Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 10, 2020

Weekly Pricing Pulse: Commodity market recovery accelerates

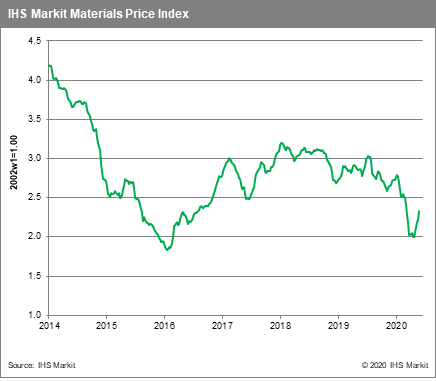

Commodity prices as measured by our Materials Price Index (MPI) rose 5.1% last week, the largest weekly gain since March 2016, a similar period of commodity market recovery. COVID-19 has hit both demand and supply in recent weeks with these supply-side impacts now proving supportive of commodity price.

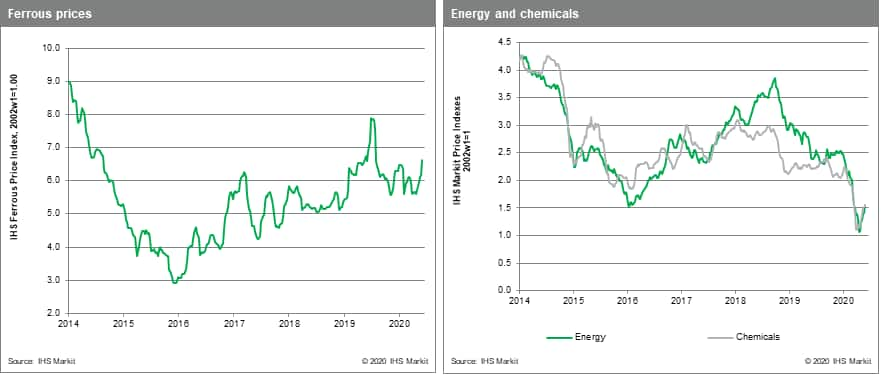

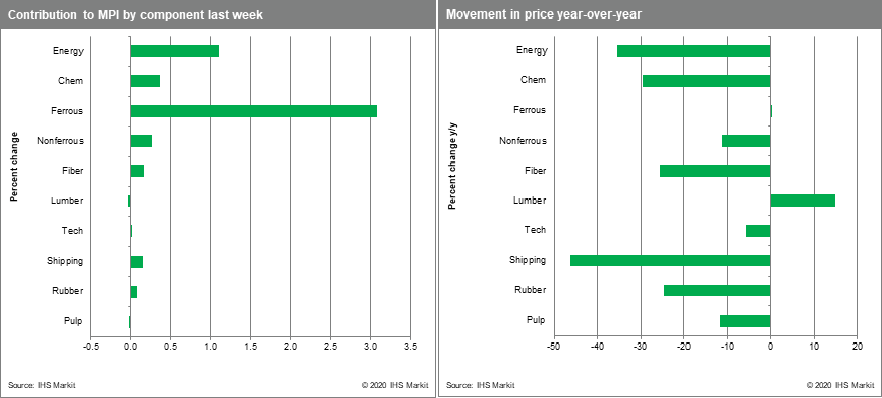

Energy prices once again dominated the week's movement in commodity markets rising 10.9%. Crude oil rose 17.8% on the OPEC+ decision to forgo production increases in July, a decline in US crude oil inventory and the promise of improving global demand. Natural gas prices jumped 19.8% due to a 49.5% rise in European gas prices amid fluctuations in Norwegian and Russian exports. Thermal coal remains becalmed, but EU prices rose 19.8%, rising from record lows, suggesting the bottom may be in for coal. Ferrous prices are up 7.2% due to an 8.5% rise in iron ore prices, which moved above $100 per metric ton. Vale was forced to idle operations at its Itabira complex (12% of Vale's annual output), due to COVID-19 restrictions as the virus spreads throughout Brazil. Non-ferrous prices rose 2.7%, driven by further stimulus measures by the European Central Bank and the May US jobs report. All base metals prices save aluminium rose by more than 3%.

While supply-side disruptions or cuts have provided commodity prices with support over the past six weeks, markets are also becoming increasingly optimistic about demand for the second half of 2020. One reason for this optimism is that policymakers continue to provide stimulus, as was highlighted by the European Central Bank almost doubling the size of its Pandemic Emergency Purchase Programme to €1.35tn last week. Even more encouraging for markets, however, has been fresh data suggesting the worst of the pandemic may be over. The May US employment report, which showed strong employment growth, was a very welcome surprise. But perhaps more encouraging is the continuing decline in reported new cases of COVID-19 in Europe, even with phased re-openings taking place across the continent. This mirrors the experience in Asia, giving hope that a return to more normal consumption patterns may happen sooner than expected.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-market-recovery-accelerates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-market-recovery-accelerates.html&text=Weekly+Pricing+Pulse%3a+Commodity+market+recovery+accelerates+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-market-recovery-accelerates.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity market recovery accelerates | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-market-recovery-accelerates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+market+recovery+accelerates+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-market-recovery-accelerates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}