Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 01, 2024

Top five takeaways from June's global survey data as manufacturing price inflation accelerates

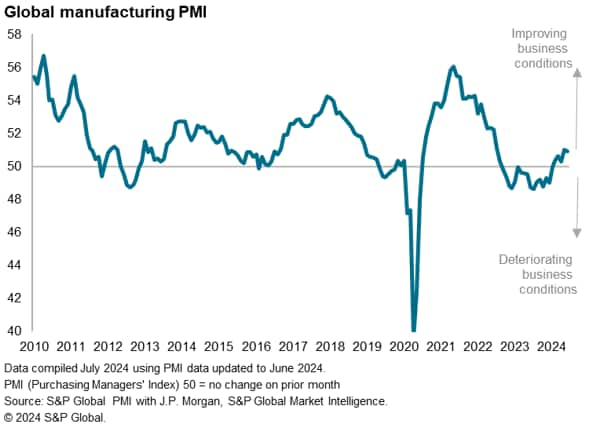

At 50.9 in June, the Global Manufacturing PMI, sponsored by J.P.Morgan and compiled by S&P Global Market Intelligence, recorded above 50.0 neutral mark (and therefore indicating improving business conditions) for a fifth successive month. Down from 51.0 in May, the latest data signalled a marginal easing in the rate of improvement, though nevertheless points to the second-strongest upturn seen over the past two years and represents a further recovery from the downturn in manufacturing which began in the latter half of 2022, through to 2023.

The PMI is a composite index derived from five survey 'sub-indices'. Here are our top five takeaways from some of these sub-indices, which provides a deeper insight into the current manufacturing trends relating to output, demand, inventories, supply chains, employment and prices.

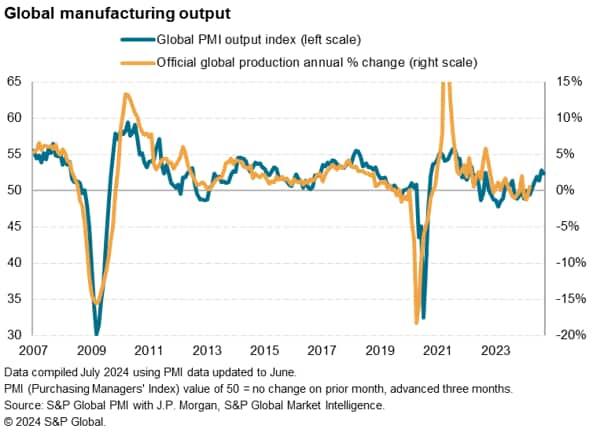

1: Global output growth holds close to two-year high

The PMI survey's sub-index of production, which tracks actual month-on-month factory output changes, signaled a sixth successive monthly expansion of production in June. Although the rate of growth slowed, it remained the second-fastest seen over the past two years. The survey data exhibit a correlation of 75% with the official annual rate of change in global production, with the survey data acting with a three-month lead. Using a simple regression-based model, the latest PMI data indicate that manufacturing output is growing worldwide at a relatively robust annual rate of approximately 2%.

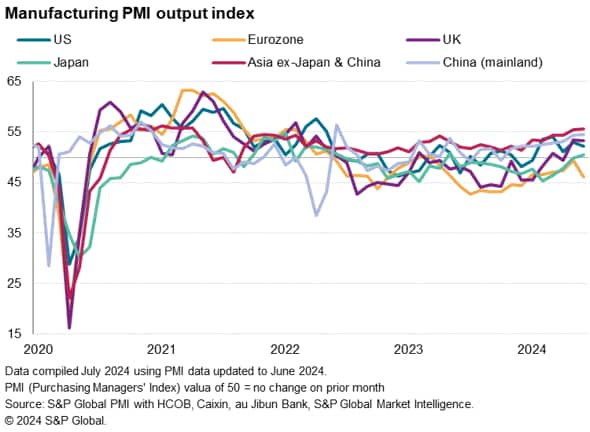

2: Asia leads the global expansion

The production improvement was again led by Asia, albeit with Japan lagging. Japan nonetheless moved into expansion territory for the first time in over a year. More modest gains were meanwhile seen in both the US and UK, while the eurozone continued to lag behind with falling output amid steep declines in Germany, France and Italy.

