Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 07, 2024

Week Ahead Economic Preview: Week of 10 June 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

FOMC, BoJ meetings, US, China inflation and UK data in focus

The Fed and Bank of Japan convene for their June meetings, while the US and mainland China also update key price gauges to provide a sense of the direction for global inflation and interest rates. Additionally, the UK updates output and employment figures ahead of the Bank of England's meeting later in the month.

While the Fed is widely expected to keep rates unchanged at the upcoming June meeting, in contrast to the European Central Bank, the Federal Open Market Committee (FOMC) meeting may well generate a lot of buzz given the market's hunt for clues regarding the timing of the next Fed move. Despite the consensus having pointed in the direction of a Fed cut toward the tail end of 2024, recent data have been mixed, notably with weaker growth signals for the second quarter combining with stubborn price signals, thereby fuelling uncertainty over when the Fed will eventually lower rates. The release of May CPI in the US, ahead of the FOMC meeting conclusion, will therefore provide another important data point to help guide the expectation for rates. Additionally, the June S&P Global Investment Manager Index will shed light on investor sentiment and expectations with regards to central bank policy after the May update showed investors viewed central bank policy to remain a drag for equity performance.

The Bank of Japan will be another major central bank meeting to set policy in the week, though likewise with no changes to monetary policy expected imminently. That said, the Japanese central bank's stance will similarly be eyed closely, especially with the domestic currency weakness prevailing. Japanese manufacturers fare facing the fastest rise in input costs among the economies tracked by PMI data, in part due to the currency impact.

With anticipation also having gathered for the Bank of England to lower rates, the UK sees timely updates to both employment and monthly GDP for April. While it is unlikely for the BoE to cut rates prior to the general election on 4th July, markets will be assessing scope for an August rate cut.

Other data to watch in the week include factory gate inflation out of mainland China, which comes on the heels of Caixin PMI updates outlining some margin pressures for manufacturers.

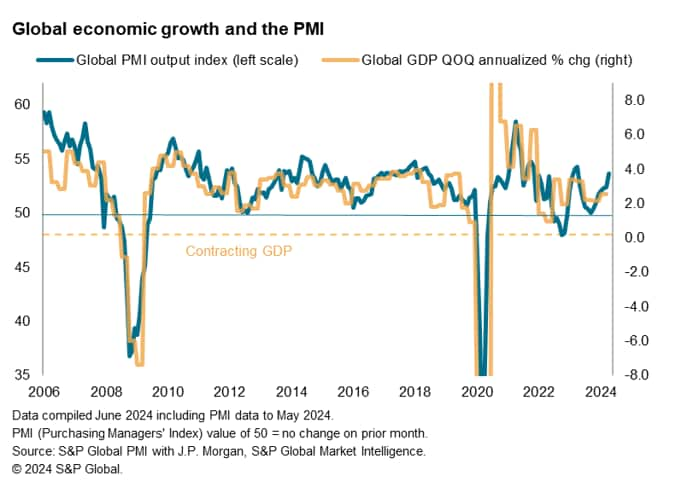

Global growth accelerates

Global economic growth accelerated for seventh consecutive month in May, according to the PMI surveys compiled by S&P Global in over 40 countries, hitting a 12-month high. The data point to a gathering upturn so far in 2024 after the marked slowdown seen in late 2023.

May saw accelerating growth in the US accompanied by further signs of economic rebounds in Europe, with the eurozone expansion gaining pace and the UK continuing to show resilient growth. Japan's upturn also remained robust alongside reviving growth in mainland China, the latter helping buoy overall emerging market performance to a 12-month high.

An improving global service sector picture is evident alongside a further recovery in manufacturing and trade, with signs of resilient consumer spending plus improving business spending, notably on capex, and restocking.

Price pressures remain elevated globally, albeit showing signs of cooling in Europe, as stubborn service sector inflation pressures are joined by reviving cost pressures in the manufacturing sector.

Leading indicators have meanwhile ticked higher, driving increased employment, with business uncertainty now down to its lowest since 2018, boding well for the upturn to persist into mid-year. Read more PMI analysis here.

