Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 22, 2020

Weekly Pricing Pulse: Commodities rise for eleventh straight week

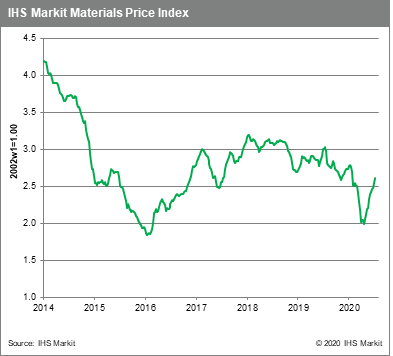

Our Materials Price Index (MPI) rose 2.2% last week, continuing the rally that began early in the second quarter. Commodities prices have now risen for 11 straight weeks, recording a cumulative gain of 30.4% over this span. Prices are still down 6.1% year-to-date. As has been the case since early April, the increase in our index was broad-based -- only two of the MPI's ten sub-indices fell, illustrating the underlying strength of the rally.

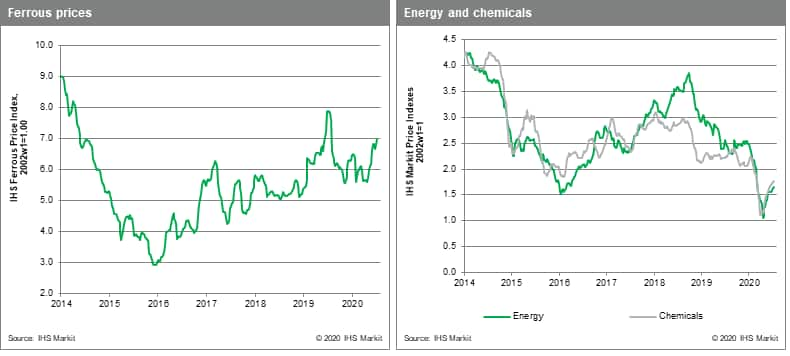

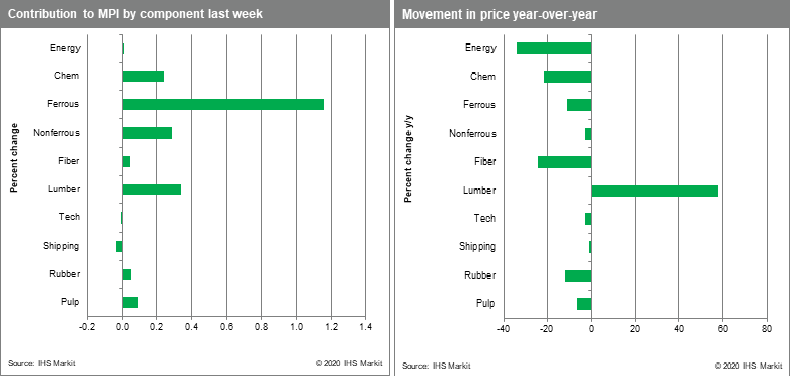

For a second week ferrous prices helped lead the MPI higher, rising 2.8% as benchmark iron ore prices reached $112 per metric ton. Ore prices were supported by higher Chinese finished steel prices and June Chinese iron ore imports, which were the second highest on record. Non-ferrous prices rose 3.0% in another strong weekly gain; copper prices increased 4.2% (to a 15-month high), with zinc jumping 5.2%. Mine supply disruptions and optimism over Chinese demand continued to be the story in base metals. Lumber prices maintained strength, rising 9.9% as rebounding demand collides with the tight inventory position at Canadian mills. Pulp prices rose 2.3% though underlying demand remains weak. Even with last week's gain, pulp prices are still languishing near recent lows. Rubber prices have been improving since the end of May helped higher by Chinese automotive production, which grew 23% y/y in June.

Commodity prices chugged higher again last week even after we raised the question about how much longer they can continue doing so given the alarming rise in COVID-19 case counts and its implication for the global recovery. For the moment, markets are brushing aside any concerns. Instead prices are reflecting a heady combination of good Chinese data, continuing supply disruptions, a softer US dollar, the promise of yet more policy stimulus, and hopeful news on a possible vaccine. Still, our caution remains. The effect on labor markets is not temporary, nor will consumer spending return to normal soon, fundamentals which commodity markets cannot ignore forever.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-eleventh-week.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-eleventh-week.html&text=Weekly+Pricing+Pulse%3a+Commodities+rise+for+eleventh+straight+week+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-eleventh-week.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities rise for eleventh straight week | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-eleventh-week.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+rise+for+eleventh+straight+week+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-eleventh-week.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}