Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 28, 2023

Week Ahead Economic Preview: Week of 1 May 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The start of May sees a truncated week for some amid public holidays, but it's nevertheless a busy diary which includes worldwide PMI data, US nonfarm payrolls and rate setting meetings in the US, Eurozone, Norway, Brazil and Australia.

The big event of the week is the FOMC meeting on Wednesday, which is preceded by manufacturing PMI data to help take the temperature of goods-producing economies in the US and worldwide (see box). The narrative has taken a hawkish turn among US policymakers in the lead up to the FOMC gathering, at which a 25 basis point hike is widely anticipated to take the Fed Funds Rate to 5.00-5.25%. However, the presser will be eagerly anticipated to assess whether this represents a peak, as a further hike in June is by no means off the table according to futures markets.

The health of the banking sector will play a key role in the FOMCs decision making process, but so will the state of the labor market, bringing Friday's employment report firmly under the spotlight. Current expectations are for the jobless rate to tick higher and payroll growth to slow, but to remain robust at around 180k. Anything other than an upside surprise will fuel speculation that May's hike will be the last in the current cycle. Services PMIs from S&P Global and ISM will add to the data flow in the lead up to the May decision.

Interest rates are also expected to be lifted higher by the ECB on Thursday, with a 50 bp hike taking the deposit rate to 3.5%. As with the FOMC, the May ECB hike is firmly priced in, but markets are more convinced of the need for a further 25bp hike by the ECB than the FOMC in June. The rhetoric from the press conference will be important to monitor, as will the preliminary inflation data for April and the final PMIs for the region. Although the flash Eurozone PMIs were surprisingly robust, price trends cooled.

In Australia, the RBA will be mulling the appropriateness of its decision to hold rates at its last meeting. Inflation has since shown signs of peaking, but business activity growth has accelerated, setting the scene for a lively meeting.

Also watch out for inflation data from mainland China, UK mortgage lending, Canada's jobs report and GDP data from both Hong Kong SAR and Indonesia, to list just a few of the other economic data releases scheduled for the week.

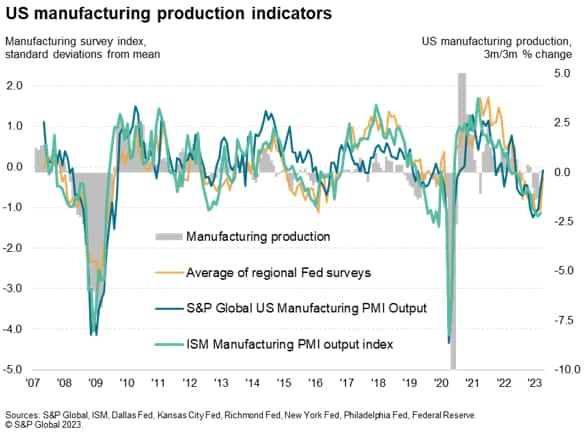

US manufacturing, on the rebound?

The final April PMI data will be closely watched in the coming week for signs that reviving demand for services is driving a geographically-broad global economic upturn, as had been signalled by the preliminary flash numbers.

However, we are also keen to monitor the health of the manufacturing sector. Goods producers have suffered from major headwinds in recent months, most notably the cost of living crisis, a shift in post-pandemic spending from goods to services and a concomitant unwinding of inventories. The latter is linked to easing supply shortages as well as concerns that inventories have risen too high for many goods relative to expected future demand. Hence manufacturing globally reported a ninth successive monthly fall in new orders in March.

The rate of decline of manufacturing has nevertheless eased compared to the steep downturn seen late last year. Besides a boost from the reopening of the mainland Chinese economy, the US has seen as particularly encouraging uplift in the S&P Global PMI, which gathered momentum in April, according to the flash PMI data.

The various regional Fed surveys have already started confirming this manufacturing turnaround from the dark days of late 2022, and we await ISM data to likely follow suit. It's not yet clear what's driving this production improvement in the US, but a lower incidence of inventory reduction policies is playing a role. This suggest that the inventory correction could be playing out, and could soon be replicated in Europe and Aisa, potentially providing a much-needed boost to worldwide production. But a key question is also whether prices will start to rise again in this scenario.

