Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 24, 2024

Week Ahead Economic Preview: Week of 24 June 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US core PCE, UK Q1 GDP, China PMI data in focus

A data-heavy week includes US core PCE plus an update of first quarter GDP in the UK and early NBS PMI from mainland China over the weekend. May inflation updates from Canada, various eurozone and Asian economies will also be tracked closely by policy watchers. Monetary policy meetings are meanwhile set to unfold in Sweden, Turkey, Mexico and the Philippines.

May's core PCE reading will be closely tracked for inflation progress. The Fed's preferred inflation gauge will be assessed for progress in hitting its 2% target after May US CPI came in below consensus, injecting hopes for earlier rate cuts. These hopes came despite the Fed meeting later the same day that CPI was released, which scaled back their expected cuts in 2024. More up-to-date US flash PMI data for June have meanwhile alluded to further downward pressure on inflation, the headline gauge of prices charged for goods and services dropping to one of the lowest levels seen since inflation took off in the second half of 2020, including an all-important softening of services inflation.

We will also get a final estimate of first quarter GDP in the UK. Earlier estimates showed a strong 0.6% quarterly uplift in the first three months of the year, though subsequent monthly GDP data have disappointed, showing no growth in April, and the recent PMI data have signalled a softening of growth into June. Any new signs of weakness in the GDP data could help dovish stances among policymakers at the Bank of England, where markets are speculating on the possibility that rates could be cut at its August meeting.

A series of inflation updates are also anticipated from France, Spain and Italy, which will be eyed for signs that the ECB made the correct decision in reducing interest rates for the first time in five years in June. According to the HCOB Flash France PMI, prices are now close to falling.

Turning to APAC, PMI figures from the NBS in mainland China will be released for insights into June business conditions. Additionally, the summary of opinions from the June Bank of Japan policy meeting, and a range of Japanese economic indicators, will be published as the Bank of Japan weigh up its policy stance. The June au Jibun Bank Flash Japan PMI showed growth stalling in June but with persistent price pressures amid a weak yen.

US bucks developed world slowdown in June

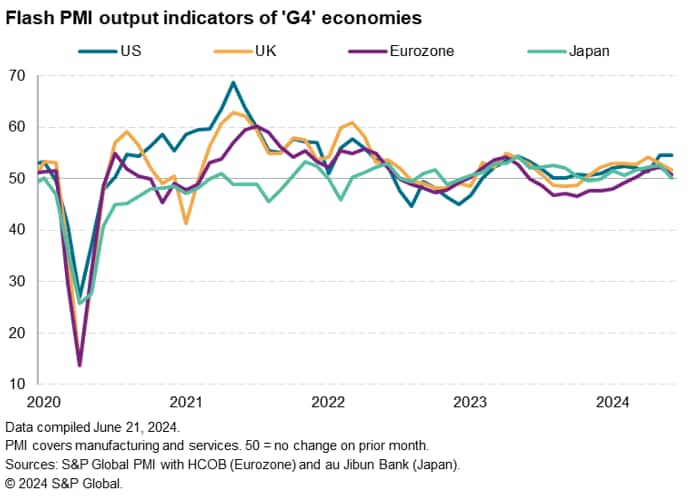

June flash PMI showed further robust growth of business activity in the US, contrasting with slowdowns in Europe and Japan. While the main survey measure of output across both manufacturing and services edged up to record the fastest economic expansion for 26 months in the US, comparable gauges fell elsewhere. In Europe, the equivalent UK and eurozone PMIs fell to seven-month and three-month lows respectively, albeit still registering growth, while the PMI for Japan sank to a six-month low, signalling stagnation.

In Europe, the survey data were subdued in part by political uncertainty ahead of upcoming elections both in the UK and France, the latter dragging the eurozone services data lower. So, some of this weakness may prove temporary should businesses react positively to the July election outcomes.

The stalling of growth in Japan meanwhile could not be traced to any special factors and poses more of a concern that the upturn may be losing momentum as companies, households and tourists start to rein in spending.

That leaves the US as the best performer among the G4 major developed economies over the second quarter, with companies often citing fewer cost of living issues and hopes of lower interest rates. Fortunately, the US PMI survey's main price gauge fell to one of the lowest levels seen over the past three years, adding to these hopes.

