Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 04, 2020

Which sectors will be hardest hit by the fall-out from containment measures?

It's clear, coronavirus 2019 (COVID-19), and the containment measures put in place to slow its spread have been devastating to the global economy. The effects have been calamitous and few industries have avoided harm. Therefore, the question has now shifted away from "Will an industry be negatively affected by Covid-19?", to "How badly will an industry be affected?". Considering this, our Comparative Industry team conducted a deep dive into each of the 105 sectors monitored by the service to assess how the current crisis will play out in each of these.

Output PMI index by IHS Markit

Sector PMIs, historical impacts, sector dependencies, monthly &

quarterly statistics and real time measures, and many other tools

were used to quantify the short-term impact at a sector level. The

PMI Indices have reflected a particularly bleak picture for 2020 so

far.

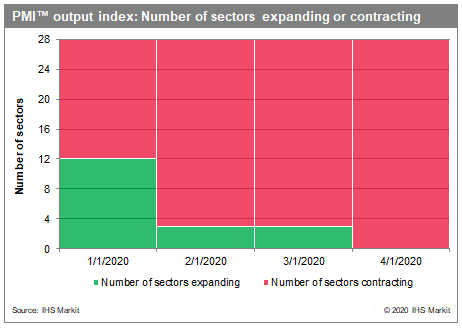

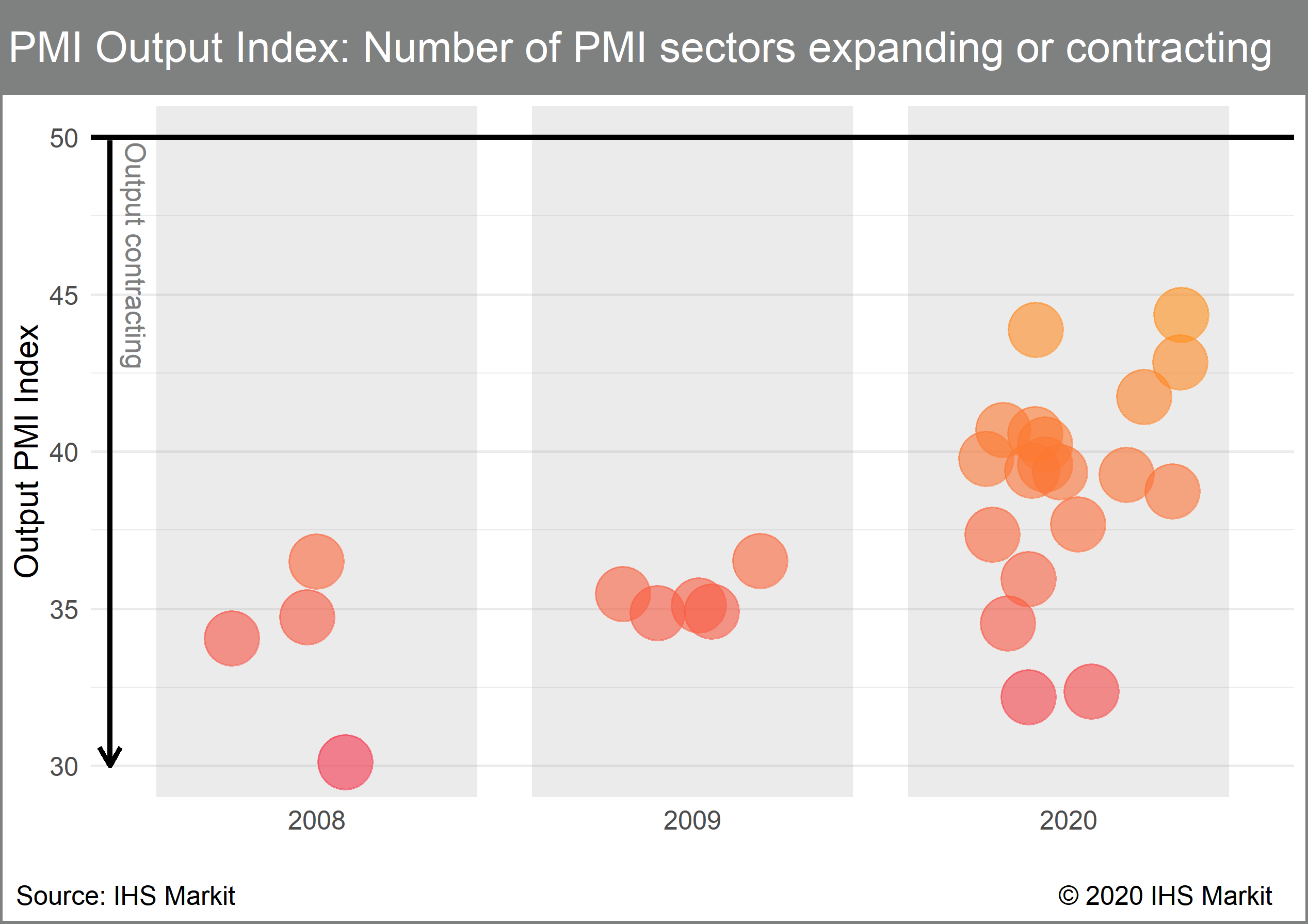

Of the 28 global sectors for which the output PMI is measured more than half were in contraction territory at the start of 2020. As the year progressed, the situation steadily deteriorated with the only sectors experiencing expansions in February were construction materials, beverage, and electronic communications equipment; in March, only food, beverages and electronic communications equipment saw output increasing. Food and beverages grew as people prepared for lockdown, and electronic communications equipment grew as more prepared to work from home.