Key diary events

Monday 1 May

Germany, Italy, France, Portugal, Spain, Singapore, China, South Korea, Ireland, South Africa & United Kingdom Market Holiday

S&P Manufacturing PMI (Apr)

South Korea Exports & Imports (Apr)

Australia Commodity Prices (YoY)

Brazil Trade Balance (Apr)

Tuesday 2 May

China Labour Day

South Korea CPI (Apr)

Australia RBA Interest Rate Decision (May)

United Kingdom Nationwide HPI (Apr)

Germany Retail Sales (Mar)

Hong Kong GSP (YoY)

Italy CPI (Apr)

Eurozone CPI (Apr)

Brazil Trade Balance

Wednesday 3 May

China Labour Day

S&P Services PMI

New Zealand Employment Change (QoQ)

New Zealand Labour Cost Index (QoQ)

New Zealand Participation & Unemployment Rate (QoQ)

Australia Retail Sales

France Government Budget Balance (Apr)

Italy Unemployment Rate (Mar)

Greece Unemployment Rate (Mar)

United States Mortgage Market Index

United States Fed Interest Rate Decision

Brazil Interest Rate Decision

Thursday 4 May

Japan Market Holiday

S&P Global Composite PMI

Australia Trade Balance (Mar)

Germany Trade Balance (Mar)

Spain Unemployment Change

United Kingdom Mortgage Approvals & Lending (Mar)

Hong Kong Retail Sales (Mar)

Europe ECB Interest Rate Decision (May)

United States Trade Balance (Mar)

Canada Trade Balance (Mar)

Friday 5 May

Japan & South Korea Market Holiday

S&P Global Construction PMI

Singapore Retail Sales (Mar)

France Industrial Production (Mar)

Europe Retail Sales (Mar)

United States Unemployment Rate (Apr)

Canada Unemployment Rate (Apr)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Worldwide manufacturing and services PMI data

Worldwide manufacturing and services PMI data are due in the coming week, providing deeper insights into global economic conditions at the start of the second quarter. The release follows the flash PMIs, which had shown strong improvement across the developed markets in April. Inflationary pressures continued to build, albeit well off last year's highs, while recessionary risks remain at bay as the service sector drove the latest upturn.

Mainland China PMI data will be especially eagerly awaited to see whether the recent relaxation of COVID-19 containment measures will continue to drive growth after the growth spurt seen in February and March.

Americas: FOMC rate decision, PMIs, and employment report. Brazil rate decision. Canada jobs report.

The US Federal Open Market Committee is set to meet with its decision due on Wednesday. The Fed has been pushing rates higher, with recent predictions pointing to a further tightening in May to help bring down inflation to target, despite GDP growth slowing in the first quarter. More data from the US includes nonfarm payrolls, wages, and unemployment figures, as well as trade, construction spending and factory orders data.

In Brazil, the central bank will also be deciding their interest rates mid-week while Canada also updates its monthly labour market statistics.

Europe: ECB meet, eurozone CPI and UK mortgage data

Following PMI releases for eurozone and European countries, the ECB will convene to decide on interest rates. While the bank will also be reviewing the inflation data (CPI figures to be released on Tuesday) to form a decision.

In the UK, other than the PMI data, the housing market will come under scrutiny via the updating of mortgage lending and approvals data.

Asia-Pacific: South Korea CPI and trade data, retail sales for Singapore and Hong Kong and RBA meeting

Data to look out for across Asia will be trade and CPI figures for South Korea and retail sales for both Singapore and Hong Kong SAR. Also look out for GDP for Indonesia and Hong Kong SAR plus consumer confidence in Japan.

Additionally, the Australian central bank meeting will unfold this coming week.

Special reports:

Electronics sector reports greatest improvement in supply chains since 2001 - Chris Williamson

South Korea Resumes Positive GDP Growth in Early 2023 - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-may-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-may-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+1+May+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-may-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 1 May 2023 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-may-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+1+May+2023+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-1-may-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}