Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 19, 2024

Week Ahead Economic Preview: Week of 22 July 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

July flash PMI, BoC meeting, plus US GDP and prices data in focus

Flash PMI releases for July offer the earliest insights into growth and inflation conditions across major developed nations, while a barrage of US economic data, including GDP and core PCE figures, will also be highlights in the new week. On the central bank front, the Bank of Canada will be in the spotlight amid rising expectations that the Canadian central bank might lower rates in their July meeting. All of these are set to unfold in another week watching US second-quarter earnings, including from major US tech firms.

US flash PMI data will be closely eyed after the June figures provided evidence of resilient growth and easing inflation in the world's largest economy. This goldilocks environment will be essential to sustain the enthusiasm that we have observed in the equity market midway into July, especially against a backdrop of broad-based sector growth, according to the S&P Global US Sector PMI.

Insights into the US growth environment will also be provided the advance release of Q2 GDP for the US, which is expected to show growth accelerating from the 1.4% annualized rate seen in Q1 to 2.1%. The US Federal Reserve's preferred inflation gauge, the core PCE reading, will also be updated on Friday and watched for clues on the monetary policy outlook. Following recent inflation updates, including softer PMI price index and CPI readings, expectations have built for a September rate cut. As such, both the core June PCE and the more up-to-date July PMI prices data will provide policy guidance ahead of the end-July Federal Open Market Committee (FOMC) meeting.

The Bank of Canada's monetary policy committee will update interest rates on Wednesday with the consensus leaning towards the lowering of rates at the July meeting. This has been fuelled by softening economic conditions and easing inflationary pressures within Canada. Whether the BoC chooses to act at the start of the second half of 2024 will fuel expectations for other major developed central banks.

Finally, a series of key economic releases are also due from the APAC region, including South Korea GDP and inflation readings from Singapore, Hong Kong SAR and Malaysia. Industrial production will also be closely watched, with Asia having been a key driver for manufacturing growth in June.

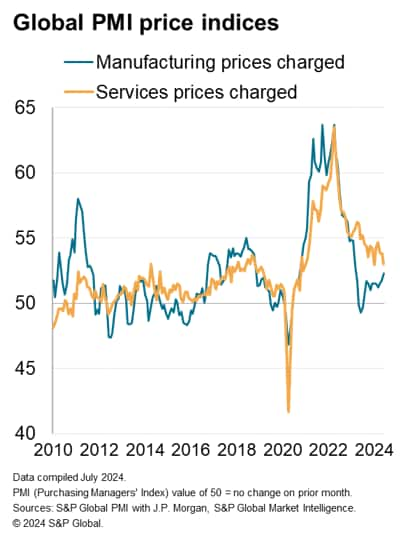

Inflation pressures rotate back to manufacturing

Flash PMI data released in the coming week will be scoured for inflation signals, especially amid recent signs that upward price pressures have rotated back to manufacturing from services.

A major feature of the post-pandemic economic picture was the swing in inflation drivers from goods to services, in turn driven by the switch in demand away from goods once vaccines enabled many services activities, such as tourism and travel, to flourish. This service sector price surge caused a stickiness to inflation which is only recently showing signs of moderating. The global PMI data compiled by S&P Global, showed average prices charged for services rising worldwide at the joint-lowest rate seen over the past three and a half years. This is partly due to wage negotiations adjusting to lower headline inflation in many countries.

However, just as these stubborn wage-related price pressures in the service sector are subsiding, price growth is picking up again in manufacturing. Average prices charged for goods by manufacturers rose in June at the sharpest rate for 15 months, according to the PMI.

Various factors are pushing goods prices higher again. These include a global shift away from inventory reduction, which dampened demand in the 2022-23 post-pandemic period, towards inventory building. Shipping prices are also back on the rise, likely linked to Red Sea and Panama Canal issues and advanced buying of goods ahead of the holiday season and concerns over possible tariffs.

