Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 29, 2018

Weekly Pricing Pulse: Oil suffers another rout

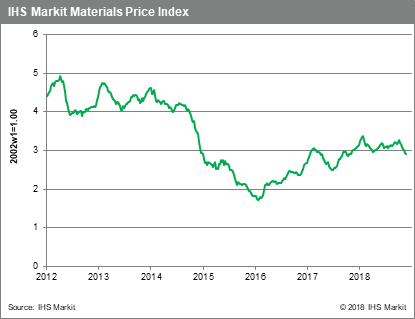

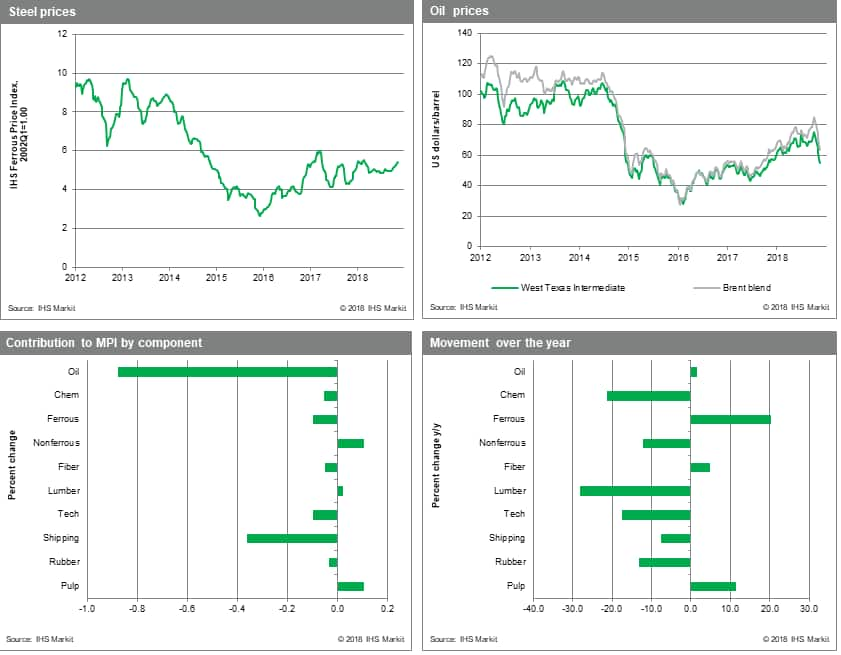

Commodity prices, as measured by the Materials Price Index (MPI), fell another 1.3% last week, their seventh consecutive decline. The MPI is now at its lowest level since September 2017. Sentiment remained sour with bearish US-housing data, credit stress in China, and weaker oil market fundamentals reinforcing anxiety over the health of the global expansion.

Oil prices dropped 5.0% w/w as seven of the MPI's ten components fell last week. Ocean going freight rates dropped just over 9.0% as worries about cargo volumes and the lagged effect of lower bunker fuel prices filtered into charter costs. Other notable moves included the first w/w decline in the Ferrous Price Index in 11 weeks. Steel making raw materials fell 0.4%, driven by a rout in Chinese steel prices. An exception to the general decline were non-ferrous metals prices, which rose 1.6% on news that copper and zinc inventories were near ten-month lows.

The recent increase in stock market volatility, weakness in corporate bonds, the G-20 meetings this week, a pending Brexit vote in the British Parliament, a new Mexican Administration and a December US interest rate increase all promise to keep commodity markets on edge during December. Moreover, looking into 2019, we do not see much of an improvement. A slow normalization in financial markets and a continuing deceleration in Chinese growth mean that the environment for commodities will remain challenging.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-another-rout.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-another-rout.html&text=Weekly+Pricing+Pulse%3a+Oil+suffers+another+rout+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-another-rout.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Oil suffers another rout | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-another-rout.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Oil+suffers+another+rout+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-suffers-another-rout.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}