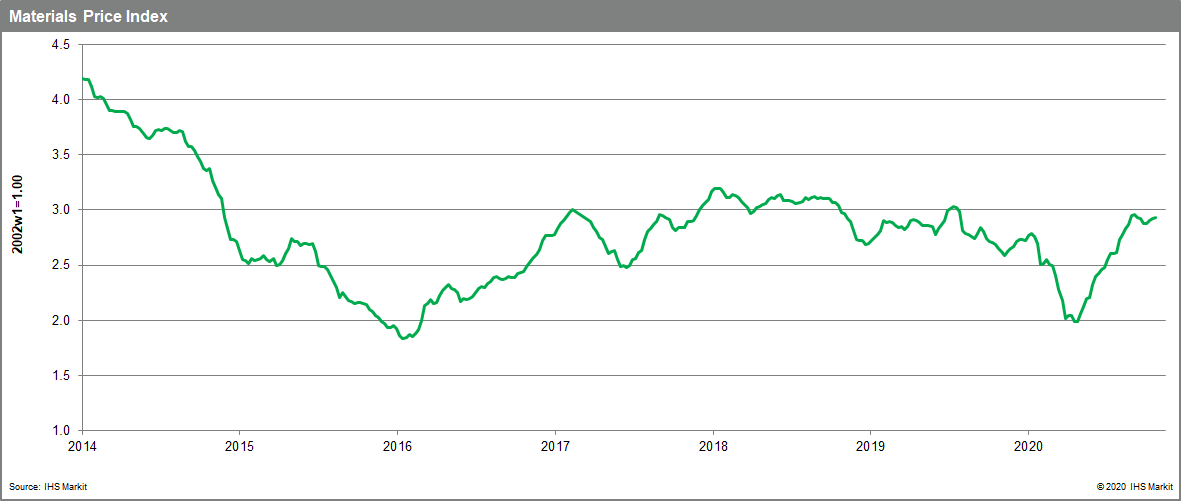

Commodity prices, as measured by our Materials Price Index (MPI), trended roughly sideways last week, gaining just 0.3%. Six of the MPI's ten subcomponents fell as questions around the US election, China's ability to maintain demand and fresh lockdowns in Europe created uncertainty and undercut markets.