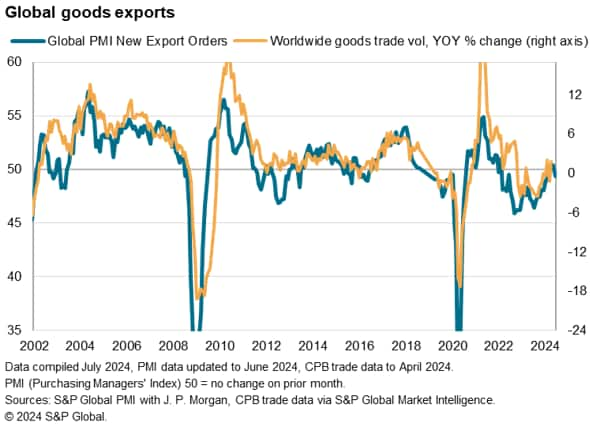

3: Global exports fall for the first time in three months

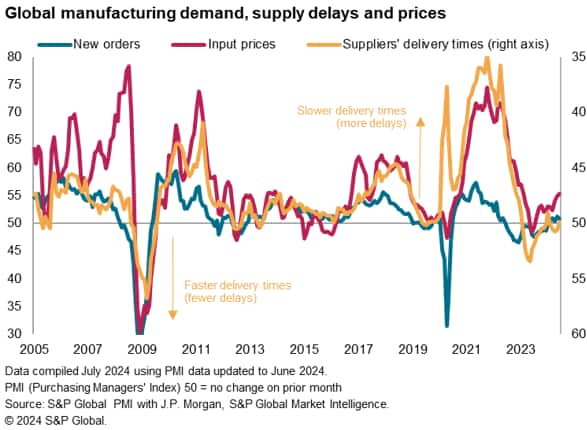

Global output growth was buoyed by new orders for goods rising for a fifth successive month, although the rate of increase was only modest, having dipped from May's 26-month high. The reduced inflow of new work was in part fueled by the first, albeit marginal, worldwide decline in new export orders for three months. However, it should be noted that - in the three months to June - overall new orders and new export orders have registered their best quarterly performances since the final quarter of 2021.

4: Supply chain stress remains low

Although the amount of inputs purchased by manufacturers rose only slightly in June, the rise built on a further modest increase in May. Together, these months represent the first spell of rising purchasing seen in nearly two years. This contrasts with the focus on deliberate stock reduction that has previously dominated global manufacturing since mid-2022.

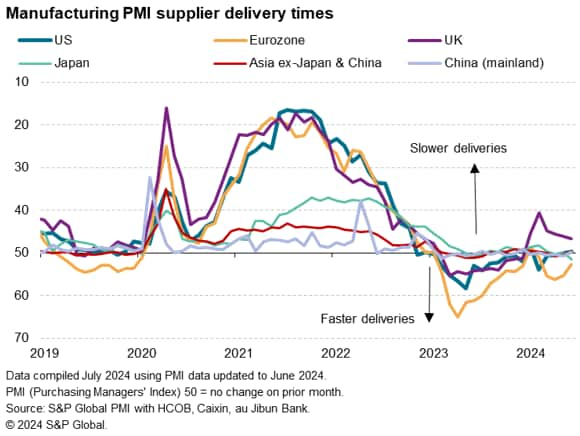

Encouragingly, the rise in purchasing has not been sufficient to strain supply chains, even in the face of Red Sea and Panama Canal disruptions to shipping. Although suppliers' delivery times lengthened on average in June, the first such deterioration signalled since the initial Red Sea impact in January, the lengthening was only very marginal and certainly nothing like the delays seen during the pandemic.

