Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 30, 2018

Weekly Pricing Pulse: Markets seize on positive sentiment

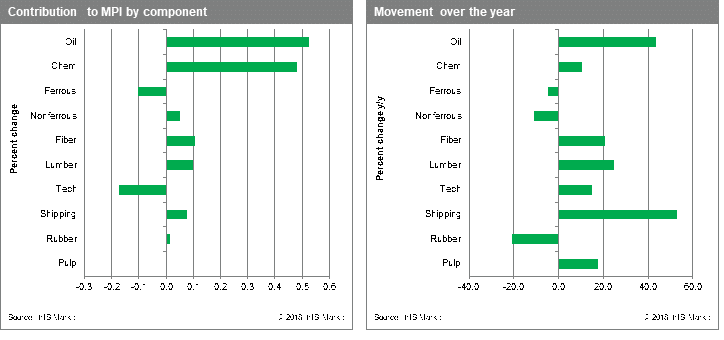

Following the Jackson Hole meeting of central bankers and a tentative refresh of NAFTA between at least the US and Mexico, commodity headwinds abated somewhat last week, helping to lift our Markit Materials Price Index (MPI) 1.1% w/w.

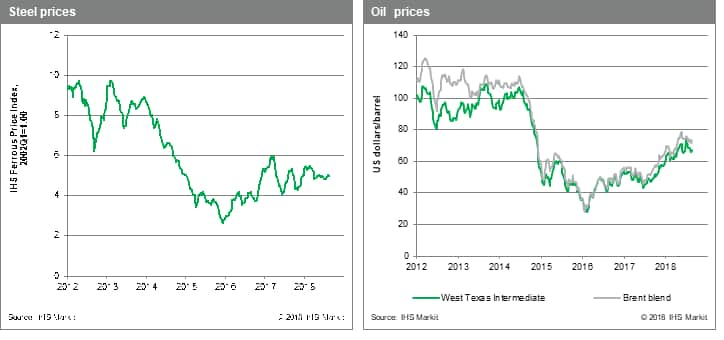

Eight of the ten MPI components contributed to last week's increase. Oil led the way rising 3.0% on the back of easing of trade tensions. Chemicals increased 2.0% mainly due to strengthening oil prices and despite caution in the market surrounding US tariffs on Chinese polyethylene imports that went live on August 23. Lumber had a second consecutive week of gains, rising 3.9% as it recovers from a 16-week bear run. Freight continued its 12-week bull run jumping up 1.7%. This has been driven by seasonal demand as well as higher oil prices. Only DRAMS and the Ferrous index fell last week.

After the recent Turkish crisis, which drove investors towards the US dollar, Fed Chairman Powell has been diplomatic, but has presented a thoughtful justification for a gradual rise in interest rates. While currency markets have calmed, with the US dollar retreating slightly last week, we still see two additional rate increases in 2018. Moreover, we assume the Fed will move interest rates to near 3.5% by the middle of 2020 to keep inflation contained and maintain its inflation fighting credentials. This tightening will be accompanied by a similar tightening by other central banks both in developing and emerging markets and represents a restraining factor on near-term commodity prices.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-markets-seize-on-positive-sentiment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-markets-seize-on-positive-sentiment.html&text=Weekly+Pricing+Pulse%3a+Markets+seize+on+positive+sentiment+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-markets-seize-on-positive-sentiment.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Markets seize on positive sentiment | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-markets-seize-on-positive-sentiment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Markets+seize+on+positive+sentiment+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-markets-seize-on-positive-sentiment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}