Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 08, 2018

US PMI signals further inflationary pressures lie ahead

- Manufacturing and service sector firms report improved pricing power amid stronger demand

- Cost pressures remain elevated, fuelling uptick in output prices

- Building inflationary pressures could challenge Federal Reserve's policy path

US economic data over the coming few months will have a strong bearing on market expectations towards the Federal Reserve's path for monetary policy. Although the advanced estimate of fourth quarter GDP growth came in weaker than the third quarter, in line with the IHS Markit PMI, the latest data point to both stronger domestic demand and inflationary pressures.

An end to the 'Goldilocks' economy?

The recent 'Goldilocks' scenario of solid economic expansion and stable inflation has contributed to improved global optimism in recent months. This has been particularly apparent in the US and eurozone. Alongside moderate inflation, US GDP expanded at 2.3% in 2017, the economy's best year since 2014, while strong PMI data for the eurozone suggests fourth quarter GDP growth of 0.6%, rounding off the best year since 2010, is likely to be revised even higher to 0.8%.

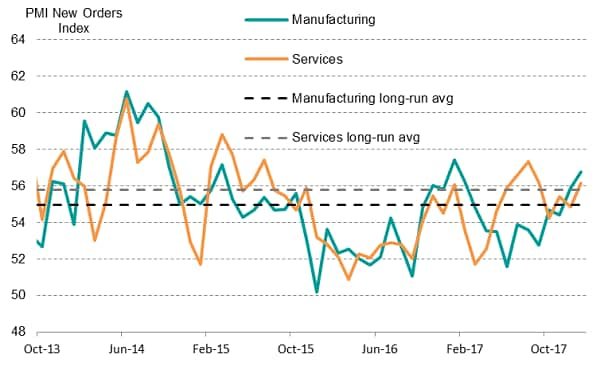

Although 2017 fourth quarter US GDP growth was weaker than that of the third quarter, domestic demand growth accelerated and January PMI data indicate that demand pressures in both manufacturing and service sectors are above their respective long-run averages.

PMI indicates strong and accelerated demand growth

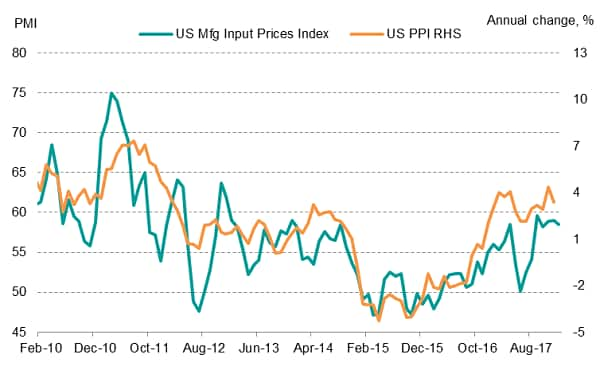

Meanwhile, PMI data point to increasingly elevated cost pressures. The US manufacturing PMI Input Prices Index registered 58.5 in January to signal a sharp pace of inflation, broadly in line with the strong annual growth observed in the official purchasing prices index.

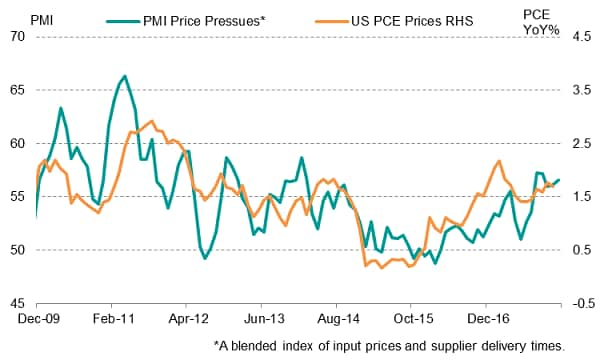

The combination of strong demand and rising costs is encouraging firms to raise output prices, which could spur inflation higher. In fact, with deteriorating supplier delivery times and rising input costs, overall price pressures look set to build even further. As evidenced by the chart, greater costs in tandem with supply chain pressures usually feed through to consumer prices.

Production costs inflate sharply

Supply-side pressures intensify

To that end, mounting price pressures and robust demand questions how much further economic growth can continue before inflation begins to edge into unwanted territory for monetary policymakers.

Market response

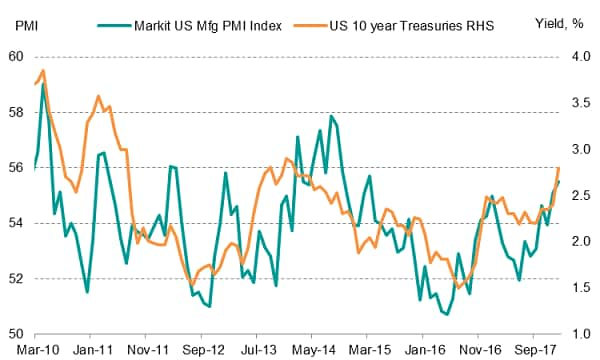

The fear of rising inflation has resonated through global markets in the past week. Yields on US Treasuries have been driven higher, while equity markets have experienced widespread declines. However, according to IHS Markit Manufacturing PMI data, the recent uptick in US 10-year Treasury yields is a fair reflection of economic fundamentals.

PMI supports higher bond yields

The policy path ahead

Overall, strong demand coupled with intensified cost pressures was observed across both surveyed sectors, according to January PMI data. The median member of the Federal Reserve Open Market Committee expects 3 rate hikes in 2018. If demand and supply-side pressures are to mount further, questions will be raised as to whether the Fed should seek an even quicker rate of policy normalisation to prevent the US economy from overheating.

Joseph Hayes, Economist, IHS Markit

Tel: 01491 461 006

joseph.hayes@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-signals-further-inflationary-pressures-lie-ahead.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-signals-further-inflationary-pressures-lie-ahead.html&text=US+PMI+signals+further+inflationary+pressures+lie+ahead+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-signals-further-inflationary-pressures-lie-ahead.html","enabled":true},{"name":"email","url":"?subject=US PMI signals further inflationary pressures lie ahead | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-signals-further-inflationary-pressures-lie-ahead.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+PMI+signals+further+inflationary+pressures+lie+ahead+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-signals-further-inflationary-pressures-lie-ahead.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}