Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 02, 2020

Weekly Pricing Pulse: Holiday lull slows end of year commodity rally

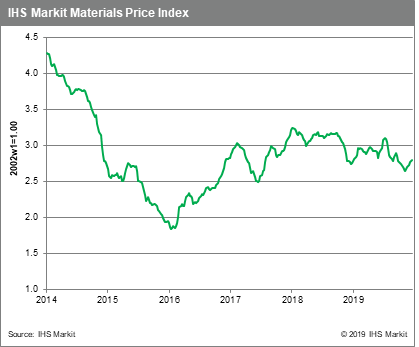

Commodity prices as measured by our Materials Price Index (MPI) edged up 0.1% last week, their sixth consecutive weekly rise, capping an end of year rally that has carried prices nearly 6.0% higher since mid-November. Low trading volume over the winter holidays, however, did help check prices and reflected a normal seasonal pause in activity.

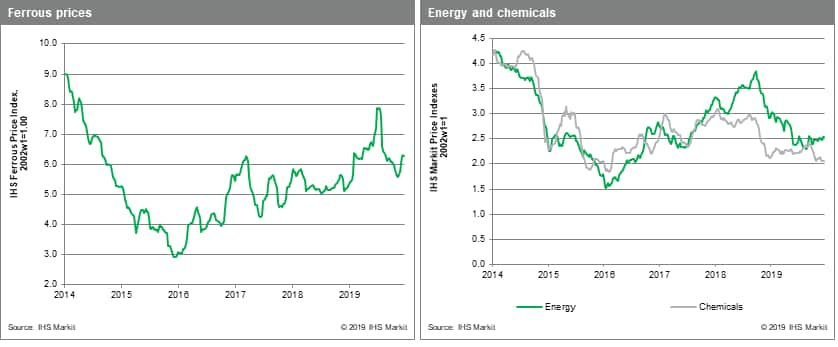

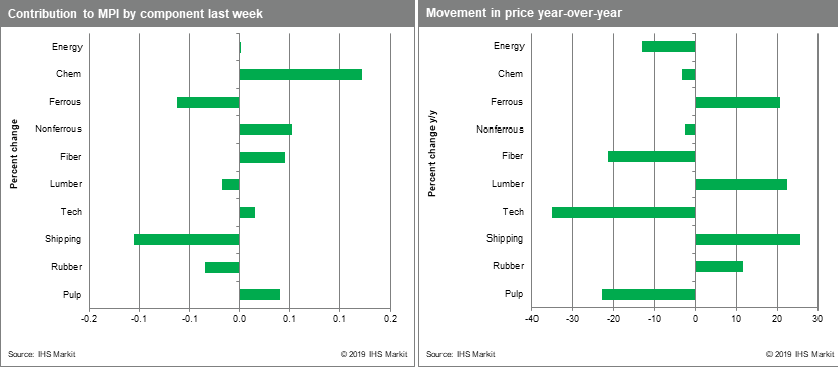

DRAM prices lead the MPI higher last week, rising 3.5%. Although DRAM prices are down 35.1% year-on-year, in a hopeful sign for early 2020, prices have staged a modest rebound in December, increasing more than 6.0% in the last five weeks. Chemicals prices rose 0.7% driven by widespread gains in prices of benzene, propylene and ethylene. Propylene prices rose for the first time in thirteen weeks and US ethylene, which had plunged 32.9% in the previous three weeks, finally bounced 4.9%. Non-ferrous prices rose 0.7% last week, with copper hitting an eight-month high on easing trade-tensions and signs of supportive policy from the Chinese authorities. Energy prices were virtually flat for the week, with a 0.5% increase in oil prices rising 0.5%, offsetting a 1.0% drop in natural gas prices. Spot gas prices in the US are down by more than 21% since November because of mild December weather in much of the country.

The MPI is ending 2019 slightly higher than the end of 2018, although the past 12 months have been anything but stable. Commodity prices rose strongly in the first quarter and rallied again in June and July as bouts of optimism over trade carried markets higher. Prices, however, never reached their mid-2018 peak. Indeed, the mood in markets soured in the third quarter as weak manufacturing data and the lack progress in US-China trade negotiations created recession fears. Recession anxiety has receded with some clarity on trade and Brexit and data showing manufacturing activity stabilizing. Notwithstanding this positive change, challenges remain. Near-term growth is forecast to be modest, with the US dollar projected to be strong, a combination that argues against any sustained rally in in commodity markets. Indeed, an oil market surplus and an expected correction in iron ore prices points the MPI down slightly in 2020 with the eight quarter stretch from early 2019 looking remarkably range bound.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-holiday-lull-slows-end-of-year-commodity-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-holiday-lull-slows-end-of-year-commodity-.html&text=Weekly+Pricing+Pulse%3a+Holiday+lull+slows+end+of+year+commodity+rally+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-holiday-lull-slows-end-of-year-commodity-.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Holiday lull slows end of year commodity rally | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-holiday-lull-slows-end-of-year-commodity-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Holiday+lull+slows+end+of+year+commodity+rally+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-holiday-lull-slows-end-of-year-commodity-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}