Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 29, 2019

Weekly Pricing Pulse: Prices remain on the fence awaiting 31st July

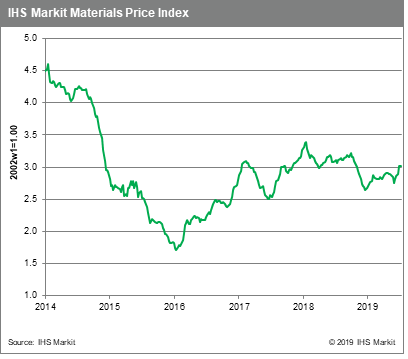

Commodity prices, as measured by our Materials Price Index (MPI), experienced another mixed week rising only 0.3% w/w, despite the growing certainty of a rate cut from the US Fed next week.

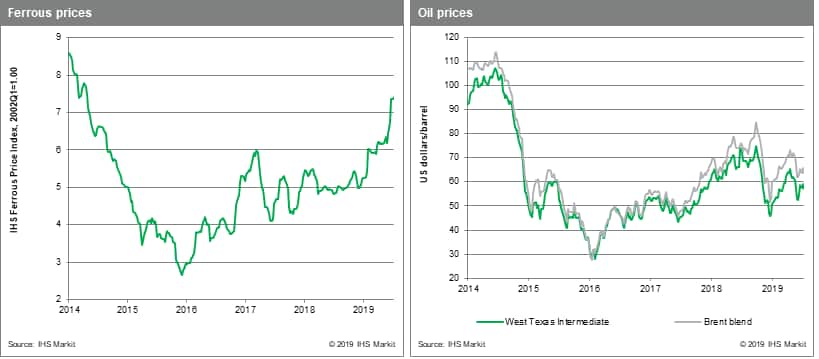

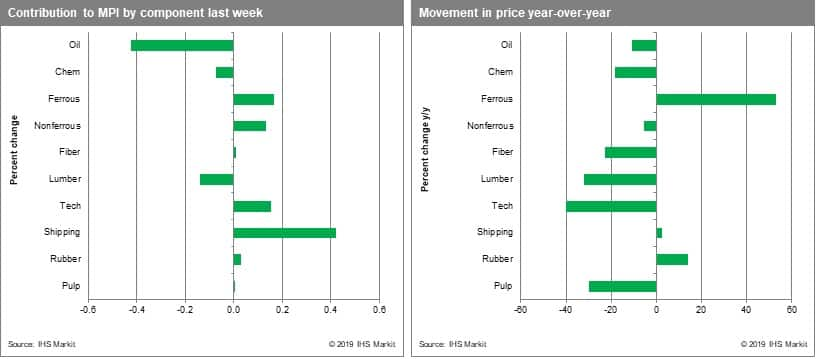

Oil markets remained tense last week, though in the end, worry about a widening trade issue (weaker demand) offset fear of a real war (disrupted supply), with crude prices dropping 2.5%. Lumber prices followed last week's 6.1% retreat with a further 7.1% loss, perhaps induced by June housing starts in the US indicating tepid y/y growth. Bulk freight prices, up 115% in the last four months, show no signs of slowing on strong iron ore demand. Non-ferrous prices leapt back to life last week, rising 2.2%, suggesting this may be the start of a demand rally in China. Nickel prices shone, rising 10.0%; this move was exacerbated by technical and speculative buying, but is underpinned by historically low-price levels and a 2019 supply deficit. The other non-ferrous metals moved up between 1.4-3.7%.

Expectations of a US interest rate cut were reinforced by comments from US Fed officials on Thursday, who hardened their public case for acting, quickly if needed, to support the US economy, should strengthening economic headwinds derail growth. Added to this, US and Chinese officials spoke by telephone last week with the US Treasury Secretary indicating face-to-face talks could follow. Sentiment does seem to have improved in commodity markets, but we do expect volatility on the upcoming Fed announcement.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-prices-remain-fence-awaiting-31st-july.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-prices-remain-fence-awaiting-31st-july.html&text=Weekly+Pricing+Pulse%3a+Prices+remain+on+the+fence+awaiting+31st+July+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-prices-remain-fence-awaiting-31st-july.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Prices remain on the fence awaiting 31st July | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-prices-remain-fence-awaiting-31st-july.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Prices+remain+on+the+fence+awaiting+31st+July+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-prices-remain-fence-awaiting-31st-july.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}