Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 30, 2020

Weekly Pricing Pulse: Materials price inflation ends 2020 on a high note

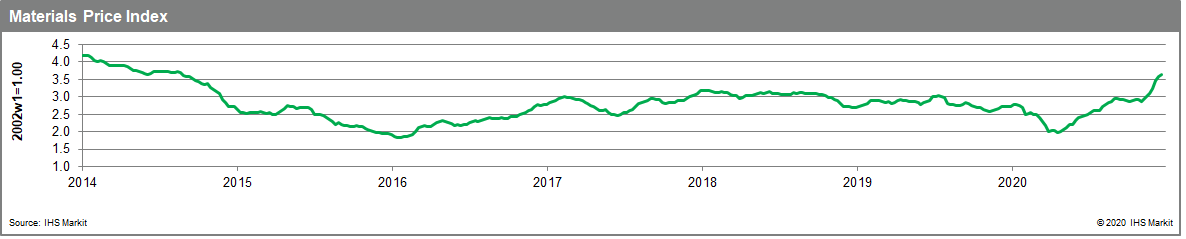

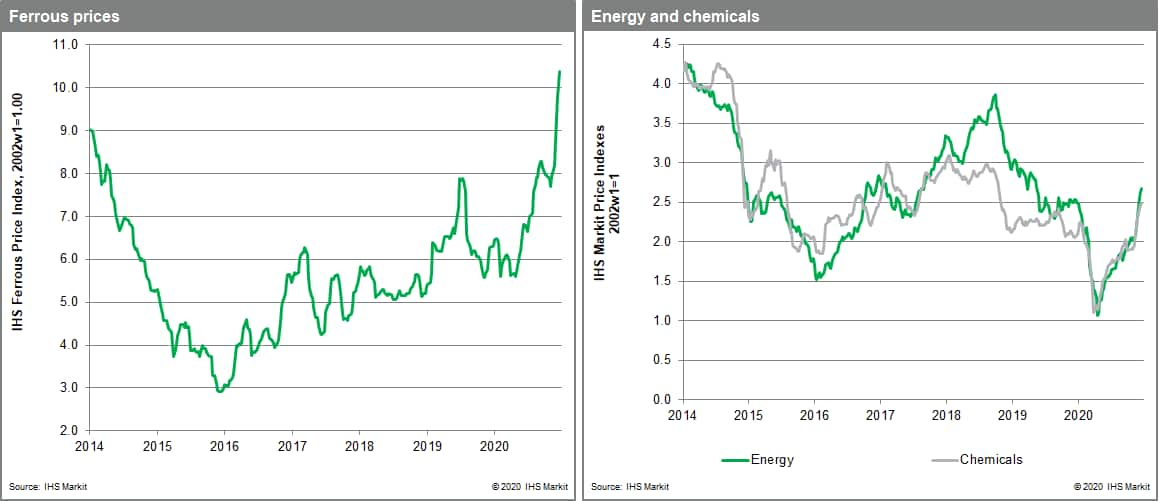

Our Materials Price Index (MPI) rose 1.9% last week, its seventh consecutive increase. While the pace of price increases has slowed from recent weeks of surging growth, commodity markets close 2020 on a torrid pace -- the MPI is up nearly 26% since the start of October and is now at its highest level since early September 2014. Year-over-year, the MPI is up 33%, and shows few signs of the pandemic that has upended the global economy.

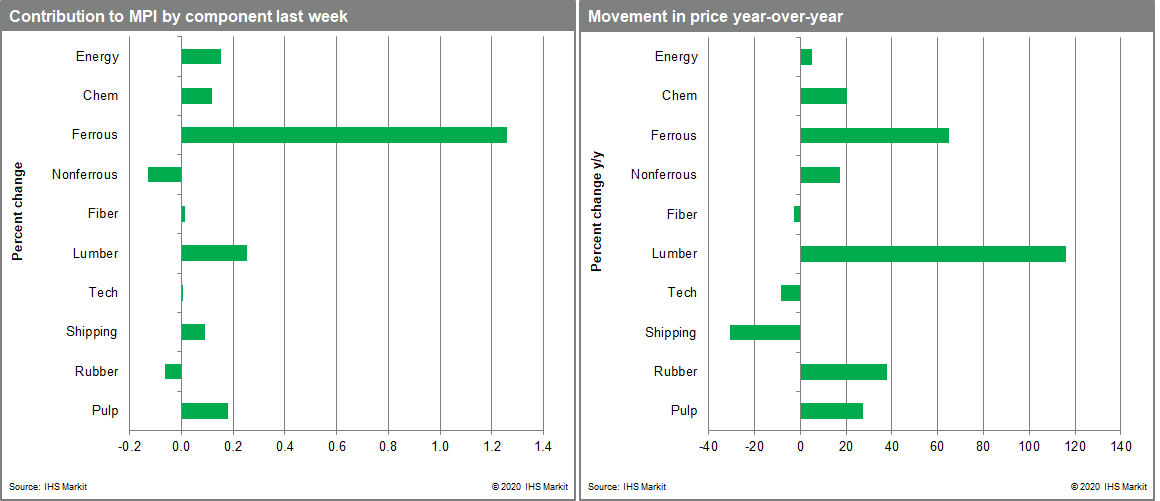

Lumber was again the biggest mover last week, though the rate of increase slowed from 10.4% to 'just' 6.1%. Lumber prices are within 4% of their all-time high, set just three months ago in September, as short supply and upbeat homebuilding in the North American market underpin a months-long climb. Pulp prices built on last week's 4% climb with a 5% increase this week. Ongoing logistics challenges have restrained the ability to get cargoes into China, the one market globally that has shown strong growth in 2020. Quieter market activity around the Christmas holiday provided some easing to metals markets, as the nonferrous metals subcomponent posted a 1.5% decline, its first since October. Nonferrous metals prices remain elevated, though, with industrial base metal prices collectively 18% higher than a year ago.

The race between the continued spread of COVID-19 and the distribution of vaccines is now driving expectations for 2021, with commodity markets pricing in an optimistic 'the glass is half full' view of the near-future. A definitive result in the US presidential election plus fresh fiscal stimulus, clarity around Brexit, continuing goods news on mainland Chinese manufacturing activity and the roll-out of two vaccines has created a buoyant mood in markets. The question for 2021 is how long supply-chain bottlenecks last and whether they last long enough to create elevated goods price inflation. An answer may be apparent immediately after the Lunar New Year holidays when Asian markets return from their normal seasonal lull.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-materials-price-inflation-2020-high-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-materials-price-inflation-2020-high-note.html&text=Weekly+Pricing+Pulse%3a+Materials+price+inflation+ends+2020+on+a+high+note+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-materials-price-inflation-2020-high-note.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Materials price inflation ends 2020 on a high note | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-materials-price-inflation-2020-high-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Materials+price+inflation+ends+2020+on+a+high+note+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-materials-price-inflation-2020-high-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}