Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 12, 2018

South African fiscal policy outlook

Finance Minister Nhlanhla Nene resigned from his position on 9 October 2018 after testifying to the Commission of Inquiry investigating widespread corruption in government. He has been replaced by Tito Mboweni, former governor of the South African Reserve Bank. The change coincides with growing focus on the details of the government's ambitious economic recovery plan, due for release in the Medium-Term Budget Policy Statement slated for 24 October 2018.

- Tito Mboweni's appointment as finance minister is likely to be well-received by the markets given his experience and good track record in his previous role as governor of the South African Reserve Bank. The Medium-Term Budget Policy Statement (MTBPS) will be a key indicator of South Africa's fiscal policy direction in the one-year outlook. Fiscal policy is unlikely to change significantly under Mboweni, and he is likely to place emphasis on tightening government outlays across the public sector: additionally, the success of the upcoming MTBPS will be determined by how a ZAR400-billion infrastructure fund will be financed.

- If the MTBPS were poorly received, particularly regarding the government's ability to restrict expenditure, a Moody's ratings downgrade to sub-investment grade is highly likely.

Tito Mboweni was South Africa's first post-apartheid Minister of Labor and served in Nelson Mandela's cabinet between 1994 and 1998. He was governor of the central bank, the South African Reserve Bank (SARB) from 1999 until 2009. Since 2010, he has worked as an adviser to Goldman Sachs International, giving strategic advice on South and Sub-Saharan Africa. He is considered to be a favorable choice for the post of finance minister because he is well-known to international financial institutions and ratings agencies and has extensive experience at the SARB. During his tenure there, he improved South Africa's monetary policy framework by forming a Monetary Policy Committee, introducing bi-annual monetary policy forums and the compilation of a monetary policy review while successfully managing to keep inflation within the 3-6% target band, despite fierce opposition from the African National Congress' leftist alliance partners. Mboweni worked closely with Trevor Manuel, who was a highly respected finance minister from 1996 until 2009. Both were viewed favorably by the markets. Initial market reaction to his appointment was favorable, with the rand gaining roughly 0.7%.

IHS Markit expects Mboweni to follow a conservative path and to seek to instill fiscal discipline across government, in a similar manner to that previously expected of the former finance minister Nhlanhla Nene (2014-15). Mboweni is regarded as highly competent by our financial-sector sources and markets thus are likely to respond well to his appointment. He is also unlikely to depart from the policy path outlined by President Cyril Ramaphosa in his State of the Nation Address. A crucial test for both Mboweni and Ramaphosa will be the detail of the MTBPS. Mboweni now needs to bring greater clarity to the economic stimulus and recovery plan outlined by Ramaphosa on 21 September 2018. We expect markets to focus heavily on how the plan will be funded.

The Medium-Term Budget Policy Statement (MTBPS)

The appointment of Mboweni triggers concerns about the timing of and possible effects on the MTBPS slated for 24 October. The statement faces risk of a modest postponement, to allow the new minister to settle in. Markets will view it as important for Mboweni to convey a sound grasp of the economic recovery plan and to provide the required detail.

