Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 08, 2020

Weekly Pricing Pulse: Equities pause, but the commodity sell-off gathers pace

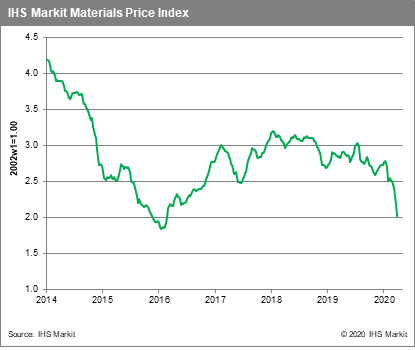

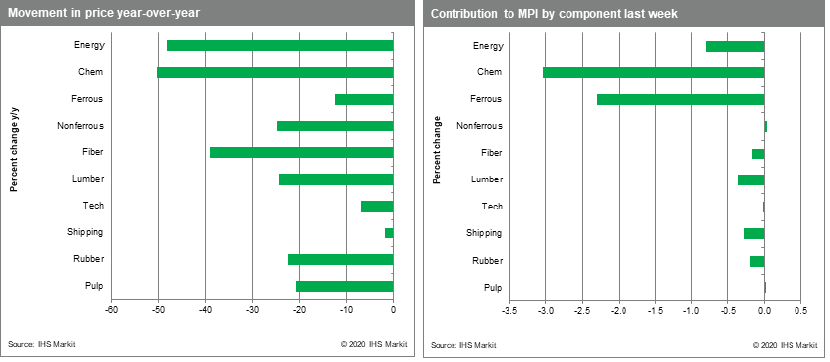

Equity markets have found support in the last two weeks, with the S&P 500 index bouncing 5.6% from its mid-March low. In contrast there remains an absence of buyers in commodity markets. As measured by IHS Markit's Materials Price Index (MPI), commodity prices have fallen 11.6% over the same period, dropping 7.1% last week alone. The MPI is now down nearly 26% since the start of the year and by almost 36% since its 2019 peak last July.

Chemicals prices plummeted 19.4% last week as lower crude oil prices continue to move into feedstock costs. Lower feedstock costs have also coincided with a sharp drop in demand, which has swelled inventories, adding further downward pressure on prices. Ethylene prices fell 23.8% globally, but a staggering 50.8% fall in Europe as lockdowns across the Eurozone crippled the market. Benzene saw similar weakness falling 22.6% last week, with declines uniform throughout the world. Propylene fell 13.0% overall but US prices rose 11.8% bouncing on news that all major US producers are cutting production due to weak demand. Energy prices fell 7.3%, chiefly because of 21.0% decline in natural gas prices, which plunged in both Europe and Asia. Thermal coal is a noteworthy outlier in the energy complex. Coal prices fell only 1.4% last week and are still up 0.8% for the year. Ferrous prices finally showed some weakness falling 5.4% on the week as a slew of blast furnaces were shut down across Europe, South America and the US. Chinese iron ore inventories, however, stand at 115 MMt, just above the 2019 low of 114 MMt due to strong buying from Chinese mills, who have actually increased production over the past month. Lumber prices suffered another poor week falling 14.0% as the US moved closer to a nationwide shut down.

The economic dataflow has now started to reveal the impact of the COVID-19 pandemic on the global economy, which commodity markets have been recording for the past two months. IHS Markit's Purchasing Manager Indexes for March showed manufacturing output slumping last month outside of China in the same way that February data showed Chinese manufacturing collapsing. Employment data in the last two weeks has also been alarming and highlights weakness in the service sector that is, if anything, worse than in manufacturing. The question for April is will any sign of a bottom forming in markets become evident?

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-equities-pause-commodity-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-equities-pause-commodity-selloff.html&text=Weekly+Pricing+Pulse%3a+Equities+pause%2c+but+the+commodity+sell-off+gathers+pace+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-equities-pause-commodity-selloff.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Equities pause, but the commodity sell-off gathers pace | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-equities-pause-commodity-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Equities+pause%2c+but+the+commodity+sell-off+gathers+pace+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-equities-pause-commodity-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}