Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 18, 2020

Weekly Pricing Pulse: Momentum carries commodity prices higher, but demand doubts increase

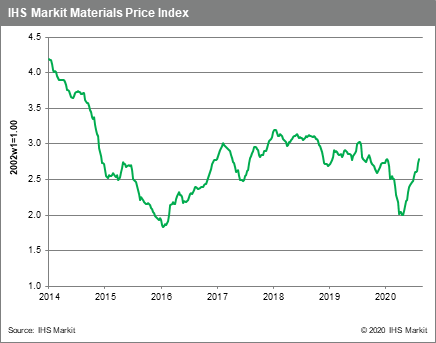

During a week of mixed headlines and data releases, markets chose to latch onto strong demand data coming out of China early in the week, with our Materials Price Index (MPI) pushing 1.8% higher. As was the case during the second quarter, gains in the MPI were broad-based, with eight of the index's ten components rising. The MPI is now flat year-to-date (YTD), having totally erased its 28.1% first quarter fall.

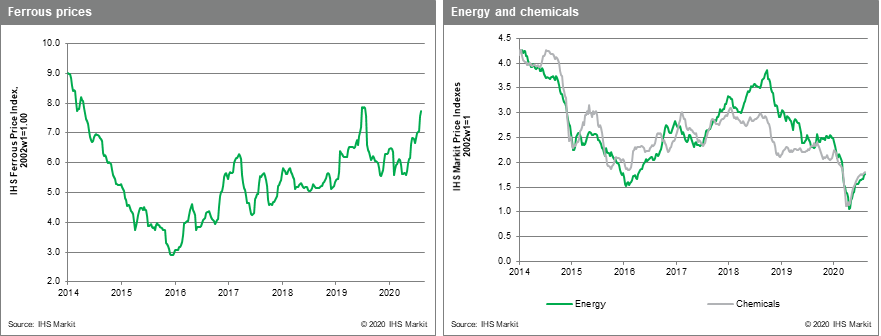

Energy and steel raw materials shared the limelight last week, both increasing 2.2%. Natural gas prices were also a standout, leaping 13.3%, carried higher by momentum from the previous week's 22.4% move and unexpected outages. Crude steel production shows no signs of slowing; July crude steel output hit 93.4 MMt, up 9.1% y/y. Lumber prices rose 12.3%, another double-digit weekly rise. North American lumber prices are up 98% YTD and 177% from their March low. North American sawmills continue to struggle to lift production in the face of strong demand. Rubber prices rose 1.1% on continued strength in Chinese vehicle sales, which jumped 16.4 % y/y in July 2020, their fourth straight monthly increase. Fiber prices, still down 23% YTD, fell 1.4% on rising inventory in China. Demand has stayed firm but the end of maintenance at two factories has seen supply recover, swelling inventories once again.

The MPI took direction early last week from data that showed July Chinese fixed asset investment and value-added industrial production continuing their rapid improvement. US industrial production also showed improvement, though US production year over year is still down by 10%. Nevertheless, unspectacular Chinese retail sales and the failure of the US Congress to agree on extending stimulus, caused markets to focus at week's end on the prospect of reduced government support in several countries later this year. Growing trade friction also remains a worry. In short, we still do not see a "V" shaped global recovery. The rebound in material prices since April has been impressive. But we do not expect the momentum to be maintained across the rest of the year.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-momentum-carries-commodity-prices-higher.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-momentum-carries-commodity-prices-higher.html&text=Weekly+Pricing+Pulse%3a+Momentum+carries+commodity+prices+higher%2c+but+demand+doubts+increase+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-momentum-carries-commodity-prices-higher.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Momentum carries commodity prices higher, but demand doubts increase | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-momentum-carries-commodity-prices-higher.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Momentum+carries+commodity+prices+higher%2c+but+demand+doubts+increase+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-momentum-carries-commodity-prices-higher.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}