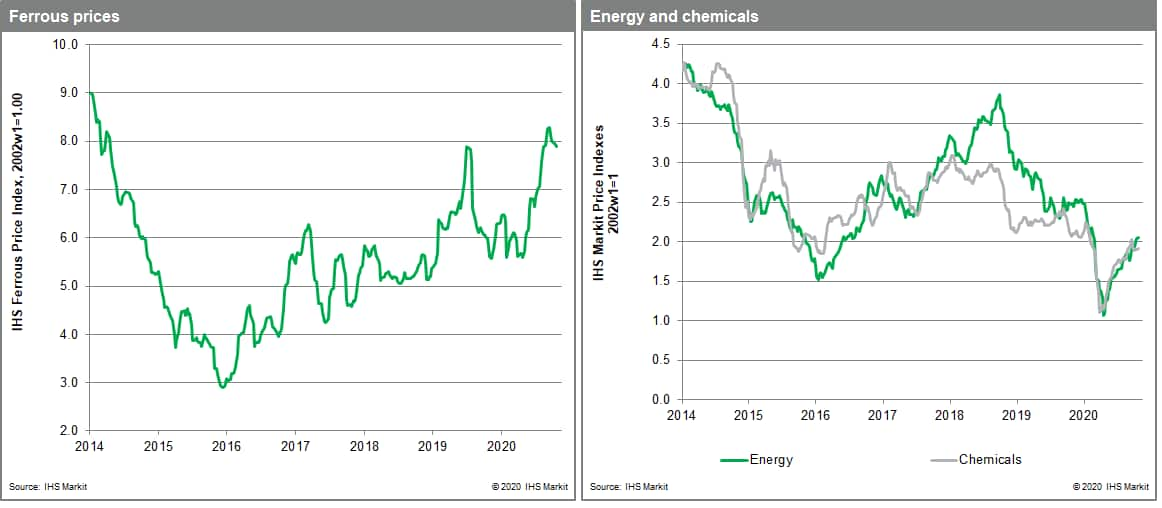

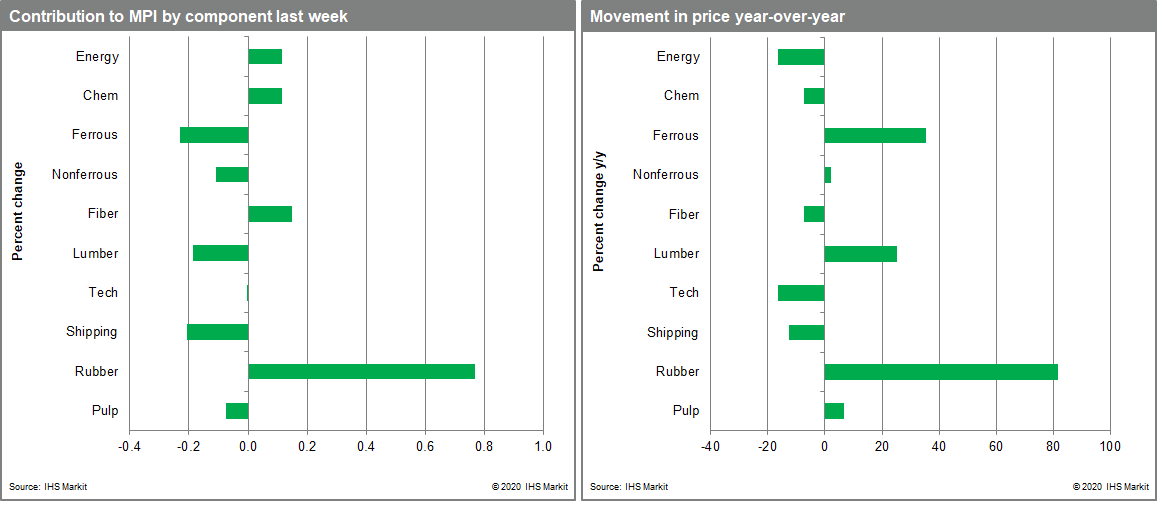

Rubber was an important exception in a generally downbeat week, with prices jumping another 18.0%. Since the end of September prices are up almost 40%. A litany of issues are impacting rubber, which include supply disruptions from COVID-19 related labour shortages in South East Asia, flooding and political unrest in Thailand and, on the demand-side, strong PPE shipments and a good recovery in auto production. Fiber rose 2.7% on tight inventories helping to lift prices that are still down 8.4% on pre-COVID-19 levels. Energy rose 1.0%, due to moves in natural gas prices, which gained another 7.6% last week. US and Asian gas rose 17.8% and 14.5%, respectively, as demand continues to improve. Nevertheless, supply is not constrained, with US exports increasing strongly in recent weeks. Coal moved sideways whilst oil dropped 2.5% on news of reduced mobility and increased Libyan supply. Lumber fell 5.0%, a fourth fall in five weeks. Prices are now down 45% since hitting an all-time high in early September. Steel raw materials fell 0.6% on slightly lower blast furnace operating rates in China.

Two significant events will command markets attention this week: the US Presidential election and a return of lockdowns in Europe. The election on November 3 will create froth in commodity markets as the outcome of the election is digested. The second, more concrete event is the return of community lockdowns in Europe in light of rapidly escalating COVID-19 case counts. This latest round of containment measures - as announced - is less stringent and shorter in duration and thus impact to industrial activity is likely to be much less severe than in the second quarter. Nevertheless, some businesses will be forced to halt activity with demand slowing. More worrisome, surging COVID-19 case counts in North America and elsewhere point to additional control measures in other regions, signalling a potentially difficult winter ahead.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tighter-lockdowns-stoke-uncertainty.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tighter-lockdowns-stoke-uncertainty.html&text=Weekly+Pricing+Pulse%3a+Tighter+lockdowns+stoke+uncertainty+and+commodities+trend+sideways+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tighter-lockdowns-stoke-uncertainty.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Tighter lockdowns stoke uncertainty and commodities trend sideways | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tighter-lockdowns-stoke-uncertainty.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Tighter+lockdowns+stoke+uncertainty+and+commodities+trend+sideways+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-tighter-lockdowns-stoke-uncertainty.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}