Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 21, 2018

Weak start to 2018 for South Africa

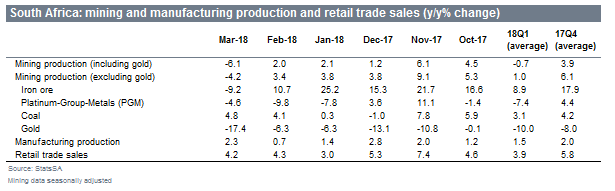

- Latest statistics released by the South Africa Statistical Service (StatsSA) point to weak economic activity in some of South Africa's largest sectors (retail trade, manufacturing and mining). The real seasonally adjusted GDP growth could contract as much as 2.0% during Q1 but is expected to pick up pace for the remainder of the year.

- South Africa's growth constraints are structural in nature and will take time to address in order to place the economy on a stronger growth path. Short-term growth prospects hinge primarily on a cyclical rebound in the South African economy.

- Fiscal consolidation, which include tax hikes, limit room for further monetary easing and a less favorable shift in emerging market sentiment and portfolio flows could mean that any rebound in South African economic growth would be very soft.

South Africa's real seasonally adjusted annualized growth rate could contract as much as 2.0% during Q1. Some rebound in economic activity for the remainder of the year could nonetheless leave overall GDP growth close to 1.5%, marginally lower than our current growth expectation of 1.6% and well below historical averages. Although the risk of a recession in the South African economy during 2018 remains limited, the prospects of a strong recovery in economic activity is just as unlikely.

South Africa's growth constraints are structural in nature and will take time to address in order to place the economy on a stronger growth path. To this end some progress has been made of which some recovery in consumer and business sentiment and addressing some financial and operations difficulties at State Owned Entities (SOEs) are the most prominent. In the past week, debt ridden power provider Eskom announced that top management will not receive annual bonuses this year and that the parastatal will have to take a serious look at its salary bill. South African Airways (SAA) approached National Treasury to seek financial support well above previous estimates for the next three years, but made a strong commitment towards debt restructuring and focussing on its business model to keep the parastatal afloat and more profitable in the future.

Investment has also become a priority for President Cyril Ramaphosa who has set up a task team, comprising Trevor Manuel, Mcebisi Jonas, Phumzile Langeni and Trudi Makhaya to secure USD100 billion in private investment before the end of the year. Around USD25 billion will hopefully be sourced from the energy sector, with a specific focus on Independent Power Producers (IPP), infrastructure development for the transportation of natural gas and liquefied natural gas (LNG) (regional pipelines and LNG terminals at strategic ports) and improving South Africa's refinery assets to meet global emission standards. Some of these projects are linked to developments in Mozambique's Rovuma basin. Progress of LNG project development in Mozambique has been very slow with only the smaller offshore Coral-South project reaching a Final Investor Decision to date. Project development by South Africa's Sasol Ltd is nonetheless progressing favorably.

Securing the President's desired amount of investment from the private sector could disappoint as uncertainties over property rights, for both commercial and private individuals in South Africa, continues to delay any significant private sector investment. Government's projected fiscal consolidation over the medium term and increasingly strained balance sheets of SOEs also limit the ability of public sector investment and the commencement of any larger construction projects. South Africa's housing market remains very depressed.

Growth prospects hinge primarily on a cyclical rebound in the South African economy. However a move towards fiscal consolidation, limited room for further monetary easing and a less favorable shift in emerging market sentiment and portfolio flows could mean that any rebound would be very soft. In our view the South African Reserve Bank will have the opportunity to cut the policy rate by a further 25 basis points during its May Monetary Policy Committee (MPC) meeting as headline inflation remains within the 3%-6% target range, economic growth slumps and the U.S. Fed policy rate remains unchanged for the time being. However as the year progresses, the possibility of lower domestic interest rates will diminish as inflation accelerates (but still remains within the target range) while the Fed funds rate moves up. This could place pressure on the South African Rand which in our view will breach the ZAR13.00/U.S. Dollar 1 level by year-end. The likelihood is nonetheless more skewed towards an unchanged interest rate outcome during the May MPC meeting with global uncertainties (such as oil prices) and the Rand exchange rate trajectory overriding any dovish SARB interest rate decision.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-start-to-2018-for-south-africa.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-start-to-2018-for-south-africa.html&text=Weak+start+to+2018+for+South+Africa+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-start-to-2018-for-south-africa.html","enabled":true},{"name":"email","url":"?subject=Weak start to 2018 for South Africa | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-start-to-2018-for-south-africa.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+start+to+2018+for+South+Africa+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweak-start-to-2018-for-south-africa.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}