Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 14, 2018

Weekly Pricing Pulse: Commodity prices continue to rise, but narrowly

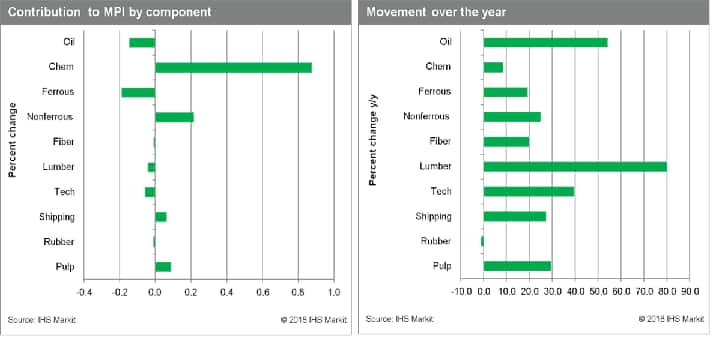

Our Materials Price Index (MPI) increased 0.8% last week, its eighth gain in nine weeks. Once again, however, the rise was narrow, with only four sub-indexes rising; the other six showed modest declines. Bullish chemical prices continue to mask declines elsewhere in the commodity complex, while nonferrous prices contributed to the upward pressure last week - these indexes rose 3.9% and 3.1%, respectively. For the third week in a row, the MPI would have fallen if chemical prices were excluded.

Ethylene prices skyrocketed last week, jumping 11.3% as several steam cracker outages provided price support. Ethane costs are also increasing, a key feedstock for ethylene prices, while demand is set to increase because of rising polyethylene operating rates. In nonferrous markets, copper prices shot up 4.2% last week on fears the big Escondida mine in Chile may see a strike.

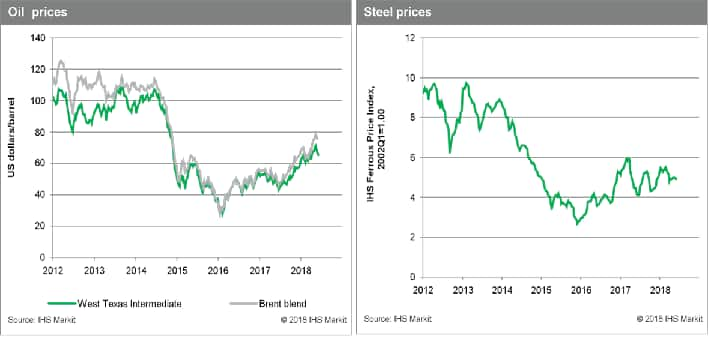

Evidence that the commodity price rally is running out of steam is provided by the fact that the current rally has depended on just few sectors over the past three weeks - mainly chemicals. Apart from chemicals, commodity prices have started to retreat, and not without reason. Macroeconomic data is pointing to peaking growth; IHS Markit's Purchasing Manager Index (PMI) reports from last week showed weakness in the Chinese service sector and a slowing economy in the Eurozone. The US headline PMI Services Index did signal continued vigor in the economy. However, this strength, coupled with a slow acceleration in compensation growth, provides support for the Federal Reserve to tighten monetary policy. This tightening will be supportive of the US dollar, at least this year, and is a headwind for any sustained rise in commodity prices.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-rise-but-narrowly.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-rise-but-narrowly.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+to+rise+but+narrowly+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-rise-but-narrowly.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices continue to rise but narrowly | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-rise-but-narrowly.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+to+rise+but+narrowly+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-to-rise-but-narrowly.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}