In April, the situation worsened to the poorest levels seen in the PMI's history, with every sector monitored by the PMI contracting. The severity of the contractions is also another area of concern as 19 of the 28 sectors monitored reached their lowest PMI output index levels in the history of the survey, with the remaining 9 sectors seeing their lowest during the 2008/09 crisis. If one were to exclude the financial crisis (post 2009), every sector, except electronic communications equipment, experienced its worst contraction in April of 2020. April's lowest readings of 31.8, 32.2 and 34 (anything below 50 represents a contraction) were reported for construction materials, forestry & paper products and general industrials, respectively.

Our view for 2020

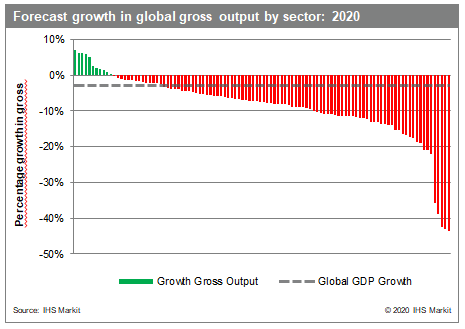

The bleak realities presented by the PMI index are reflected in

data coming from our industry verticals as well. The outlook is

negative, and most sectors will contract in 2020 as illustrated in

the chart below.

The chart presents the global 2020 outlook for growth in real (inflation adjusted) gross output, for each of the 105 sectors monitored by our Comparative Industry Service. Of the sectors monitored, 95 are expected to recede, and most will contract by more than 5%. The sectors most severely affected for 2020 are travel agencies, tour operator, reservation services; air transport; arts, entertainment and culture; and sports and recreation activities.

As is evident, the sectors most severely impacted are those in travel and tourism related activities. Travel restrictions imposed by governments have seen airlines grounded and most people traveling for tourism and business have cancelled or delayed trips until it is safer to travel. The International Civil Aviation Organization (ICAO) has reported that the daily number of departures globally fell from over 30,000 in early January 2020 to less than 2,000 in April. In March alone, departures fell from 28,700 on 1 March 2020 to 2,585 by 31 March 2020, a decline of more than 90% in daily departures in one month. Sporting events will also see a large-scale decline in 2020, with major tournaments like the NBA and the Premier League suspended, with the possibility of being cancelled, and the 2020 summer Olympics postponed by a year.

Growth sectors for 2020

There are some sectors that are unlikely to be severely harmed in

2020, but they will be primarily healthcare and hygiene related.

Two major key areas include life sciences (medical service and

pharmaceuticals) and oxygenated solvents & surfactants (a

subsector of chemicals).

Oxygenated solvents and surfactants

In the case of oxygenated solvents and surfactants, demand has

risen dramatically because of the increased need to clean homes and

institutions to prevent the spread of COVID-19. The knock-on

effects of closures to public buildings and hotels and a slowdown

in the aviation sector will, however, impede some areas of demand

in the near-term. Over the longer-term hygiene awareness is likely

to continue to support higher growth rates in home and

institutional cleaning for the coming years.

Life sciences

For obvious reasons parts of the life sciences sectors are likely

to grow in 2020 as the needs of the Covid-19 crisis are addressed.

Despite this growth it's unlikely that growth will reach extreme

levels. The reason for this being the suspension of elective

surgeries in many markets particularly in the private sector, which

will have a negative impact on their businesses. In order to

rapidly develop covid-19 vaccines and treatments the development of

many other treatments has been put on hold, and this will have some

impact in the years to come.

Essential retail trade - groceries

In many markets there has been a surge of panic buying just prior

to lockdowns being enforced, and grocery stores have benefited from

this. Something to note is that despite the initial surge in

grocery spending, consumers will be visiting stores less often

(especially in developed markets), only doing so when it is

necessary, and this is likely to continue post-lockdown. As a

result, basket sizes have increased, but convenience spending on

items like soft drinks, chocolate and other snacks will be down

notably. Stores closer to residential areas are also likely to do

better than those in business districts and commuter hubs.

A deeper more detailed reports on the impact of covid-19 at a sector and regional level is available for purchase. Learn more.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsectors-hardest-hit-containment-measures.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsectors-hardest-hit-containment-measures.html&text=Which+sectors+will+be+hardest+hit+by+the+fall-out+from+containment+measures%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsectors-hardest-hit-containment-measures.html","enabled":true},{"name":"email","url":"?subject=Which sectors will be hardest hit by the fall-out from containment measures? | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsectors-hardest-hit-containment-measures.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Which+sectors+will+be+hardest+hit+by+the+fall-out+from+containment+measures%3f+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsectors-hardest-hit-containment-measures.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}