Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 20, 2020

Weekly Pricing Pulse: The rebound begins to look more convincing

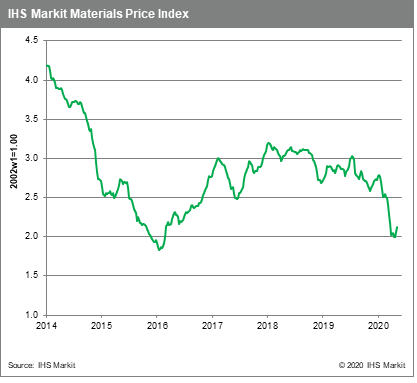

Commodity prices, as measured by our Materials Price Index (MPI), rose 3.7% last week, their second consecutive gain of more than 3.0%. Seven of the MPI's ten components recorded increases. With economies reopening, markets are feeling more confident with focus beginning to shift to the character of the recovery rather than on the depth of the recession.

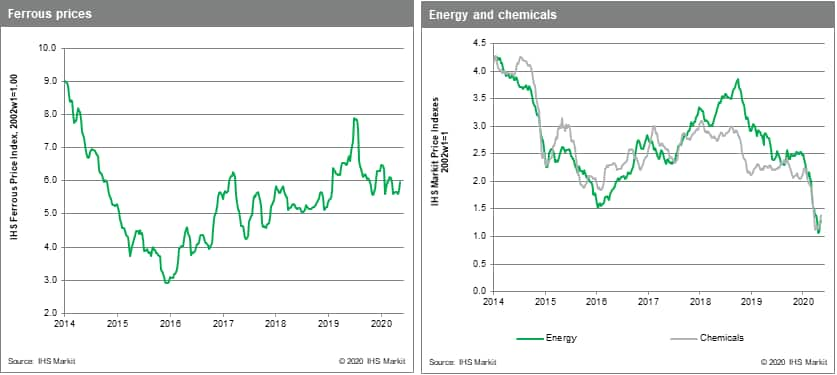

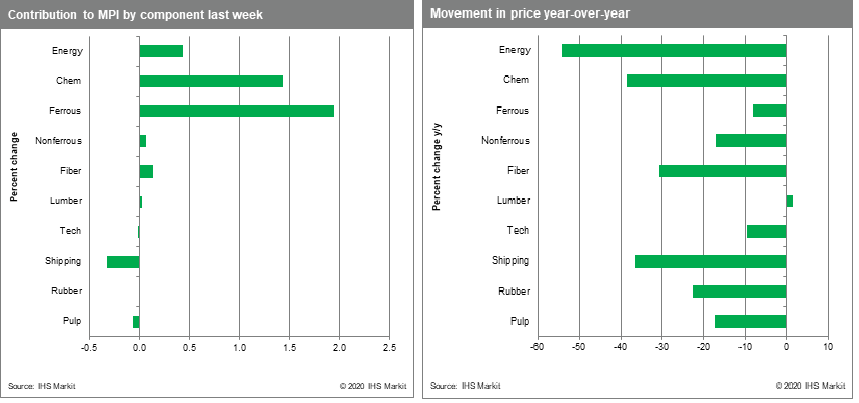

The chemicals sub-index led the MPI higher last week, increasing 9.2% due to strength in Asian ethylene prices. Strong Chinese demand and support from higher oil prices helped drive prices in the region higher. Oil rose a strong 14.7% last week on news that demand was showing signs of recovery and that Saudi Arabia would cut output a further 1 MMb/d in June. Oil's strength pulled the energy sub-index 4.6% higher for the week, countering a 1.2% fall in LNG and 1.6% drop in thermal coal prices. Ferrous prices also rose 4.6%. Iron ore prices pushed back above $90 /Mt on concerns about Brazilian supply and fresh data from China that showed steel production in April up 7.7% on March production from a year ago. Bulk freight prices fell 10% to a new four-year low on a continuing weakness in cargoes. DRAMs continued their decline falling 1.8% as weak demand overrode benefits of destocking of inventory in Q1.

Signs of recovering demand are becoming more widespread as conditions slowly return to normal. Here China may serve as a template for the broader global economy. Factories have largely returned to work although operating rates are not yet back to pre-pandemic levels. The service sector, however, still shows profound weakness, highlighting how leery consumers remain and how prolonged, therefore, a true recovery is likely to be.

Commodity to watch: Iron Ore Prices

Iron ore prices remain strong and have pushed back above $90 per metric ton on concern over Brazilian supply and data showing Chinese steel production increased in April. Notwithstanding their recent strength, IHS Markit projects iron ore prices will fall below $70 per metric ton in 2021. Iron mine capacity remains ample, and on the demand side, we expect global steel production to be cut in response to COVID-19 related softness in both global construction and light vehicle production.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-rebound-begins-to-look-more-convincing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-rebound-begins-to-look-more-convincing.html&text=Weekly+Pricing+Pulse%3a+The+rebound+begins+to+look+more+convincing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-rebound-begins-to-look-more-convincing.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: The rebound begins to look more convincing | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-rebound-begins-to-look-more-convincing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+The+rebound+begins+to+look+more+convincing+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-rebound-begins-to-look-more-convincing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}