Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 30, 2019

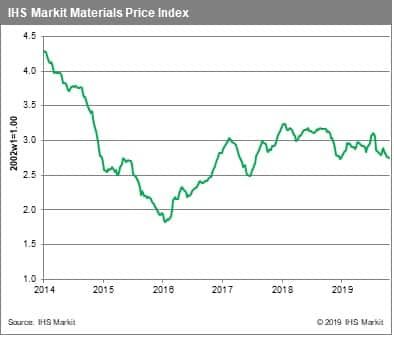

Weekly Pricing Pulse: Commodity price basket reaches lowest level of 2019

Commodity prices continued to soften last week with our Materials Price Index (MPI) falling 0.7%. Seven of the index's ten components declined, bringing the MPI to its lowest level of the year.

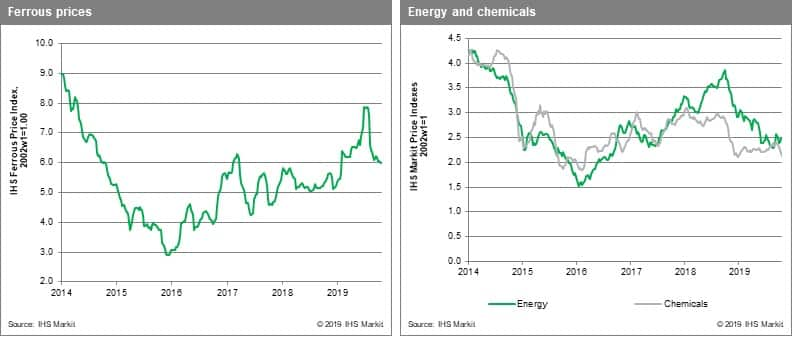

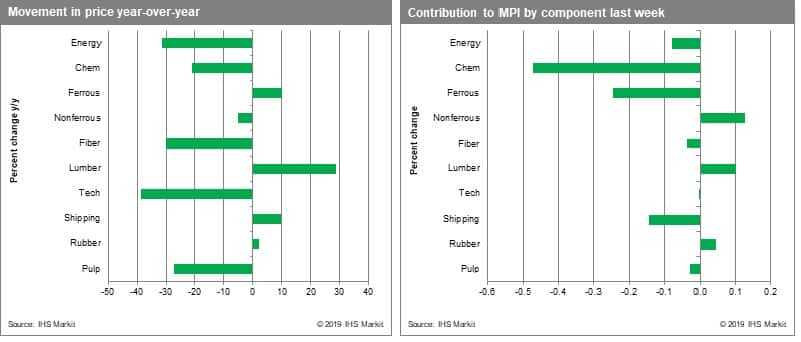

Declines in freight, chemicals, DRAMS, and ferrous metals pushed the MPI lower. Freight prices slid 2.8%, their fifth consecutive decline. Chemicals prices fell 2.6% last week, driven by the continued decline in benzene prices. Styrene production outages, benzene's largest derivative, reduced demand for benzene and undermined spot prices. Nonferrous metals bucked the downward trend, rising 1.6% last week. Unrest in Chile has traders considering the risk of mining disruptions, providing upward pressure for copper and zinc. Lumber prices were another outlier, as the index jumped 4.8% week-over-week. Canadian mill closures and disruptions to Canadian exports have tightened the US lumber market, driving prices higher.

Since Spring, markets have taken on a bearish view of the near future, reflecting uncertainty over US-China trade negotiations and Brexit. A stronger US dollar and lowered expectations for global consumption growth, the manifestations of policy uncertainty, will act as headwinds to commodity prices over the near-term. Our one caution in this picture of markets is that some commodities have seen a slow fundamental tightening during the past year that is at odds with low prices, potentially exposing buyers to a quick shift if, for instance, a US-China trade agreement is reached or some clarity emerges on Brexit.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-reaches-lowest-level-2019.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-reaches-lowest-level-2019.html&text=Weekly+Pricing+Pulse%3a+Commodity+price+basket+reaches+lowest+level+of+2019+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-reaches-lowest-level-2019.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity price basket reaches lowest level of 2019 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-reaches-lowest-level-2019.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+price+basket+reaches+lowest+level+of+2019+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-reaches-lowest-level-2019.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}