Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 11, 2018

Weekly Pricing Pulse: Oil and chemical price increases boost MPI Index despite headwinds

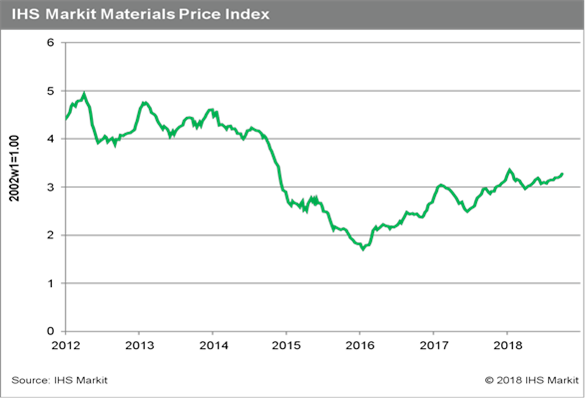

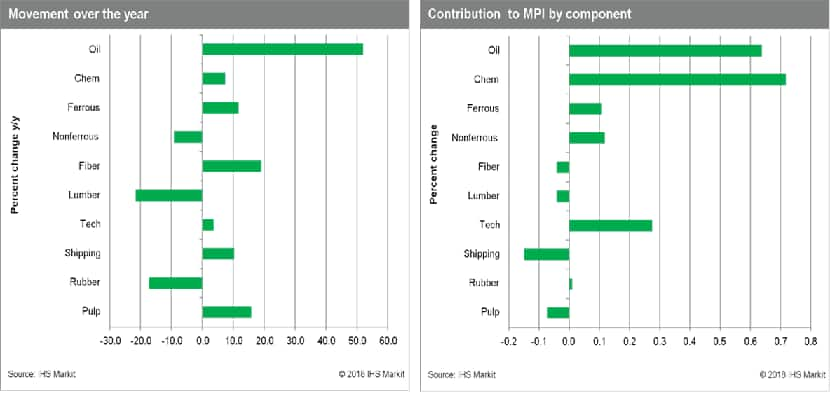

In spite of lackluster PMI data for September, rising bond yields and a US employment report that all but guarantees steady interest rate increases in the US, commodity prices rose last week, with our Materials Price Index (MPI) increasing 1.6%. Seven of the MPI's ten sub-indexes rose, led by oil (up 3.3%) and chemicals (up 2.8%). DRAM prices also helped drive the MPI higher, rising 3.7%.

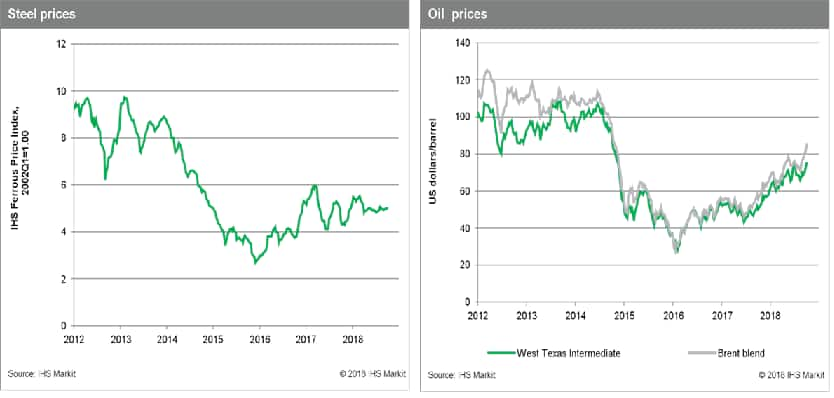

Oil prices continue to show strength, with Brent crude reaching $84.16, its highest level since November of 2014. Fears about the impact of upcoming Iranian sanctions continues to stress the market. The US government is considering a waiver program allowing current importers of Iranian crude to continue doing so, provided imports are sequentially reduced to zero. Saudi Arabia and Russia are lifting production, though their increases to date have not offset the plunge in Iranian crude reaching global markets. Ethylene prices rose 5.7%, their eighth straight weekly increase, and were the driving force behind the increase in the MPI's chemical sub-index. The increase in the DRAM price index, although dramatic, reflects updated shipment data that gives more weight to more expensive chipsets. This lifted the average selling price and thus the index, even though actual prices did not in fact rise.

Macroeconomic data releases from last week paint a picture of slowing but continued economic growth. The global manufacturing PMI Index for September came in at 52.2, a dip from the 52.6 reading in August and the lowest reading since late 2016. Bond markets also saw a sell-off, with the 10-year inflation adjusted yield on 10-year US Treasuries moving above one percent for the first time since 2011. Rising interest rate expectations rather than inflation fears appear to be the force behind the bond market sell-off, indicating confidence that the expansion will continue. This said, higher yields are a double headwind for commodity markets as they will undercut investor demand while restraining physical consumption growth.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-and-chemical-price.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-and-chemical-price.html&text=Weekly+Pricing+Pulse%3a+Oil+and+chemical+price+increases+boost+MPI+Index+despite+headwinds+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-and-chemical-price.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Oil and chemical price increases boost MPI Index despite headwinds | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-and-chemical-price.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Oil+and+chemical+price+increases+boost+MPI+Index+despite+headwinds+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-and-chemical-price.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}