Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 10, 2021

Week Ahead Economic Preview: Week of 13 September 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A busy week of economic releases is lined up ahead with US and UK August inflation numbers to watch. US and China will also be updating their retail sales and industrial production figures amid varying degrees of COVID-19 disruption. Employment data in the UK and Australia will also be of interest.

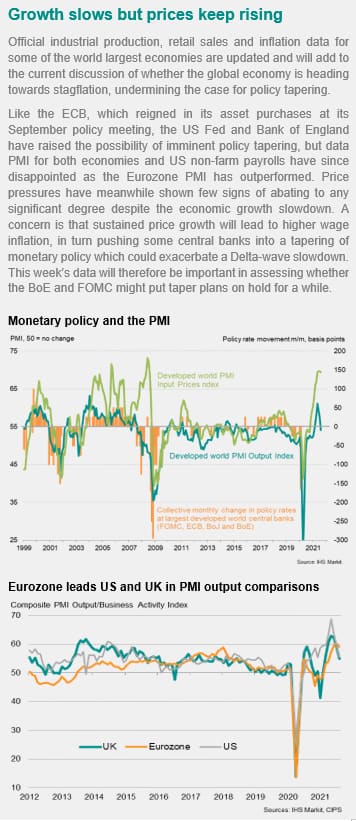

After PMI data showed global economic growth slowed in August to the lowest since January, the coming week sees some key official data releases to add colour to the global economic picture.

From the manufacturing perspective, production performance will be tracked in the week ahead via industrial output data for the US, China and the Eurozone, with hints sought as to how factories are coping with record supply disruptions.

From a consumer angle, retail sales data for the US and China will be scoured for insights into the extent to which the further spread of the COVID-19 Delta variant likely cooled spending, as hinted at by business activity growth in the service sector continuing to wane globally in August

Following the US jobs report disappointment, UK and Australia will also update employment data from two ends of the globe. While the former has seen its composite PMI employment index hit a record high, buoyed by the winding down of the furlough scheme, the latter's has fallen for the first time in ten months as COVID-19 continued to hit the economy.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-september-2021.html&text=Week+Ahead+Economic+Preview%3a+Week+of+13+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-september-2021.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 13 September 2021 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+13+September+2021+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}