Key diary events

Monday 24 Jun

New Zealand Trade (May)

Japan BoJ Summary of Opinions (Jun)

Netherlands GDP (Q1, final)

Singapore Inflation (May)

Germany Ifo Business Climate (Jun)

Taiwan Industrial Production (May)

United States Dallas Fed Manufacturing Index (Jun)

Tuesday 25 Jun

Australia Westpac Consumer Confidence (Jun)

Thailand Trade (May)

Spain GDP (Q1, final)

Turkey Trade (May)

Canada Inflation (May)

United States S&P/Case-Shiller Home Price (Apr)

United States CB Consumer Confidence (Jun)

Wednesday 26 Jun

Singapore Industrial Production (May)

Germany GfK Consumer Confidence (Jul)

France Consumer Confidence (Jun)

Canada Manufacturing Sales (May, prelim)

United States New Home Sales (May)

Thursday 27 Jun

South Korea Business Confidence (Jun)

New Zealand ANZ Business Confidence (Jun)

China (Mainland) Industrial Profits (May)

Philippines BSP Interest Rate Decision

Sweden Riksbank Rate Decision

Eurozone Economic Sentiment (Jun)

Turkey TCMB Interest Rate Decision

Mexico Balance of Trade (May)

United States Durable Goods Orders (May)

United States GDP (Q1, final)

United States Wholesale Inventories (May, adv)

United States Pending Home Sales (May)

Mexico Banxico Interest Rate Decision

Friday 28 Jun

New Zealand Market Holiday

South Korea Industrial Production (May)

Japan Industrial Production, Retail Sales, Unemployment Rate,

Housing Starts (May)

Germany Retail Sales (May)

United Kingdom GDP (Q1, final)

France Inflation (Jun, prelim)

Spain Inflation (Jun, prelim)

Germany Unemployment Rate (Jun)

Italy Inflation (Jun, prelim)

United States Core PCE (May)

United States Personal Income and Spending (May)

United States UoM Sentiment (Jun, final)

Sunday 30 Jun

China (Mainland) NBS PMI (Jun)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US core PCE, Q1 GDP, durable goods, consumer confidence, home sales and personal income and spending data, Canada inflation

Following the release of flash PMI data, a slew of economic releases are due from the US in the coming week. This includes the Fed's preferred core PCE gauge after the headline May CPI arrived weaker than expected at 3.3% and core CPI printed at 3.4%. Additionally, durable goods orders, consumer confidence and personal income and spending data, will all be assessed for changes in economic conditions that might impact the Fed's outlook for rates. The data releases follow the Fed's June meeting which showed a dialling back of expectations to just one rate cut in 2024.

In Canada, May inflation data will be released on Tuesday for insights into price developments and prospective rate cuts after the Bank of Canada lowered rates this month. According to S&P Global Canada PMI data, inflation pressures remained little changed in recent months after having eased into the end of 2023.

EMEA: UK Q1 GDP, German Ifo business climate and GfK confidence data, France, Spain and Italy inflation

The final first quarter GDP reading from the UK comes after the earlier estimate showed the UK growing at the fastest pace in nearly three years, registering a buoyant 0.6% quarter rise. More up-to-date flash PMI data from June meanwhile point to the pace of economic growth having cooled in the second quarter to a 0.25% quarterly rate, albeit with a further loss of momentum to 0.1% in June. However, some of this slowing reflects a likely-temporary hiatus in spending ahead of the July 4th general election.

Additionally, inflation data from France, Spain and Italy are released, while Germany also issues business and consumer confidence data after flash PMIs signalled a surprise slowing in the pace of eurozone economic growth, albeit accompanied by welcome signs of softer inflation.

APAC: BoJ summary of opinions, BSP meeting, China PMI, Japan industrial production, retail sales, Singapore, Malaysia inflation

In APAC, the summary of opinions is released from the Bank of Japan's June meeting, where recent inflation data have added to speculation of rate hikes, while the Bangko Sentral ng Pilipinas (BSP) is also set to convene.

On the data side, key releases in the week includes PMI data from mainland China's National Bureau of Statistics (NBS) on Sunday. A series of updates from Japan will also be closely followed including industrial production, retail sales and unemployment statistics. Tokyo CPI for June will also be updated at the end of the week. Finally, inflation figures are also due from Singapore and Malaysia.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-june-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-june-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+24+June+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-june-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 24 June 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-june-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+24+June+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-june-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}