Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 13, 2019

Weekly Pricing Pulse: MPI surges as iron ore disruption bites

MPI surges as iron ore disruption bites

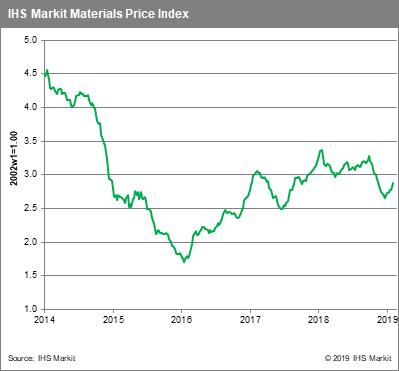

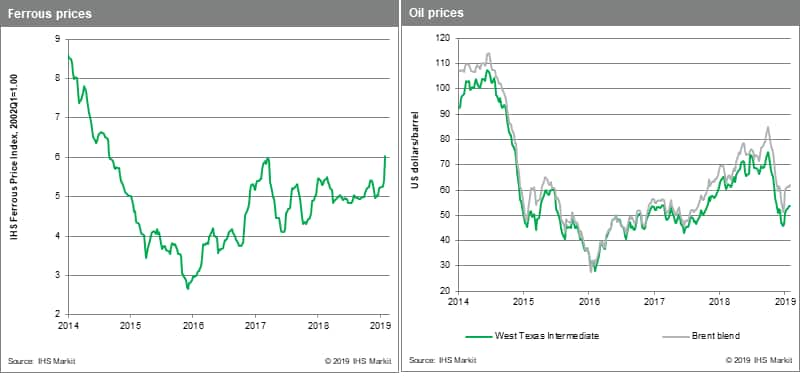

The Lunar New Year holiday meant Asian markets, and commodity markets generally, were quiet last week. Iron ore proved the exception, with prices surging on news of the Vale mine accident in Brazil. The jump in iron ore prices was large enough to drive our Materials Price Index (MPI) 3.3% higher w/w, despite the backdrop of a strengthening dollar.

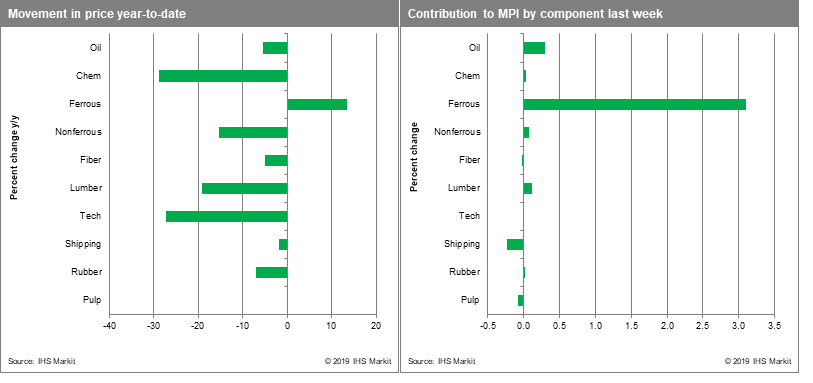

Most MPI components saw a quiet week last on thin trading. The ferrous metals sub-index, however, rose 11.1% w/w because of iron ore's move from $77 to $89 /t. The full impact of the Vale accident has been slowly emerging, though it now appears some 17% of Vale's total capacity may be shut for some time, enough to shift the global market from surplus to deficit for 2019, hence the reaction in prices. As Chinese traders re-enter the market, we expect further ore price increases, which will then move into both scrap and steel prices in the coming weeks. Apart from iron ore, oil rose last week 1.7%, as market participants adjusted to US sanctions on Venezuela. Freight prices suffered for a second straight week, falling 6.7% w/w. Vale shipped only two cargoes from Brazil to the far-east versus a more typical 7-10 sailings as volumes suffered from weak demand and the supply disruption tied to the mine accident.

The first five weeks of 2019 have

seen a nice bounce in commodity prices, with sentiment improving

after a downbeat ending to 2018. This said, incoming data is not

providing fundamental support for the better mood in commodity

markets. January's IHS Markit Global Manufacturing Purchasing

Manager Index (PMI) reading of 50.7 (versus 51.4 in December)

showed a further loss of momentum in manufacturing activity.

Regionally, conditions in the U.S. continue to hold up relatively

well. However, China's manufacturing PMI fell to a three-year low

of 48.3, with the Eurozone and Japanese manufacturing indexes

falling to 50 and 29 month lows, respectively. Markets will also

have to deal with a number of know unknowns in the weeks

immediately ahead. The UK's Brexit deadline looms, as does the

Trump Administration's deadline for a decision on whether to

increase section 301 tariffs on Chinese imports. Under the radar

screen is the US Commerce Department's section 232 report on US

auto imports, which is due shortly. Volatility has recently

declined in commodity markets, a clam that may not hold for much

longer.

The first five weeks of 2019 have

seen a nice bounce in commodity prices, with sentiment improving

after a downbeat ending to 2018. This said, incoming data is not

providing fundamental support for the better mood in commodity

markets. January's IHS Markit Global Manufacturing Purchasing

Manager Index (PMI) reading of 50.7 (versus 51.4 in December)

showed a further loss of momentum in manufacturing activity.

Regionally, conditions in the U.S. continue to hold up relatively

well. However, China's manufacturing PMI fell to a three-year low

of 48.3, with the Eurozone and Japanese manufacturing indexes

falling to 50 and 29 month lows, respectively. Markets will also

have to deal with a number of know unknowns in the weeks

immediately ahead. The UK's Brexit deadline looms, as does the

Trump Administration's deadline for a decision on whether to

increase section 301 tariffs on Chinese imports. Under the radar

screen is the US Commerce Department's section 232 report on US

auto imports, which is due shortly. Volatility has recently

declined in commodity markets, a clam that may not hold for much

longer.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-surges-as-iron-ore-disruption-bites.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-surges-as-iron-ore-disruption-bites.html&text=Weekly+Pricing+Pulse%3a+MPI+surges+as+iron+ore+disruption+bites+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-surges-as-iron-ore-disruption-bites.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: MPI surges as iron ore disruption bites | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-surges-as-iron-ore-disruption-bites.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+MPI+surges+as+iron+ore+disruption+bites+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mpi-surges-as-iron-ore-disruption-bites.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}