Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 25, 2020

Weekly Pricing Pulse: Commodities sell off as the shut-downs continue

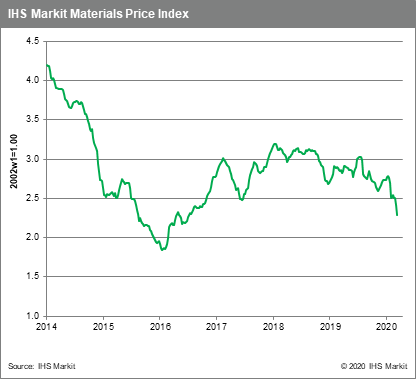

The spread of COVID-19 gathered speed over the past week, sparking a spate of manufacturing shut-downs across Europe and the US. Commodity markets are now pricing in a disruption to the global economy on the scale witnessed in China during the first quarter. In a fresh wave of selling, commodity prices retreated another 5.2% last week as measured by the IHS Markit Materials Price Index (MPI). The MPI is down 18.1% year-to-date and almost 25% from its 2019 high in July.

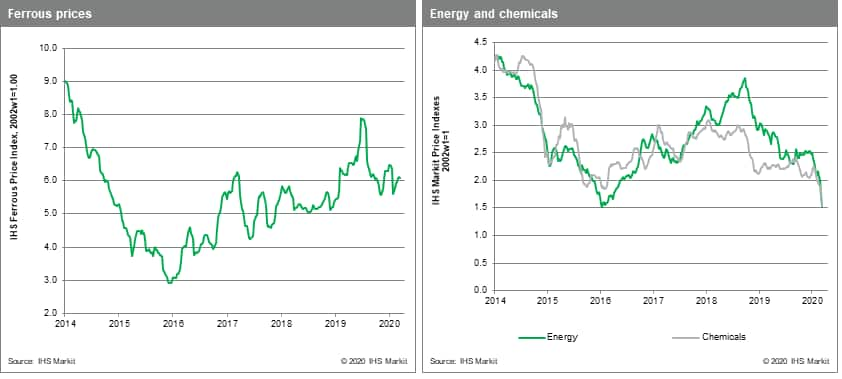

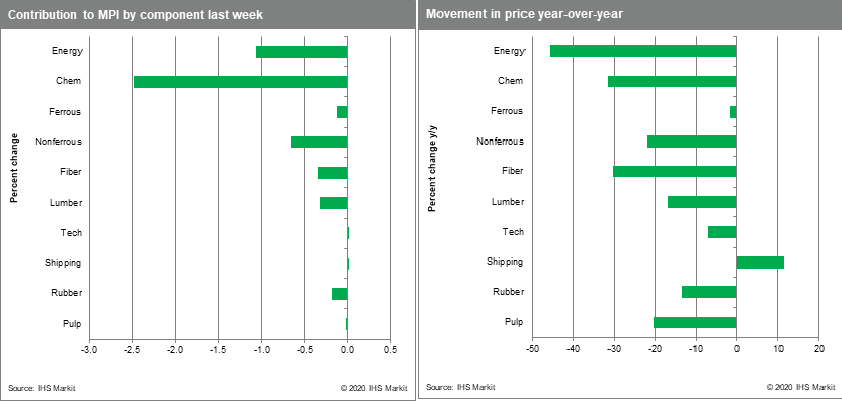

As predicted last week, the lagged effect of crude oil's recent plunge is feeding into chemicals prices, with the MPI's chemical sub-index dropping 13.5% for the week. Benzene prices fell 18.9%, while ethylene prices retreated 13.8%. Propylene, less volatile in recent weeks, fell 'only' 9.3%. Lumber prices fell heavily again last week, dropping 12.0% on the worsening outlook for home buying in the US. Energy prices suffered another bad week dropping 9.4%. Gas prices, which had rallied recently on opportunistic buying in Asia fell 13.7% back to all-time lows. Asian natural gas prices gave up much of their recent gains, dropping 18.5%. Crude oil fell 18.4% for the week as the perfect storm of surging supply and collapsing demand continues. The focus in oil markets has been on weak Chinese demand. This past week, however, the prospect of lower US gasoline demand caused WTI prices to fall to $24 /bbl. Non-ferrous prices dropped 6.9% last week as copper suffered its worst week in eight years, dropping 9.9%. Other base metals saw weakness as well: nickel fell 7.2%, zinc 4.5% and aluminium 3.5%. The rout in non-ferrous prices may be eased by production stoppages at mining operations in Peru, Chile, Canada and other countries due to isolation measures that have been ordered. Ferrous prices, in contrast, have held up due to China's recovery from the COVID-19 and promise of stimulus. The MPI's ferrous metal sub-index, however, did crack, sliding 0.3% last week, the precursor a more significant correction ahead being telegraphed by a 11.5% fall in the iron ore prices during Friday and Monday trading. The MPI's DRAM index did inch slightly higher last week. Lead times have lengthened for some electronic components as stable demand and logistics bottlenecks have kept the market from the kind of deterioration seen elsewhere.

Prices for a growing number of commodities have now pushed into the cost curve, suggesting production cuts may be looming. Aluminium, zinc, pulp and rubber all fall into this category of building cost pressures that may soon force a supply-side reaction. Unfortunately, other signs of a bottom forming such as bargain hunting buying or short covering behaviour on the part of investors are not evident, pointing to a bleak start to the second quarter.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sell-off-shutdowns-continue.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sell-off-shutdowns-continue.html&text=Weekly+Pricing+Pulse%3a+Commodities+sell+off+as+the+shut-downs+continue+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sell-off-shutdowns-continue.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities sell off as the shut-downs continue | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sell-off-shutdowns-continue.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+sell+off+as+the+shut-downs+continue+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-sell-off-shutdowns-continue.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}