Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 04, 2019

Risks of a broad US corporate debt bubble overstated

Against the backdrop of a slowing domestic economy and stretched asset valuations, many pundits are positing that the next shoe to drop may be in the US corporate debt and leveraged loan markets. Investors are rightfully concerned about these market events, but a holistic assessment of US corporate debt reveals a more reassuring financial picture, despite the use of gearing approaching levels last seen during prior recession events.

It is true that the qualitative nature of lending has changed with more cov-lite issuance, and credit ratings have degraded with the re-levering of corporate balance sheets. However, a supply-side financial analysis reveals the macro-financial picture looks adequately contained, with liquidity, interest expenses, and debt coverage all within reasonable levels.

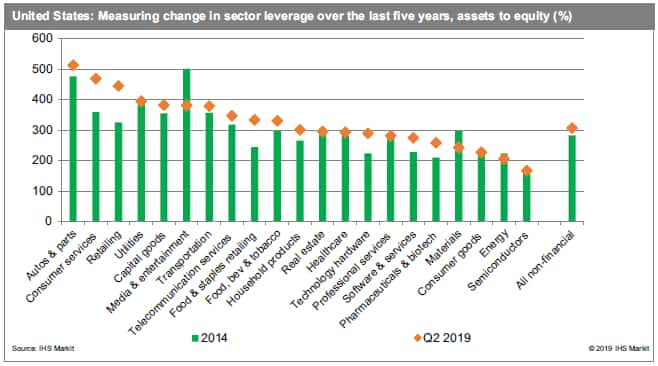

Pockets of risk are highlighted in areas like automotive manufacturing and retail, industrial conglomerates, and consumer services, which show more potential for restructuring. Consumer-related goods and retail are in challenging yet serviceable situations, albeit with very company-specific risk.

The system remains secure, reinforced by high corporate profitability, exceptional employment conditions, low interest rates (now falling), and tame inflationary pressures. The banking sector is recapitalized, and credit channels are open and flowing. Refinancing risk is among the lowest in advanced economies with most debt of a long-term maturity and the Fed standing in reserve. Tax reform has rolled back some of the preferences for excessive debt financing and defaults remain encouragingly sparse.

With the potential for select bankruptcies in identified areas, or acquirers who have bitten off more than they can chew, the probability of financial instability rippling across the rest of the economy looks very slim, indeed.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisks-of-a-broad-us-corporate-debt-bubble-overstated.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisks-of-a-broad-us-corporate-debt-bubble-overstated.html&text=Risks+of+a+broad+US+corporate+debt+bubble+overstated+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisks-of-a-broad-us-corporate-debt-bubble-overstated.html","enabled":true},{"name":"email","url":"?subject=Risks of a broad US corporate debt bubble overstated | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisks-of-a-broad-us-corporate-debt-bubble-overstated.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risks+of+a+broad+US+corporate+debt+bubble+overstated+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisks-of-a-broad-us-corporate-debt-bubble-overstated.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}