Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 10, 2019

Weekly Pricing Pulse: Commodities rise as supply-side issues impact the market

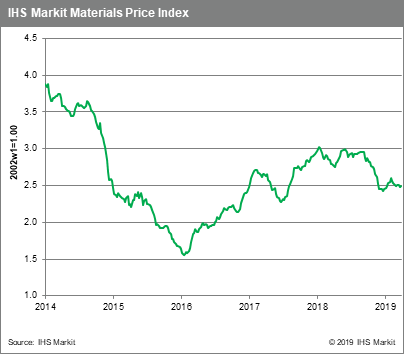

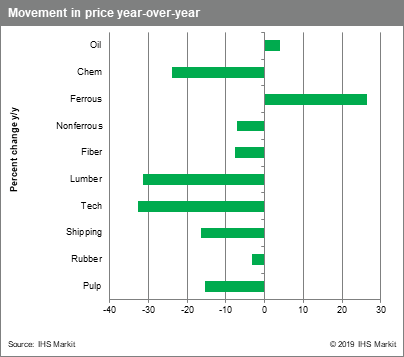

Commodity markets found support from supply disruption, geopolitical tensions and positive economic data released last week with the Materials Price Index (MPI) moving 0.6% higher.

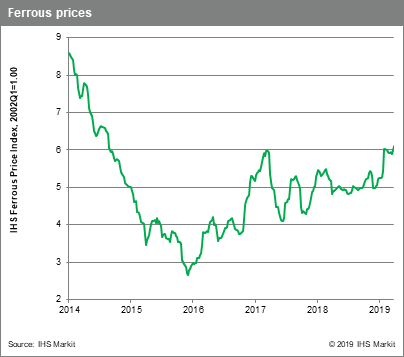

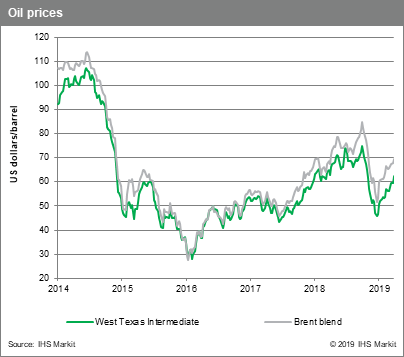

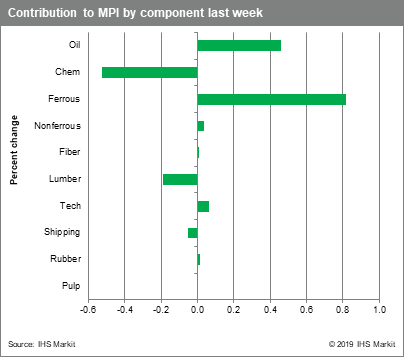

Iron ore prices, beset with supply issues in Brazil and cyclones off Australia, jumped from $85.7 /t to over $90 /t, despite inventories of iron ore in China lifting 1.4 MMt last week. However, March exports from Port Hedland plunged to 36.4 MMt vs. 43.9 MMt in 2018, indicating the impact of the disruption, which took the ferrous index up 3.7%. Oil too rallied 3.4% as tensions rose in Libya as the threat of a full blown civil war increased. A strong March US jobs report also helped boost sentiment despite a strong increase in US drill rig count. Non-ferrous metals prices rose 0.7% as optimism over US-China trade talks buoyed markets. However, the rise was curtailed somewhat by building inventories in China, particularly in copper; LME stocks have risen 65% from a low level in the past five weeks.

Since the start of March, no clear trend has developed in commodity markets despite growing optimism in equity and bond markets. This can be tied to lackluster fundamentals and, in particular, data that continues to show soft consumption growth. Until China's manufacturing sector displays a definitive upward move, markets will continue to track sideways.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-as-supplyside.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-as-supplyside.html&text=Weekly+Pricing+Pulse%3a+Commodities+rise+as+supply-side+issues+impact+the+market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-as-supplyside.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities rise as supply-side issues impact the market | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-as-supplyside.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+rise+as+supply-side+issues+impact+the+market+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-rise-as-supplyside.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}