Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 15, 2020

Weekly Pricing Pulse: Are we seeing a bottom

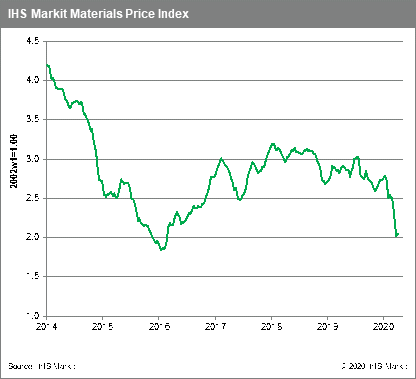

Commodity prices, as measured by the IHS Markit Materials Price Index (MPI), bounced 1.3% last week on hope, perhaps premature, that the COVID-19 crisis may be peaking. Eight of the MPI's ten components rose last week, a nice broad-based move, especially considering the pervasive weakness seen over the previous three weeks. Still, the bump in commodity prices pales in comparison to the recent rally in equities. Commodity prices have front run this crisis and are clearly saying that fundamental demand is not surging back.

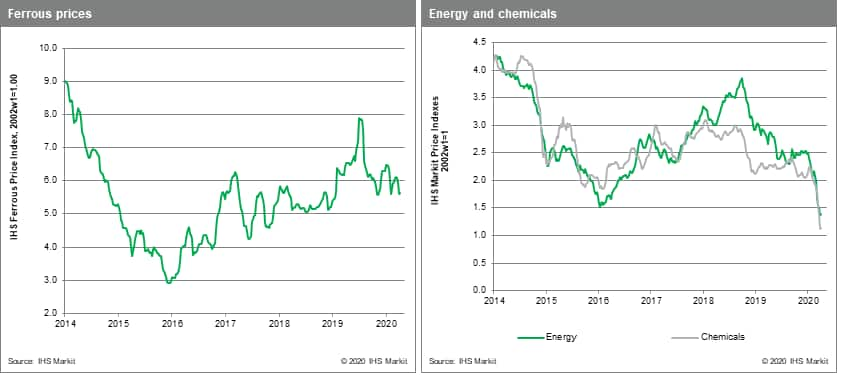

Oil was the big story last week, rising 18.3% on optimism that the OPEC+ meeting, which included US participation, would reach an understanding to reduce the global oversupply of oil. The meeting did conclude over the weekend with the agreement to cut nearly 10 Mbbl/d in production starting May 1; markets reacted positively in Monday trading before falling back again. Lumber prices rallied 11.5%, feeding off optimism in the US that the lockdown would be lifted sooner than expected. Fiber prices reversed seven straight weeks of decline to rise 6.2% on rising feedstock costs and a shift in sentiment in China from negative to neutral. Ferrous prices rose 0.7% as maintenance at key iron ore ports hit shipments, supporting ore prices in the mid-$80s. Freight prices fell 6.5% as US and Europe bound cargo demand continued to underperform.

Improving market sentiment is keying off encouraging signs in several countries that the number of new COVID-19 cases are slowing. Is this optimism premature? And a second question, can China be used as a roadmap for other nations to follow? The good news is that China is returning to work. The caution is that China's recovery is being hampered by second order effects coming from its weakened trade partners, suggesting a start-stop pattern not just to its rebound, but to a wider global recovery. We may be nearing a bottom, but conditions will be far from normal for some time yet.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-are-we-seeing-a-bottom.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-are-we-seeing-a-bottom.html&text=Weekly+Pricing+Pulse%3a+Are+we+seeing+a+bottom+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-are-we-seeing-a-bottom.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Are we seeing a bottom | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-are-we-seeing-a-bottom.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Are+we+seeing+a+bottom+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-are-we-seeing-a-bottom.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}