Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 05, 2023

Resurgent service sector in mainland China drives strong economic growth at start of second quarter

A strong start to the second quarter was heralded by April's PMI data for China, with expanding business activity being driven by resurgent demand for services. Growth showed signs of faltering in the manufacturing sector, however, which also shed labour at an increased rate amid a renewed downturn in demand. Growth also came off the boil in the service sector compared to March's surge.

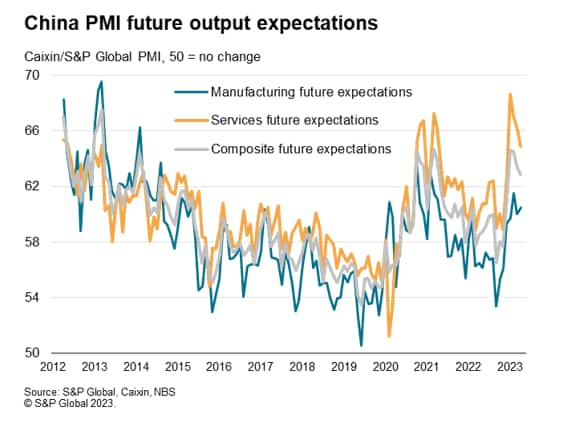

However, business optimism about the year ahead remains highly elevated, suggesting solid economic growth could persist in the near term. The data therefore support a further robust expansion of GDP in the second quarter, though it seems likely that the pace of expansion might slow compared to that seen in the opening quarter of the year, as the boost from recently relaxed COVID-19 containment measures fades.

Solid start to second quarter

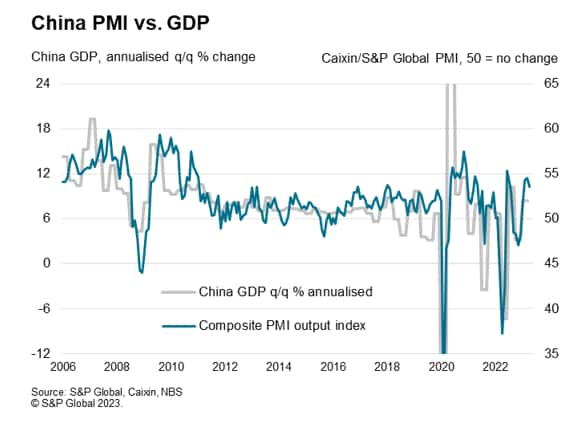

The headline Caixin PMI for mainland China, compiled by S&P Global, indicated an expansion of output for the fourth successive month in April, signalling an ongoing upturn in the economy following the relaxation of COVID-19 containment measures at the turn of the year.

The rate of growth remained among the highest recorded by the survey over the past decade, though showed some signs of losing momentum, with the index slipping from 54.5 in March to 53.6 in April. The solid reading nonetheless represents a strong start to the second quarter and sets the scene for another robust expansion of GDP after the 8.3% annualised rate recorded in the opening quarter of the year.

Resurgent service sector contrasts with stalling factories

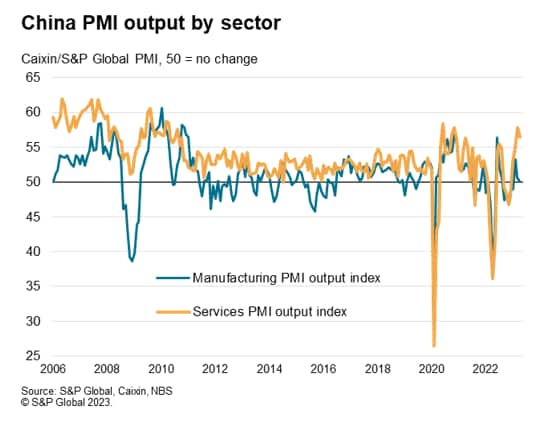

Looking into the sector split, the upturn was driven largely by the service sector, where output rose at the second-strongest rate since November 2020 and well above the average pace seen in the decade prior to the pandemic, albeit slowing from March's recent peak. In contrast, manufacturing output barely rose in April, the rate of increase losing further momentum from February's recent high, pointing to a near-stalling of factory production growth.