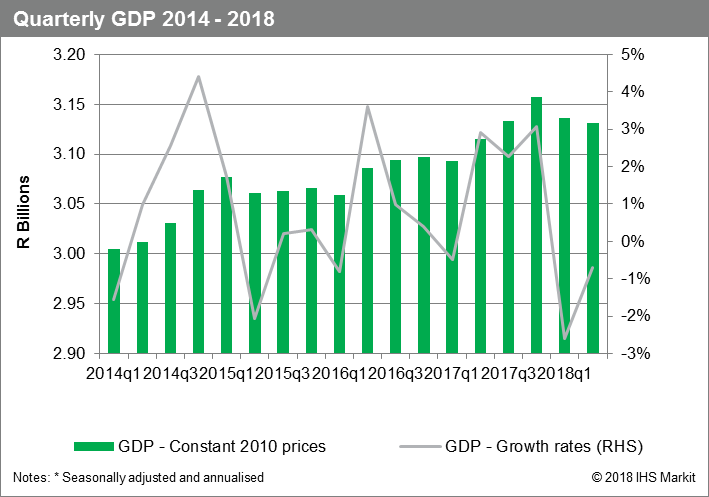

Ramaphosa inherited an economy in decline with net investment outflows since 2014 and two consecutive quarters of negative growth so far in 2018. To catalyze a turnaround, in February, Ramaphosa announced a USD100-billion investment drive over five years: the pending mid-term budget speech now represents a critical point in his presidency, at which the credibility of his plans and the prospects for economic recovery will be scrutinized both domestically and by international investors. The eagerly anticipated economic stimulus and recovery plan - which includes the establishment of a ZAR400-billion infrastructure fund, somewhat unusually to be controlled by the presidency - as well as a review of electricity, port, and rail tariffs are crucial to this recovery. The plan's near-term implementation could affect the general election in 2019. Announcement of the plan on 21 September has thus far failed to generate much initial market enthusiasm, not least because investors are waiting for greater policy detail clarity in the MTBPS, including specific description of planned funding sources.

Radical Economic Transformation (RET) effort to destabilize

Ramaphosa's government

Since his ascension to power, Ramaphosa has faced repeated

challenges from supporters of the RET populist policies, both from

within the African National Congress (ANC) and the opposition

Economic Freedom Fighters (EFF) party. They have gathered traction

after successfully bringing land reform - specifically a

constitutional change to allow for expropriation without

compensation - to parliament for debate, broadening RET appeal to

voters across traditional ANC strongholds in rural areas. Ahead of

the 2019 election, Ramaphosa needs a delicate balance between

appeasing RET supporters to maintain party unity, while not

appearing so populist as to scare away investment. Nene's cabinet

appointment had been crucial to Ramaphosa's effort to exercise

fiscal prudence, revive state-owned enterprises saddled with

corruption, and steer the ailing economy back to health. It is

likely that RET supporters, including ex-president Jacob Zuma,

released allegations claiming Nene's impropriety while he was chair

of the Public Investment Corporation (PIC) - Africa's largest

pension fund - to tarnish Ramaphosa's credibility in the lead-up to

the MTBPS and the 2019 election. Although Mboweni's appointment

gives Ramaphosa continuity in terms of likely fiscal management,

the efforts to undermine his government, both from within the ANC

and from the opposition, are likely to continue.

Outlook and implications

Mboweni's appointment prior to the MTBPS does increase the likelihood of the speech being postponed by no more than two weeks. IHS Markit economists do not expect that such a delay will have an adverse effect on the markets; although a delay of a month will be viewed negatively and likely give the market the impression that there is disagreement over policy. However, it is highly unlikely that Mboweni will significantly depart from the plans prepared by Nene for the MTBPS, nor do we expect him to depart from the broad outline set out by Ramaphosa for the economic stimulus and recovery plan.

While investors are likely to assume that this year's fiscal deficit target of 3.6% and spending target of 33.3% of GDP will be exceeded, the MTBPS will need to outline clearly how expenditure will be controlled going forward. A key priority for investors and the ratings agencies is whether public-sector expenditure can be reined in during 2019 and thereafter, with details of how Ramaphosa's infrastructure fund will be financed also representing a major concern. Ramaphosa has already stated that of the ZAR400 billion, ZAR50 billion will come from reprioritizing the existing budget. It has not been made clear where the remaining funding will be sourced, but it appears likely that some will come from the USD14.7 billion pledged by China ahead of the Forum on China-Africa Cooperation (FOCAC) at the start of September.

Overall, IHS Markit economics assesses that markets recently have tended to view South Africa as leaning towards populist policies, and if this were reinforced by the MTBPS, it would be likely to trigger a ratings downgrade by Moody's, the only ratings agency that has not yet downgraded the country to sub-investment grade. Moody's is due to announce a review of its outlook for South Africa on 12 October 2018. A loss of South Africa's investment grade or cross-over rating status will lead to significant portfolio outflows and currency depreciation and avoiding this is likely to represent a government priority. In summary, timing for the MTBPS, its content, and the specific funding arrangements for infrastructure development will be the key indicators for policy direction, fiscal stability, and currency movements in the coming months. If the MTBPS goes ahead on 24 October and markets do not react well to the funding plan for the economic stimulus and recovery plan, this will heighten the risk of a ratings downgrade by Moody's.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-african-fiscal-policy-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-african-fiscal-policy-outlook.html&text=South+African+fiscal+policy+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-african-fiscal-policy-outlook.html","enabled":true},{"name":"email","url":"?subject=South African fiscal policy outlook | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-african-fiscal-policy-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=South+African+fiscal+policy+outlook+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-african-fiscal-policy-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}