Key diary events

Monday 10 Jun

Australia, China (Mainland), Hong Kong SAR, Taiwan Market

Holiday

Japan GDP (Q1, final)

Malaysia Industrial Production (Apr)

Norway Inflation (May)

Sweden GDP (Apr)

Switzerland Consumer Confidence (May)

Turkey Industrial Production (Apr)

Italy Industrial Production (Apr)

Canada Average Hourly Wages (May)

S&P Global Investment Manager Index* (Jun)

Tuesday 11 Jun

Australia NAB Business Confidence (May)

United Kingdom Labour Market Report (Apr)

Brazil Inflation (May)

Mexico Industrial Production (Apr)

Wednesday 12 Jun

South Korea Unemployment Rate (May)

China (Mainland) CPI, PPI (May)

Germany Inflation (May, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Apr)

Thailand BoT Interest Rate Decision

India Industrial Production (Apr)

India Inflation Rate (May)

United States CPI (May)

United States Fed Interest Rate Decision

United States FOMC Economic Projections

United States Fed Press Conference

Thursday 13 Jun

Australia Westpac Consumer Confidence (Jun)

Australia Employment Change (May)

Australia Unemployment Rate (May)

China (Mainland) M2, New Yuan Loans, Loan Growth (May)

Eurozone Industrial Production (Apr)

Brazil Retail Sales (Apr)

United States PPI (May)

Friday 14 Jun

Australia Consumer Inflation Expectations (Jun)

Japan BoJ Interest Rate Decision

Japan Industrial Production (Apr, final)

Germany Wholesale Prices (May)

India Trade (May)

India WPI (May)

France Inflation (May, final)

Italy Balance of Trade (Apr)

Eurozone Balance of Trade (Apr)

United States Export Prices (May)

United States Michigan Consumer Sentiment (Jun, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: Fed FOMC meeting, US CPI, PPI

With the Fed widely expected to keep rates unchanged at the upcoming June meeting, the focus falls squarely on the central's bank stance with respect to when rates may eventually fall. In particular, the Fed's assessment of inflation via the meeting statement and the press conference will be tracked, in addition to further insights from projection materials. According to the CME FedWatch tool, a first rate cut is expected from around November. That said, more recent PMI data have outlined rising price pressures in the US, thereby outlining the uncertainty that continues to shroud the timing of a Fed cut.

In addition to the Fed meeting, US May CPI data will also be released on Wednesday, with this being the key piece of data due in the week. Inflation has proven to be rather sticky according to the PMI updates, and May is expected to be no exception with prices expected still be hanging above the Fed's target rate.

EMEA: UK labour market, output data, eurozone industrial production

The UK releases employment and output (GDP) data for April on Tuesday and Wednesday respectively. With the market keen to assess when the Bank of England (BoE) might start lowering rates, the emphasis remains with data developments. The central bank will want to see labour market and output conditions continue moving in a way that does not support further rise in inflation in order to be comfortable to lower borrowing costs this summer, with a notable focus on wage growth.

APAC: BoJ, BoT meeting, Japan GDP, China inflation

Central bank meetings unfold in Japan and Thailand in the week with the consensus pointing to no changes in monetary policy at the point of writing. That said, the BoJ remains likely to raise interest rates at some point given the pressure on the Japanese yen, which has proved to a bane for goods producers given the pressure on the cost side according to the au Jibun Bank Japan Manufacturing PMI. Final Q1 GDP data from Japan will also be updated.

Meanwhile mainland China CPI and PPI figures will be due on Wednesday for insights into how prices have evolved, particularly for factory gate inflation after Caixin PMI outlined sustained margin pressures for goods producers.

S&P Global Investment Manager Index

June S&P Global Investment Manager Index will be due at the start of the week, providing the latest update of investors' sentiment, sector preference and drivers for the market.

Email us

Have a PMI related question or want to receive this in your inbox weekly? Send us an email at PMI@spgobal.com.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-june-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-june-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+10+June+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-june-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 10 June 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-june-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+10+June+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-june-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}