Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 12, 2019

Weekly Pricing Pulse: Oil suffers a rout as US pivots on new Mexican tariffs

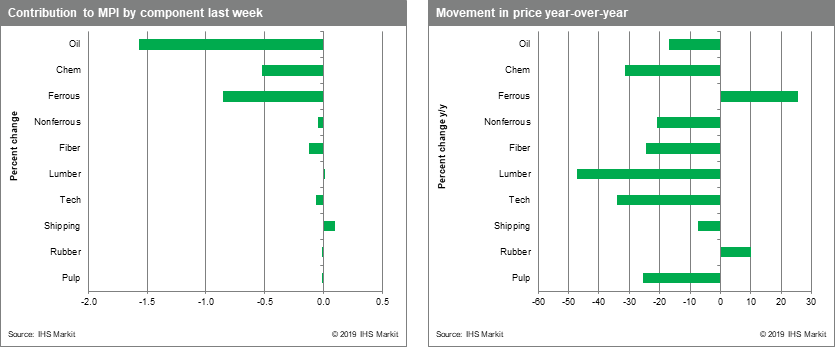

Commodity prices fell broadly last week as uncertainty over trade created fears of weaker demand. As measured by our Materials Price Index (MPI), commodity prices fell 3.1%, the index's largest weekly decline since April 2017 and its sixth consecutive weekly retreat. Oil prices led the drop, with eight of the MPI's ten components falling.

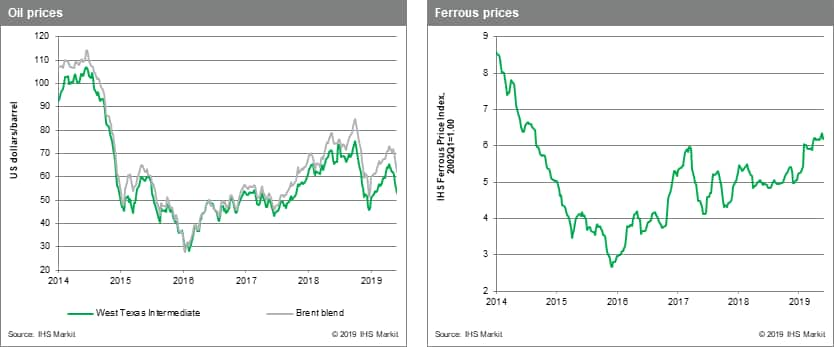

A surge in EIA crude inventories of 6.8 MMb, one of the largest jumps in three decades, surprised crude markets mid-week, reinforcing the view that the market is oversupplied relative to demand, that had taken oil prices 8.6% lower, earlier last week. This left WTI and Brent threatening the $50 and $60 /bbl price levels, respectively and down 14.4% over the last three weeks. Strengthening supply played on the ferrous index last week with prices falling 2.7%. Initial estimates of Australian and Brazilian iron ore exports in May suggest record monthly volumes, which helped to pull prices below $100 /t. US scrap prices have also suffered a significant sell off. The non-ferrous index also continued to fall, dropping 0.7%, though lead and zinc prices rallied as low-inventory drove buying. A weak US jobs report last week helped fuel the weak demand outlook which pulled fibre, rubber, pulp and DRAMs prices lower.

The US and Mexico reached an agreement on immigration Friday, ending an eight-day saga that saw the threat of 5% tariffs on all Mexican imports. Although Mexican-US relations have been hurt, the agreement re-opens the door to ratification of USMCA. A second positive for commodity prices is the softening of Fed rhetoric regarding a rate cut, especially in the wake of the disappointing May US employment report. Fed Chair Powell said last week that "we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2% objective." Gold prices, becalmed lately around $1280 /oz, surged higher on the news, testing the long-held $1350 resistance level, as markets took this as confirmation of a weakening US economy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-rout-us-mexican-tariffs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-rout-us-mexican-tariffs.html&text=Weekly+Pricing+Pulse%3a+Oil+suffers+a+rout+as+US+pivots+on+new+Mexican+tariffs+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-rout-us-mexican-tariffs.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Oil suffers a rout as US pivots on new Mexican tariffs | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-rout-us-mexican-tariffs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Oil+suffers+a+rout+as+US+pivots+on+new+Mexican+tariffs+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-rout-us-mexican-tariffs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}