Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 21, 2019

Weekly Pricing Pulse: Recession worries undercut commodity prices

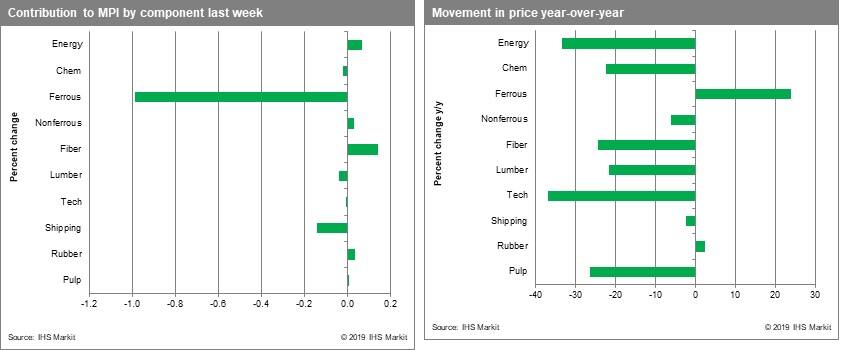

Commodity prices, as measured by our Materials Price Index, fell another 0.9% last week, as growing recession fears again kept physical users on the sidelines and investors seeking safety in less risky asset classes. The US government's announcement that some tariffs on Chinese imports would be postponed until December helped limit the retreat, however, with some stability returning to markets by weeks end. Indeed, five of the MPI's 10 sub-categories posted gains for the week.

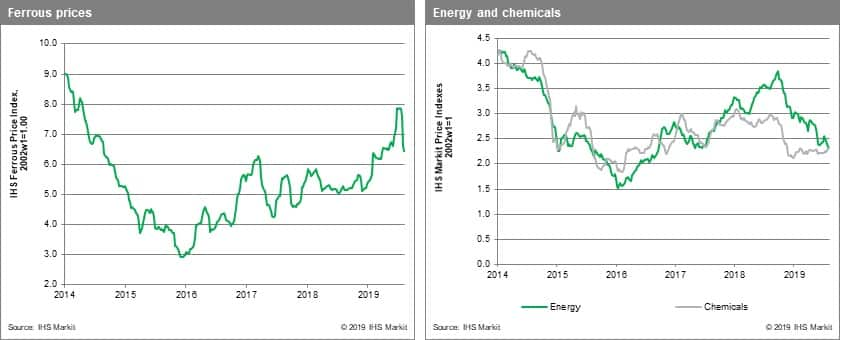

Markets and trade-war-sensitive commodities such as non-ferrous metals and fibers welcomed the tariff delay, rising 0.4% and 2.7% respectively. Energy prices rose 0.4% because of a jump in natural gas prices. Natural gas prices, hammered of late, surged 7.4%, though this lift looks short lived based on LNG trade flows. Coal prices fell 5.0% as decent inventory and the entry of met. coal into the thermal market improved supply. Oil prices dropped 1.6%, on easing tensions in the Persian Gulf and downgrades to the outlook for liquids demand growth. Falling iron ore prices pulled the ferrous price index 2.6% lower. Iron ore prices, recently as high as $120 per ton, are now just about $90 per ton expected to continue falling into the mid-$80s before pausing.

The commodity complex is suffering under pressure from all sides. Softening physical demand, a stronger dollar, trade tensions and a darkening macro outlook have all combined to produce a negative view of the near-future. Last week saw the US yield curve invert for the first time since the summer of 2007, a move viewed by markets as a recession warning sign. The 30-year treasury fell below 2% for the first time, as weak performance of the global economy and geo-political uncertainty has sent markets in search of safety trades. This sentiment is mostly baked into commodity prices but will ensure limited recovery in commodity prices in the coming months.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-worries-undercut-commodity-pric.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-worries-undercut-commodity-pric.html&text=Weekly+Pricing+Pulse%3a+Recession+worries+undercut+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-worries-undercut-commodity-pric.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Recession worries undercut commodity prices | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-worries-undercut-commodity-pric.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Recession+worries+undercut+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-worries-undercut-commodity-pric.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}