Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 16, 2018

Weekly Pricing Pulse: Commodity prices increase, but with little conviction

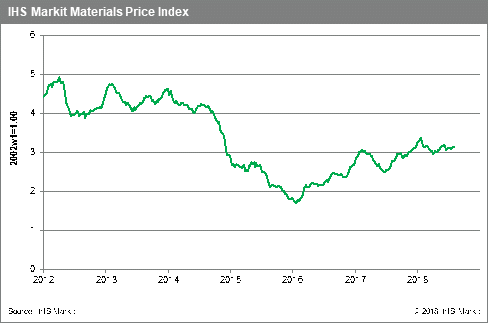

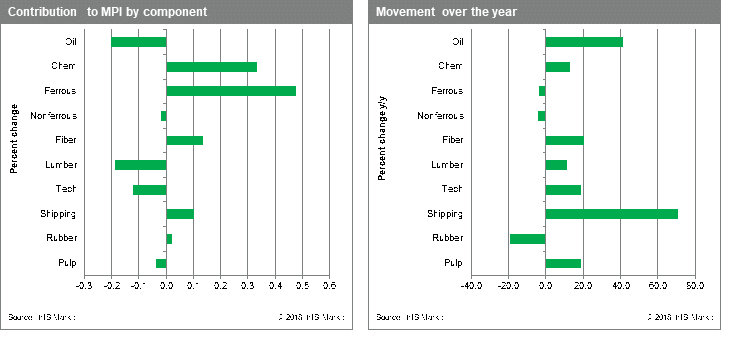

Our Materials Price Index (MPI) ticked up 0.5% this past week, though the index's ten sub-components were evenly split between those showing increases and those showing declines, highlighting the uncertainty present in markets. Lumber prices again fell sharply, while fiber, freight rates and the ferrous metals index all rose by more than 2.0%.

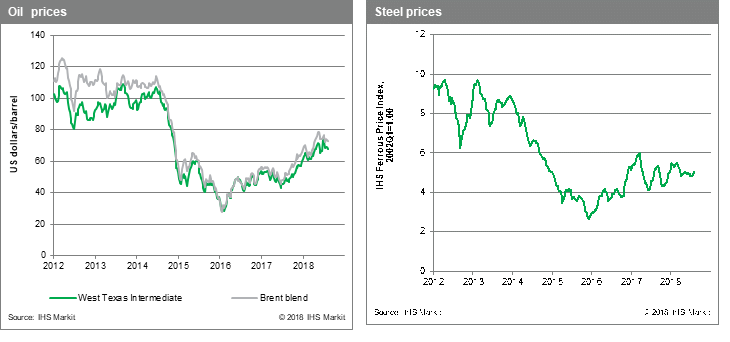

The ferrous price index rose 2.1% w/w despite a softening of US scrap prices, underscoring the strength of the recent iron ore rally. Rising steel prices in China have caught the market by surprise and are running counter to copper and other base metal pricing. Higher steel prices reflect forced consolidation in the Chinese industry and the expected effects of stimulus in China on shipments later this year. Ocean going freight rates, driven up by this sentiment, rose another 2.3% w/w. Lumber prices fell another 7.3% after dropping 9.0% the week before, as the market corrects with logistical bottlenecks in British Colombia being cleared. Oil prices have been moving lower in fits and starts since late May. Last week oil prices fell 1.1% with WTI reaching $66.5 /bbl, down from $74 a month before. This most recent move was based on US crude inventory data, which fell less than expected.

US dollar strength has been a headwind for commodity markets since the start of the second quarter with last week's intensifying financial crisis in Turkey providing a fresh challenge. The collapse in the Turkish lira is likely to create disruption in the region's commodity market dynamics, especially in steel - Turkey imports large amounts of scrap and is an important supplier of commodity grade steel to the region. More broadly, European stock indices declined and the US Treasury market benefited from flight-to-safety flows that helped push the US 10-year bond yield below 2.90%; it had hit 3.0% as recently as August 1. Two more US interest rates hikes this year will push long bond rates higher, provide support to the US dollar and keep commodity markets volatile.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-81618.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-81618.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+increase%2c+but+with+little+conviction+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-81618.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices increase, but with little conviction | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-81618.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+increase%2c+but+with+little+conviction+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-81618.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}