Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 16, 2020

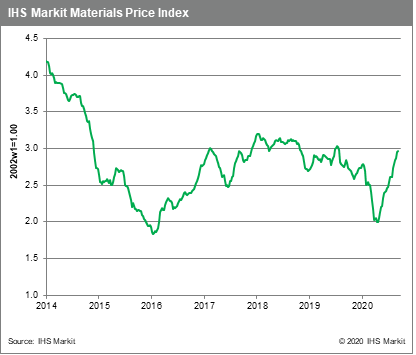

Weekly Pricing Pulse: Cracks start to appear, but commodity prices continue rising

Our Materials Price Index (MPI) increased 0.6% last week in a mixed five days of trading that saw half of the MPI's ten sub-components falling week-on-week. A dearth of short-term data around China stoked uncertainty in commodities particularly exposed to China i.e. pulp, rubber, non-ferrous metals.

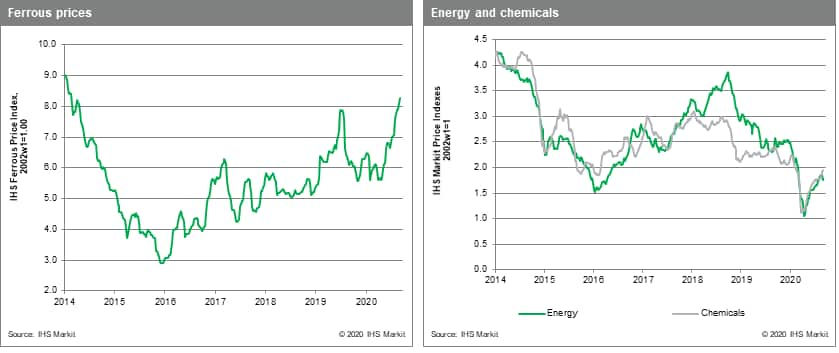

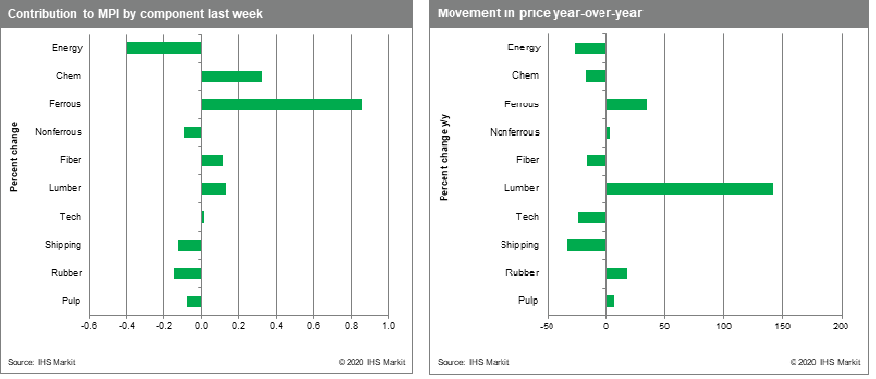

Steel raw materials once again drew the MPI higher last week, rising 2.0% due to a 7.6% rise in steel scrap prices which lifted the sub-index. Iron ore prices also continued to advance, but by a more modest 1.1%. Scrap prices in the US have been subdued due to a lack of demand, but September contract prices were settled 7.6% higher across major grades on improving demand in the US. Chinese iron ore port inventories rose to 119 MMt last week as domestic mills slowed buying due to pollution related production controls. Chemicals rose 2.0% on a 4.8% rise in ethylene prices. The ethylene price increase came purely from a 16.5% rise in US prices on strong demand and curtailed supply, some of which were unplanned outages tied to Hurricane Laura. Propylene ticked up 1.0%, but benzene prices fell 3.1% with drops experienced in all major markets. Benzene inventory has built up as derivative demand in the wake of Hurricane Laura has struggled to recover. Energy prices fell 4.0% last week on a heavy 9.5% fall in crude oil that was tied to fresh concerns about demand. Uncertainly is also coming from inside OPEC "plus", where the group is starting to export slightly above quota. Non-ferrous prices fell 1.0%, the first fall in seven weeks with all metals falling save copper. Some doubts around Chinese demand have started to undercut base metal prices. Even though copper bucked the trend, copper's Shanghai market premium dipped to its the lowest level since March. Rubber prices also showed weakness, falling 4.2%, their first drop in 11 weeks, as Chinese auto demand ebbed slightly after the output and demand explosion seen in the last few months.

Although last week did not give us the correction we have been anticipating, the series of commodities that rolled over last week after a long run of consecutive weekly increases indicates a potential change in markets - or at least in sentiment. Our sense, however, is that manufacturing activity will soon see growth slow. The combination of satisfied pent-up demand, an end to inventory restocking, and reduced government stimulus all point to momentum fading in the fourth quarter. Three known unknowns also open the possibility for increased volatility next quarter: a contentious US election, a no deal Brexit, and a second wave of COVID-19 infections. The mixed performance of the subcomponents within the MPI last week may be a harbinger of things to come.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-cracks-appear-commodity-prices-rising.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-cracks-appear-commodity-prices-rising.html&text=Weekly+Pricing+Pulse%3a+Cracks+start+to+appear%2c+but+commodity+prices+continue+rising+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-cracks-appear-commodity-prices-rising.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Cracks start to appear, but commodity prices continue rising | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-cracks-appear-commodity-prices-rising.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Cracks+start+to+appear%2c+but+commodity+prices+continue+rising+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-cracks-appear-commodity-prices-rising.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}