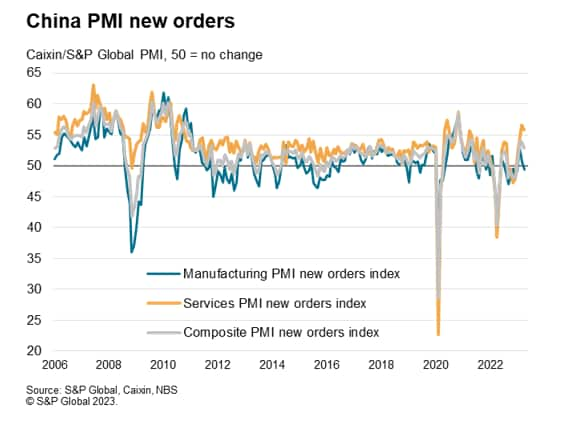

Weaker demand growth

The diverging output trends were reflective of varying demand conditions within the two sectors. Resurgent growth of demand for services, as signalled by the fourth-largest increase in new business inflows into the sector since 2010, contrasted with a renewed drop in new orders for goods, albeit only marginal. The rise in new orders in the service sector was nevertheless weaker than seen in March which, combined with the drop in goods orders, led to the weakest overall monthly rise in orders since January.

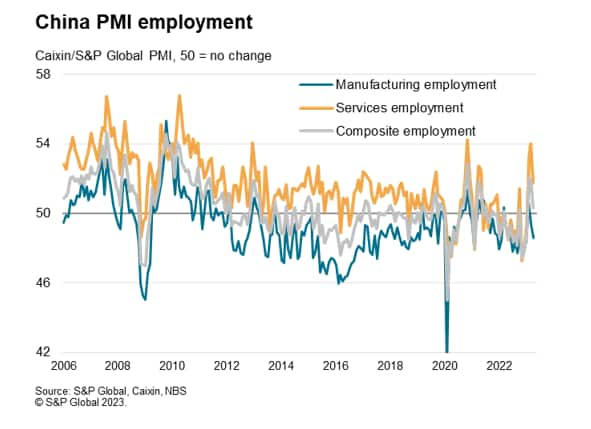

Jobs growth close to stalling

Employment growth likewise moderated in April, the rate of job creation near-stalled after the solid gains seen in February and March, which had been some of the strongest rates of payroll growth since 2010. A sharp slowing in the rate of job creation in the service sector was accompanied by an increased rate of loss of manufacturing jobs.

Elevated expectations

It is not clear the extent to which slower jobs growth in the service sector was a symptom of hiring difficulties rather than a reflection of the recent weakening of order book growth, but it was notable that backlogs of work increased in both manufacturing and services in April to hint at some problems in being able to expand capacity sufficiently. Future output expectations also ticked higher in manufacturing. Although optimism about the year ahead sank lower in the service sector, the degree of confidence remained high by historical standards.

These elevated levels of business confidence bode well for the upturn to persist in the coming months, though the evidence points to the recent surge in demand growth having peaked.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fresurgent-service-sector-in-mainland-china-drives-strong-economic-growth-at-start-of-q2-may23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fresurgent-service-sector-in-mainland-china-drives-strong-economic-growth-at-start-of-q2-may23.html&text=Resurgent+service+sector+in+mainland+China+drives+strong+economic+growth+at+start+of+second+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fresurgent-service-sector-in-mainland-china-drives-strong-economic-growth-at-start-of-q2-may23.html","enabled":true},{"name":"email","url":"?subject=Resurgent service sector in mainland China drives strong economic growth at start of second quarter | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fresurgent-service-sector-in-mainland-china-drives-strong-economic-growth-at-start-of-q2-may23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Resurgent+service+sector+in+mainland+China+drives+strong+economic+growth+at+start+of+second+quarter+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fresurgent-service-sector-in-mainland-china-drives-strong-economic-growth-at-start-of-q2-may23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}