The price data for the July flash PMIs, which includes the tracking of charges for both goods and services as well as input price growth for these sectors, could therefore provide policymakers with valuable insights into inflation developments in the coming months.

Key diary events

Monday 22 JulThailand Market Holiday

China (Mainland) Loan Prime Rate (Jul)

Taiwan Export Orders (Jun)

Hong Kong SAR Inflation (Jun)

Mexico Retail Sales (May)

United States Chicago Fed National Activity (Jun)

Germany Retail Sales (May)

Tuesday 23 Jul

South Korea PPI (Jun)

Singapore Inflation (Jun)

Turkey Consumer Confidence (Jul)

Taiwan Industrial Production (Jun)

Taiwan Retail Sales (Jun)

Canada New Housing Price Index (Jun)

Eurozone Consumer Confidence (Jul, flash)

United States Existing Home Sales (Jun)

Wednesday 24 Jul

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

South Korea Consumer Confidence (Jul)

New Zealand Trade (Jun)

Malaysia Inflation (Jun)

Germany GfK Consumer Confidence (Aug)

South Africa Inflation (Jun)

Taiwan Unemployment (Jun)

Canada BoC Interest Rate Decision

United States New Home Sales (Jun)

Thursday 25 Jul

South Korea GDP (Q2, adv)

Germany Ifo Business Climate (Jul)

Hong Kong SAR Trade (Jun)

Turkey TCMB Interest Rate Decision

United States Durable Goods Orders (Jun)

United States GDP (Q2, adv)

United States Wholesale Inventories (Jun, adv)

Friday 26 Jul

Thailand Industrial Production (Jun)

Singapore Industrial Production (Jun)

Thailand Trade (Jun)

United States Core PCE Price Index (Jun)

United States Personal Income and Spending (un)

United States UoM Sentiment (Jul, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Flash PMI data release for July

The first set of flash PMI data going into the second half of 2024 will be released on Wednesday, July 24, for major developed economies including the US, UK, Eurozone, Japan and Australia. Additionally, early PMI data for India will also be due for insights into how this outperformer has fared in July.

Slower developed market output growth was observed with last month's release, though the US had been an exception, further indicating a 'goldilocks' scenario of solid economic growth and softer price increases. Both growth and price trends will be key to watch with implications for monetary policy going forward.

Americas: BoC meeting, US Q2 GDP, core PCE, personal income, spending, durable goods orders, existing and new home sales data

The Bank of Canada convenes in the coming week with the potential for a rate cut to unfold in the July meeting. Expectations have risen for the BoC to lower rates amid the softening of economic conditions and easing inflationary pressures, which has also been shown by the latest PMI data.

A busy data week is meanwhile set to unfold in the US as we find a barrage of releases lined up, with the highlights being advance Q2 GDP and core PCE figures for June, as well as durable goods orders, consumer sentiment, home sales and inventories.

EMEA: Germany GfK, Ifo data, Eurozone consumer confidence, Turkey TCMB meeting

The focus in the coming week is expected to be with the flash PMI releases across the euro area and UK. Besides which, sentiment data in the form of Germany's GfK and Ifo survey data will also be released, in addition to the July flash reading of eurozone consumer confidence.

APAC: China Loan Prime Rate, South Korea GDP, Singapore, Hong Kong SAR, Malaysia inflation, Taiwan industrial production

In APAC, the week ahead sees mainland China updating the Loan Prime Rate for July. Additionally, several tier-1 data releases are anticipated in the region including the advance reading of South Korea's Q2 GDP. This follows indication of a subdued start to the quarter for the manufacturing sector, according to the South Korea Manufacturing PMI, though the latest June figures showed solid expansions in production. Separately, inflation readings are also anticipated from Singapore, Malaysia and Hong Kong SAR.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-july-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-july-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+22+July+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-july-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 22 July 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-july-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+22+July+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-july-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}