Of the major economies, longer delivery times were commonly reported in the UK, as well as Taiwan, Australia, Brazil, Mexico, Russia and Spain.

5: Manufacturing prices rise at fastest rate for 15 months

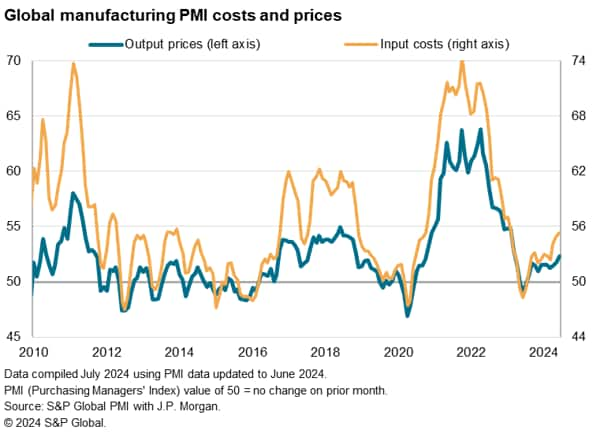

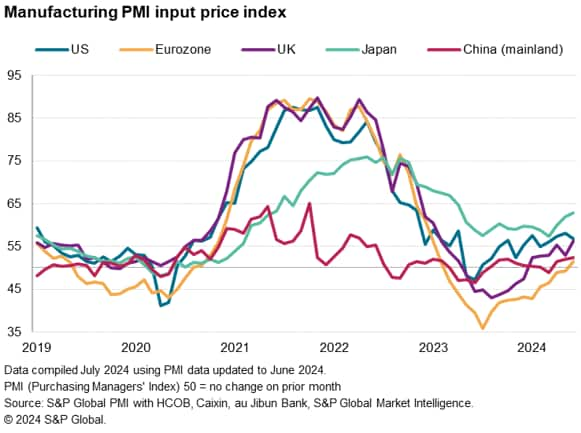

Measured overall, worldwide manufacturing input costs rose at the steepest rate for 16 months in June. At 56.3, the Global Manufacturing PMI Input Prices Index is now only marginally below the pre-pandemic decade average of 55.6. These rising costs have pushed up factory gate selling prices, which also rose in June at the sharpest rate for 15 months. In the case of selling prices, the increase exceeded the pre-pandemic decade average, adding further to signs that the disinflationary spell from goods prices (that has helped bring inflation down since the pandemic peaks) is reversing.

Of the major economies, the steepest rate of input cost inflation was seen in Japan during June, where upward pressure on prices was again exacerbated by the impact of the yen's further weakening via higher import costs. However, input cost inflation in the US remained close to its pre-pandemic 10-year average and hit a 17-month high in the UK. Even in mainland China a two-year high was recorded and in the eurozone, still plagued with a manufacturing downturn, prices rose at the fastest rate for nearly one-and-a-half years.

Other notable highs included two-year peaks for input cost inflation in both Taiwan and Vietnam, helping push factory input costs across Asia as a whole up at the steepest rate for 16 months.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-takeaways-from-junes-global-survey-data-as-manufacturing-price-inflation-accelerates-jul24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-takeaways-from-junes-global-survey-data-as-manufacturing-price-inflation-accelerates-jul24.html&text=Top+five+takeaways+from+June%27s+global+survey+data+as+manufacturing+price+inflation+accelerates+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-takeaways-from-junes-global-survey-data-as-manufacturing-price-inflation-accelerates-jul24.html","enabled":true},{"name":"email","url":"?subject=Top five takeaways from June's global survey data as manufacturing price inflation accelerates | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-takeaways-from-junes-global-survey-data-as-manufacturing-price-inflation-accelerates-jul24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+five+takeaways+from+June%27s+global+survey+data+as+manufacturing+price+inflation+accelerates+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-takeaways-from-junes-global-survey-data-as-manufacturing-price-inflation-accelerates-jul24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}